Chinese equities have had plenty thrown at them in 2023: sluggish economic growth, turmoil among property developers, ongoing geopolitical tensions and an exodus of foreign investors and capital, just to name a few. Yet, despite the challenges, some mainland equity indices are holding up alright.

FTSE China A50 holding up despite macro risks

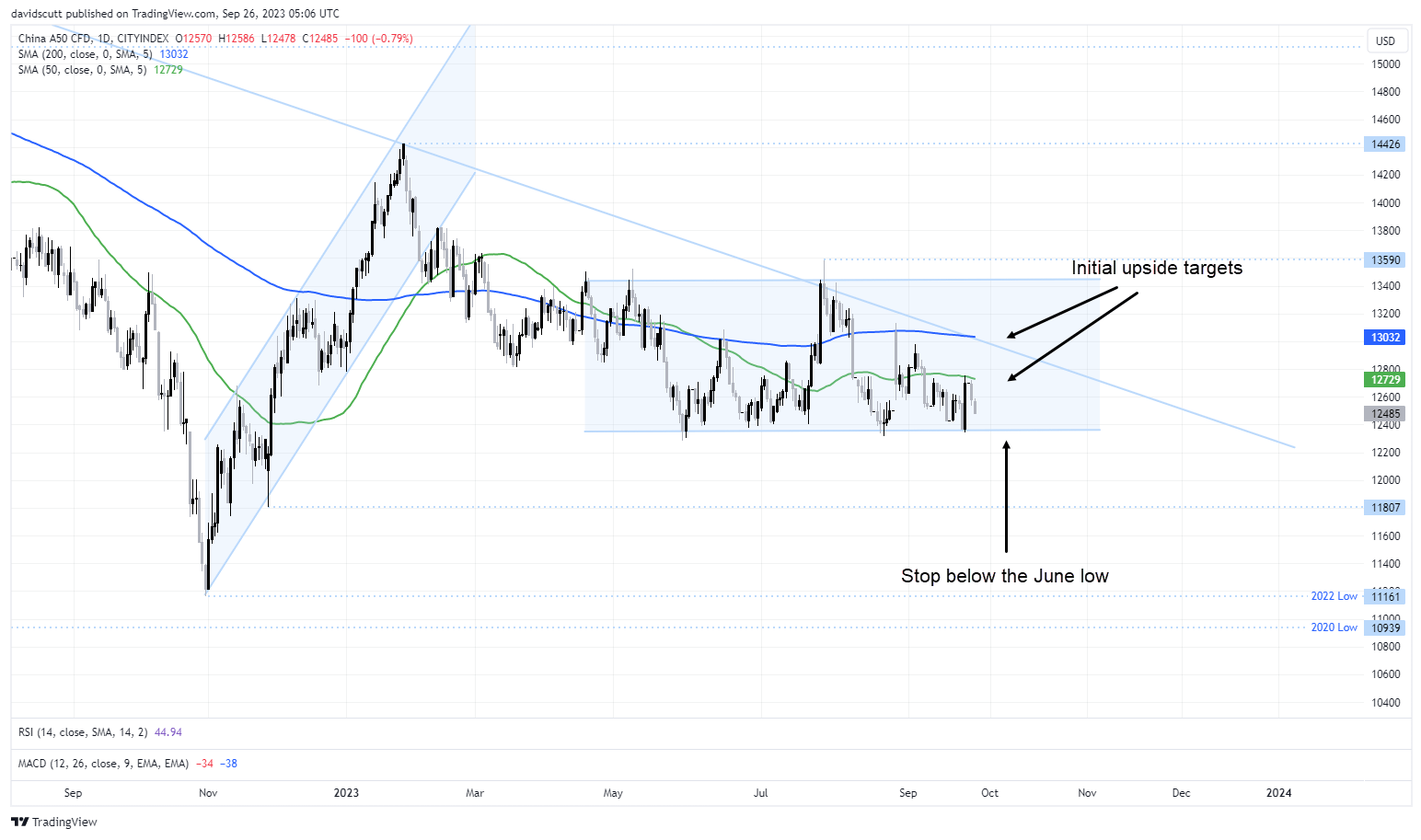

The FTSE China A50 Index, comprising the 50 largest onshore companies by market capitalisation listed on the Shanghai and Shenzhen stock exchanges, is only marginally below where it started the year, oscillating in a more than 1000-point trading range over the past six months.

While the index looks ugly longer-term, putting in a series of lower highs as part of a downtrend that began in early 2021, nearer-term it looks a little more palatable with it sitting near the bottom of the range where it has attracted bids on numerous occasions since May, most recently on Friday when it logged its largest gain in months, coinciding with reports China was considering easing rules that cap foreign ownership in publicly traded companies at 30%.

The A50 has since pulled back, undermined by renewed concerns over the fate of heavily indebted China Evergrande, once the largest property developer in the world. Despite the obvious macro risks, the latest dip has improved the risk-reward for those looking for another near-term bounce.

A50 approaching the bottom of its sideways range

A potential trade idea would be to go long on probes towards 12400 with a stop around 12250, just below the nadir the index hit in June. The initial upside target would be 12729, the 50-day MA which the index has respected on multiple occasions in 2023. Should that break, it would open the door to a potential test of long-running downtrend resistance located just above 13000. That just happens to be where the 200-day MA is also found right now.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade