- AUD/USD has not had any luck overcoming resistance at .6530 over the past week

- January US CPI will provide a major catalyst for volatility later in the session

- A break to the topside may be more explosive for AUD/USD given how rapidly Fed rate cut expectations have been unwound recently

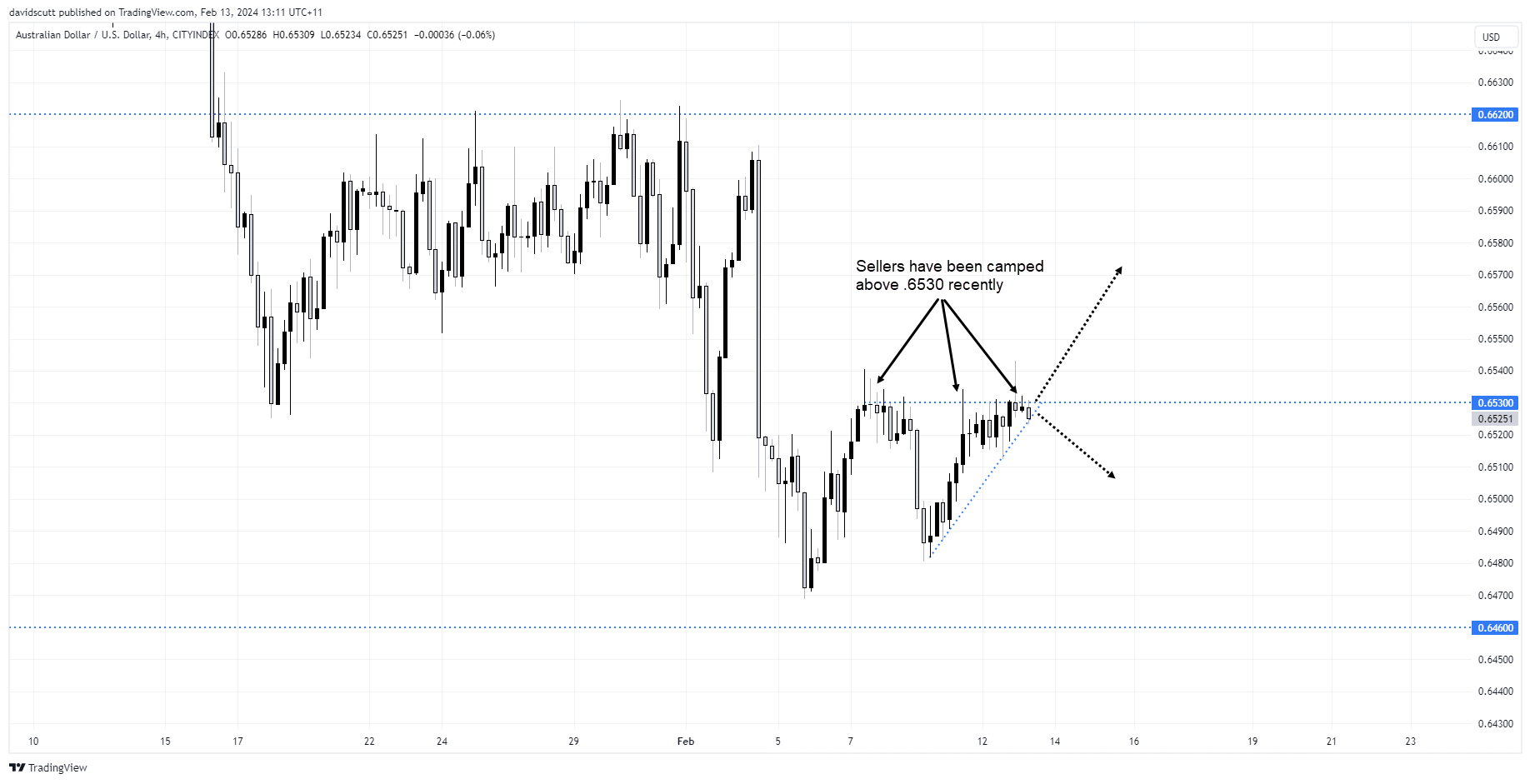

AUD/USD hasn’t had much luck dealing with sellers layered above .6530 recently. 13 attempts on the four-hourly chart in less than a week to no avail, leaving it sandwiched in a tight range between minor uptrend support. Ahead of the US consumer price report (CPI) report on Tuesday, the stalemate hints at the potential for a chunky move in the wake of the release.

AUD/USD sandwiched in a tight range

Having steadily fallen since the beginning of the year on the back a repricing in US rate cut expectations and continued challenges in China, AUD/USD has steadied in recent days, bouncing from below .6500 before continually bumping up against resistance starting from .6530. With uptrend support dating back to earlier February nearby, you get the sense we could see an explosive move to the topside or another dribble lower depending on what the US inflation report dishes up.

USD vulnerable to dovish developments

I use those words specifically as it’s now up to the US economic data to justify the more than 2.5 rate cuts that have been stripped out of the 2024 Fed funds curve since mid-January, meaning any further evidence of moderating underlying price pressures could easily see dovish bets piled back on.

Stickiness may well be a requirement for hawked up US dollar bulls. Anything less and the AUD and other G10 FX names could fly against the buck.

Should we see a topside break, there’s not a lot standing between the AUD/USD and a push towards .6620 where it ran into sellers during January. On the downside, support may be found between .6460 and .6480, where the AUD/USD has bottomed on several occasions in recent months, including earlier in February.

Whichever side .6530 the price breaks, a tight stop on the opposite will provide protection against the trade doing against you.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade