In short, probably this:

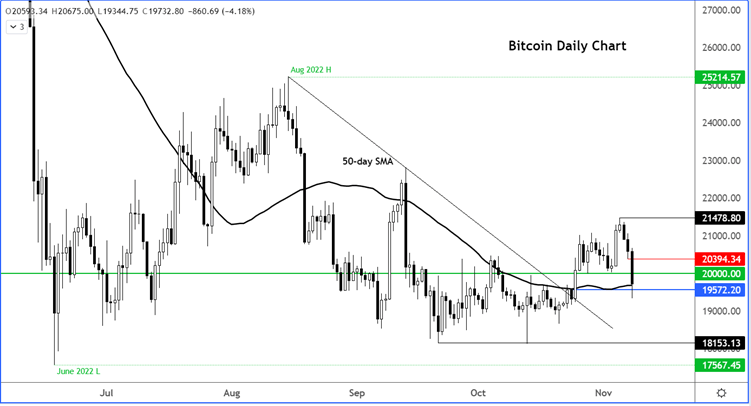

We have seen a bit of a rug pull in crypto currencies over the past couple of days. After rallying sharply on Friday along with everything else, Bitcoin rose a little bit further to reach $21,400, before plunging to two-week lows beneath $20K. Other cryptocurrencies have also dropped sharply.

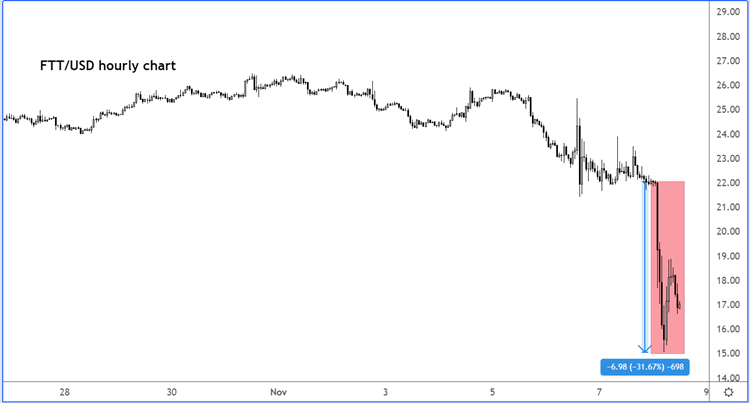

It looks likes the latest sell-off in crypto has been triggered by a 30% drop in FTT coin, which is FTX’s token (see above).

Binance CEO Changpeng Zhao in a tweet said that he will liquidate the $529 million in FTX tokens that Binance holds over a few months, citing “risk management.” He also seemingly accused FTX CEO Sam Bankman-Fried, “who lobby against other industry players behind their back.” This is apparently in response to a report that says Bankman-Fried's trading company Alameda Research has about $6 billion of its $14.6 billion assets in the coin created by his other company.

These developments will do little to ease investor nerves in crypto assets, following that disastrous crash in Luna back in May. The plunge in FIT has set off rumours about insolvency, although this is something that has been denied by Bankman-Fried, in a tweet:

"FTX is fine. Assets are fine… FTX has enough to cover all client holdings. We don't invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be."

As well as worries about insolvency, cryptocurrencies are probably also hurt by the recent rebound in global bond yields, which make zero-yielding assets less appealing compared to government debt which guarantee a return on investment. The US 10-year rose to 4.244% earlier, before easing back a little.

As a result of the above, Bitcoin has broken below the key $20K support level, where it had established a base prior to Friday’s rally. Unless this level is reclaimed decisively later, the path of least resistance would remain to the downside.

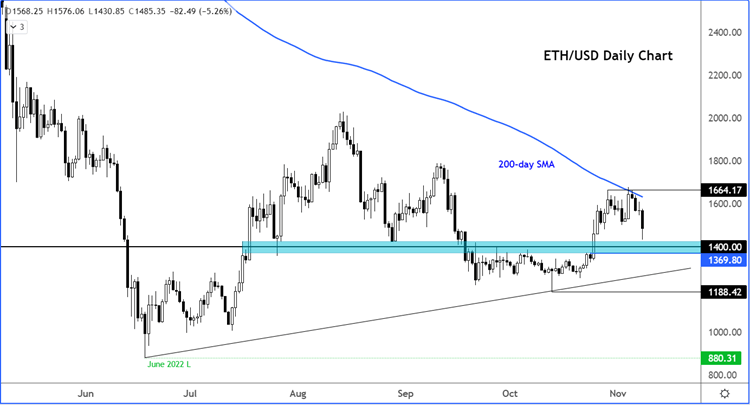

Similarly, Ether couldn’t hold Friday’s breakout as it run into strong selling around its 200-day average and resistance circa $1650:

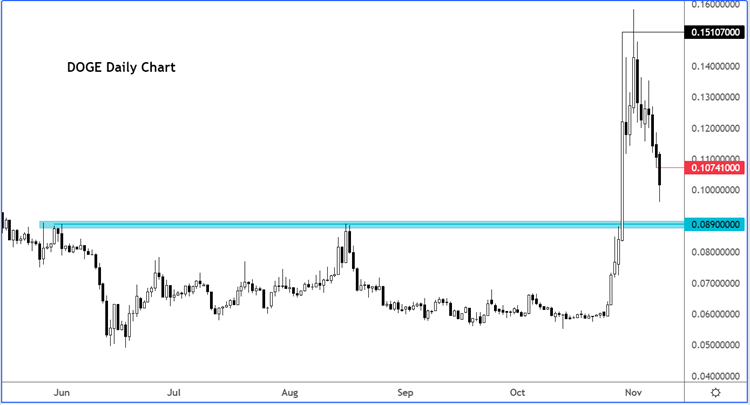

It is also worth watching Elon Musk’s favourite coin (Doge), which jumped after he took over Twitter. But it is now coming back down to the point of origin of the breakout around 0.089:

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade