- China’s “National Team” are rolling out further measures to stabilise mainland stocks

- After opening sharply lower, indices such as the A50 are now surging higher

- To date, measures to promote market gains have typically not lasted more than a couple of days

China’s “National Team”, the nickname given to state-backed entities tasked with rescuing markets whenever they deviate too far from the government’s desired path, are doubling their efforts, upping purchases of exchange-traded funds (ETFs) while restricting certain undesirable activities detrimental to stock prices.

National Team moving closer to going “all in”

Fresh from going public about increased ETF purchases in October, Central Huijin Investment, a division of China’s sovereign wealth fund which collects stakes in financial firms, said it will continue to increase holdings of ETFS to maintain the smooth operation of the capital market. It released a statement noting it “fully acknowledges the value in the A share market”, coinciding with a sharp turnaround in mainland stocks which opened lower on Tuesday before suddenly ripping higher.

China’s securities regulator, the CSRC, said in a separate statement it will guide institutional investors to increase stock allocations while encouraging listed firms to increase share buybacks. Before trade, Bloomberg reported Chinese authorities had tightened trading restrictions on domestic institutional investors as well as some offshore units to help stem the nation’s deepening bear market.

The latest announcements are just the latest in a long line of measures we previously covered on the site. The big question is whether it will work beyond the ultra-short term to bolster market returns? While it feels like we’re getting closer to an “all in” moment as part of the stock rescue plan, measures that have been rolled out so far have simply not worked.

China A50 futures through key resistance level

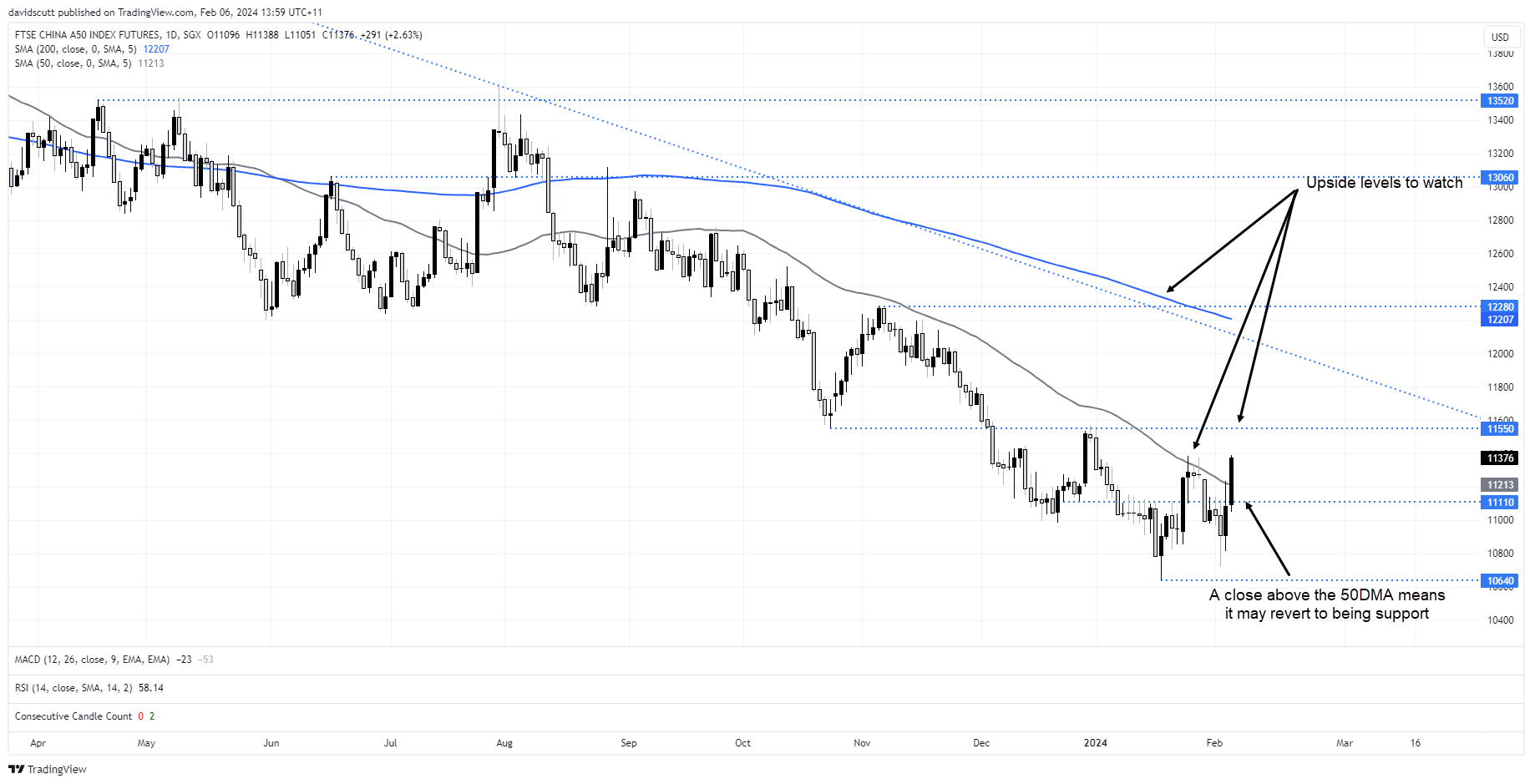

Looking at the daily chart of China’s A50 futures, the current candle is big and bullish, taking futures towards the highest level since early 2024. Importantly, should futures manage to hold above the 50-day moving average – a level they have not closed above since September – it may help to increase confidence that this latest bounce may be a little longer than fleeting.

Given how respectful futures have been of the 50DMA recently, a close above this level provides a decent location for traders to place stop-loss orders below if intending to initiate long positions. Above, resistance is located at 11400, 11550 and around 12120, the latter part of a major downtrend dating back to early 2021. The 200DMA is located just above, making this a key level for traders to watch, if and when it gets there.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade