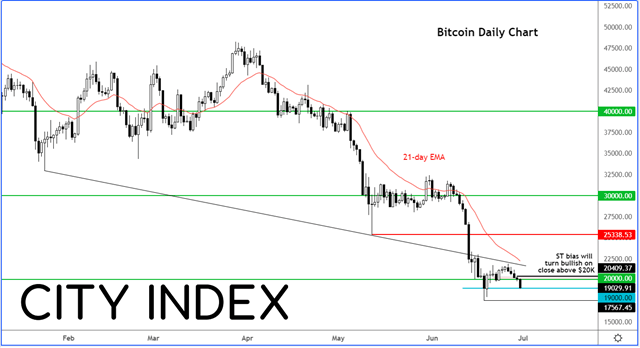

With everything falling, Bitcoin has not wanted to be left out this week. The world’s most popular cryptocurrency fell on Thursday to $19K, extending its losses for 5 consecutive days. It has fallen along with stocks and gold, as investors’ appetite for risk continues to diminish. The reason behind the latest sell-off of risk is the same factors that have been prevalent all year round: Surging inflation, interest rate hikes and worries about an economic slowdown. Month- and quarter-end portfolio rebalancing is also adding to the pressure today.

The big news for Bitcoin earlier this week was from MicroStrategy, purchasing an additional 480 bitcoins for about $10.0 million at an average price of $20,817 per coin. So far, the news hasn't impacted the price of Bitcoin as it has now fallen below the $20K handle. Of course, $10m is a relatively small purchase, but it is not nothing.

We will need to see a big reversal stick around current levels to give hope that we have seen at least a short-term low. But for now, the path of least resistance remains to the downside.

While Bitcoin remains in danger of further falls, the big correction has increased the probability of a recovery in the not-too-distant future. So, I would be on the lookout for signs of a bullish reversal at these levels. If we go back above $20K handle, and stay there, that could be the signal I am looking for.

Crypto enthusiasts just cannot wait until that happens. Patience is the name of the game.

Meanwhile the focus will remain on MicroStrategy and how it can cope with such a severe sell-off in the crypto space. The company now holds around 129,699 bitcoins, acquired for about $3.98 billion. That gives it an average price of $30,664 per bitcoin, more than 11K below the current market price of $19K.

From an investing point of view, this is what you are supposed to do – buy more at lower levels. The company’s Chief Executive Officer Michael Saylor must believe that the downturn for bitcoin is nearing an end and that a recovery is nigh. To some degree, I agree with that viewpoint. It is just that it feels a bit like a gamble though as prices haven’t stabilised to give you confidence that a low is in just yet. I hope that doesn’t scare investors who are holding the company’s stock.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade