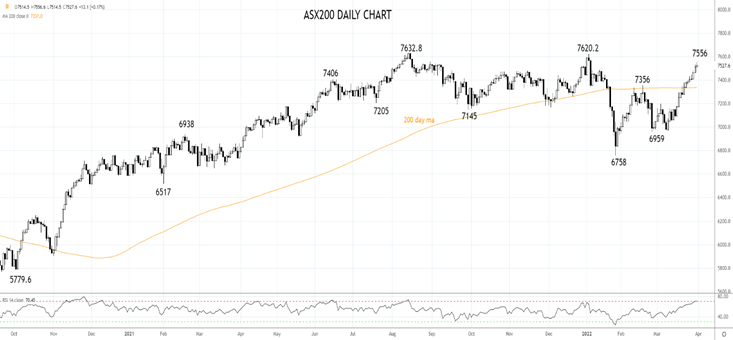

The ASX200 closed 15 points lower (-0.20%) at 7500, paring 55 points of early gains as end of month and quarter rebalancing flows picked up the pace in the afternoon session.

“Beware the ides of March”

Whether you believe in superstitions or not, March 2022 will go down as a memorable one for the local bourse. After its 6.40% rally this month, the ASX200 will be one of the few stock markets to end the first quarter of 2022 in positive territory.

The Materials sector has finished the month with a bang, up 8.18%, with today's rise coming on the back of a 4% lift in iron futures in China, to their highest level since August 2021.

Fortescue Metals (FMG) added 4.34% at $20.66. BHP Group (BHP) added 2.31% to $51.75. Rio Tinto (Rio) lifted by 1.88% to $119.11, while Mineral Resources (MIN) added 4.36% to $52.71.

Reports that the U.S administration is weighing the release of oil from its reserve as soon as Thursday to help counter surging inflation triggered a 6.5% dive in the price of crude oil from $107.50 to below $101.00.

Beach Energy (BPT) fell 2.20% to $1.56, Santos (STO) fell 1.65% to $7.74, while Woodside Petroleum (WPL) fell by 1.35% to $32.10.

Despite the fall in the oil price, triggering a rally in U.S. equity futures, IT stocks have given back a chunk of yesterday's gains.

Xero (XRO) lost 4.56% to $102.75, Afterpay owner Block (SQ2) shed 4.65% to $185.33, Appen (APX) lost 3.35% to $6.92 while Zip Co (Z1P) fell 3.26% to $1.59.

Brushing aside a 43.5% surge in building approvals in February, it's been a mixed day for banking stocks.

Commonwealth Bank (CBA) lost 1.84% to $105.77, Westpac (WBC) lost 1.10% to $24.24, ANZ fell 1% to $27.60. While Bendigo Bank (BEN) and National Australia Bank (NAB) lost 0.10% and 0.06%, respectively.

A mixed day also for healthcare names. BioTech giant CSL fell by 0.70% to $268.15, while Cochlear added 1.16% to $225.33 and Ramsay Health Care (RHC) added 0.63% to $65.15.

Lithium miners were back in the news as Liontown Resources (LTR) added 1.08% to $1.88 after extending talks with EV battery maker LG. Vulcan Energy (VUL) added 4.10% to $10.15, while AVZ minerals (AVZ) added 2.49% to $1.24.

The AUDUSD is trading lower at .7482, after again failing overnight to conquer the .7555 high of October 2021.

Source Tradingview. The figures stated are as of Mar 31st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Source Tradingview. The figures stated are as of Mar 31st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade