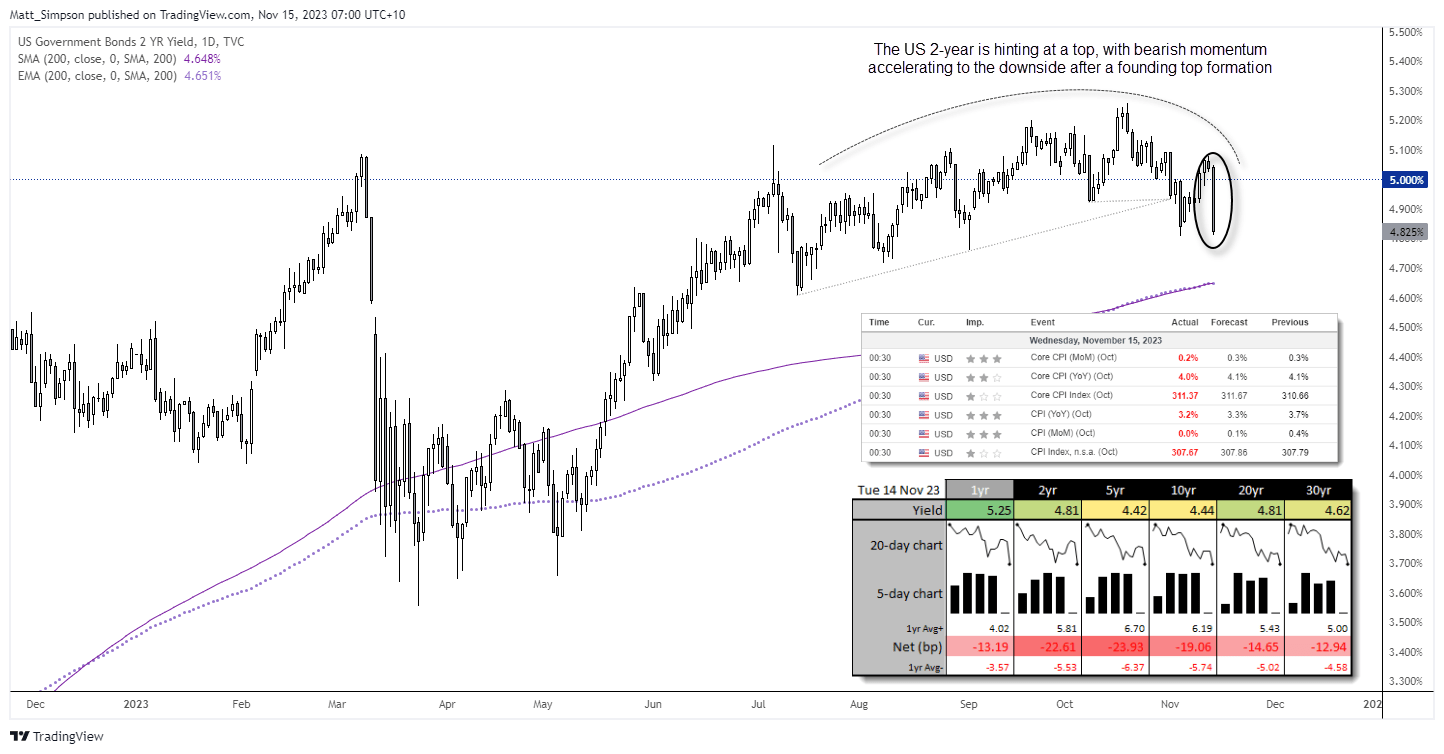

Hopes that the Fed have reached their terminal rate were revived with a softer-than-expected US inflation report. Earlier comments from Fed officials (namely Powell) had rekindled concerns that the Fed may have another hike up their sleeve, yet with CPI and core CPI reads all undershooting consensus estimates, risk-on returned in a big way.

The volatility and one-directional moves seen on across markets sends a clear message to the Fed; markets aren’t buying the Fed’s narrative. A hold at the Fed’s December meeting is effectively fully priced in, up from 85.5% yesterday according to Fed fund futures. And I suspect the remaining Fed members this week will have trouble pushing back against Tuesday’s market moves, assuming that remains their plan.

- US CPI was flat in October at 0% m/m and slowed to a 3.2% y/y (3.3% expected, 3.7% prior)

- Core CPI rose 0.2% m/m, beneath its long-term average of 0.29% and slowed to 4% y/y (4.1% expected and prior)

- The USD was the weakest FX major, falling against all of its major peers whilst the risk-on session saw NZD and AUD as the strongest

- US bond yields fell sharply, with the 2 and 5-year falling over 20bp

- Wall Street gapped sharply higher, sending the Nasdaq 100 to a 3-month high and the S&P 500 and Dow Jones to 8-week highs

- AUD/USD enjoyed its best day this year with a 2% gain, and is considering a breakout above 65c leading into today’s wage price index report

- Gold rose to a 4-day higher after rebounding from its 200-day MA for a second day

Events in focus (AEDT):

With AUD/USD probing a key resistance level, Aussie trader’s attention now shifts to today’s wage price index report for Australia and China’s data dump. With the RBA making hawkish noises after their hike, a hot WPI print and okay or better data from China could send the Aussie hold on to gains above 65c for the first in three months.

- 08:45 – New Zealand electronic card retail sales, visitor arrivals

- 10:50 – Japan GDP, capex

- 11:30 – Australian wage price index

- 13:00 – China fixed asset investment

- 15:30 – Japan industrial production, capacity utilisation

- 18:00 – UK inflation

- 21:00 – Euro industrial production, trade balance

ASX 200 at a glance:

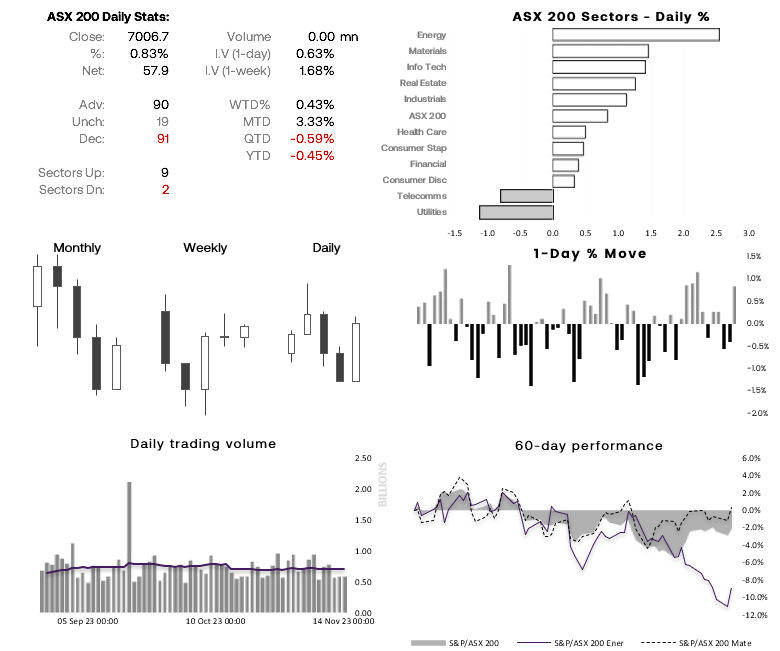

- The ASX 200 cash index enjoyed its best day in seven, with 9 of its 11 sectors rising (led by energy and materials)

- The softer US inflation figures saw SPI futures continue higher overnight, helping the Australian market nearly reach our 7100 target mentioned in yesterday’s report

- With risk-on expected to continue into today’s Asian session, a move to 7150 at a minimum seems feasible

- The next major resistance levels for bulls to eye are the 200-day MA at 7185 and the 7200 handle

AUD/USD technical analysis (daily chart):

I’m pleased to see that the call for AUD/USD to hold above 63c and form a bullish reversal is playing out. A multi-week bullish divergence has now been coupled with a higher low and notable increase of bullish momentum. This strongly favours a bullish breakout in my books, leaving it more of a question of when and not if to my eyes.

Should China data and Australian wages become a non-event (or come in softer), it builds a case for a pullback within yesterday’s range. At which point bulls could seek ‘the dip’ to enter or evidence of a swing low on an intraday timeframe, to position for an anticipated breakout.

The 200-day MA and 66c handle are now in focus.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade