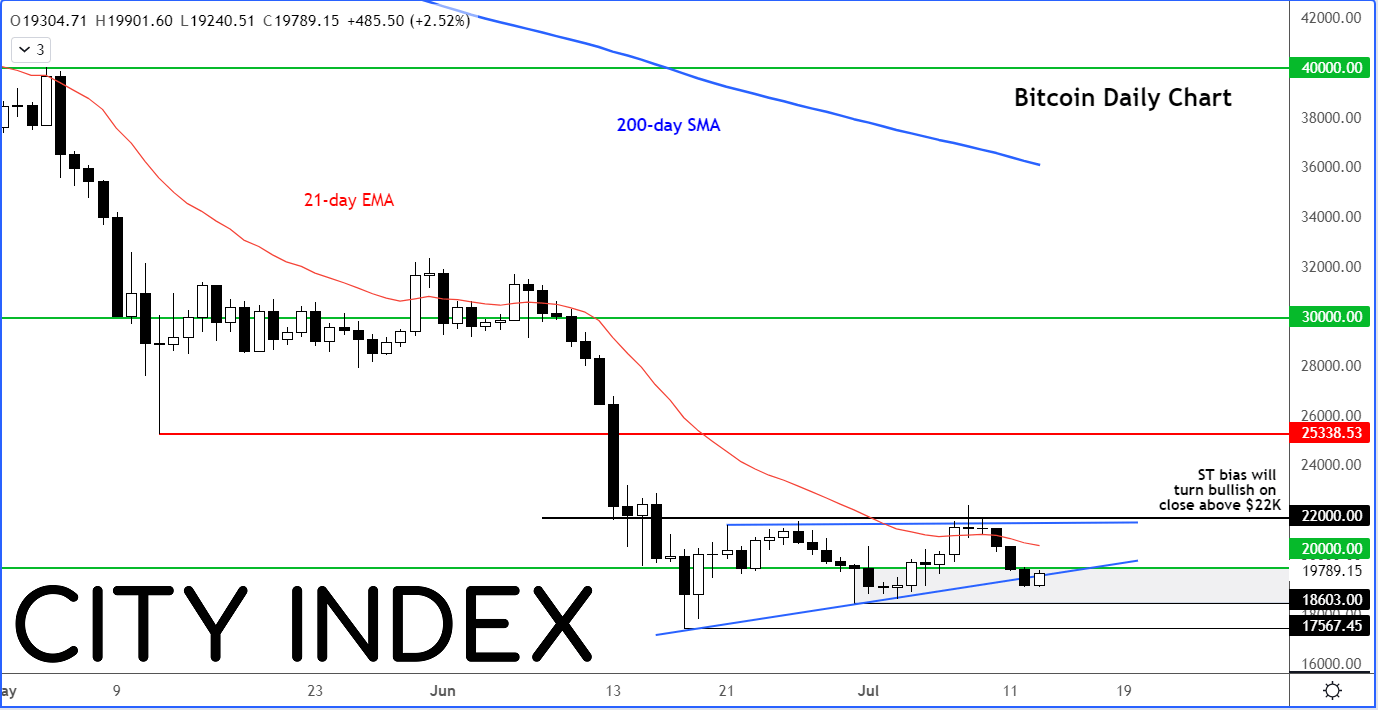

It is no surprise why investors are so bearish on cryptos right now. The way prices have collapsed makes you wonder whether cryptos will ever experience the same sort of mania we saw post Covid and previously in 2017. Troubled crypto lenders, worthless coins, difficulty withdrawing funds and collapsed hedge funds all underscore the risks investors face.

On top of all this, you have multi-decade high inflation, low economic growth and end of easy monetary policy. The big sell-off in equity markets and the weakness in gold means investors have less disposable money to put to work, especially in highly speculative crypto markets.

On Wednesday, crypto investors will be watching US inflation data like hawks, along with the more traditional market participants.

Annual CPI is expected to have accelerated to 8.8% in June from 8.6% in May. On a month-over-month basis, CPI is seen rising by 1.1% on the month following a 1.0% rise the month before. Core CPI is seen rising by 5.7% in June, which would actually be weaker than 6% recorded in May. On a monthly basis, core CPI is expected to have risen by 0.6% again as it did in May.

If consumer inflation comes in ahead of expectations, this will only raise speculation about aggressive monetary tightening. As a result, we may well see renewed selling of risk assets, including cryptos. However, a weaker reading has the potential to brighten the mood a little.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade