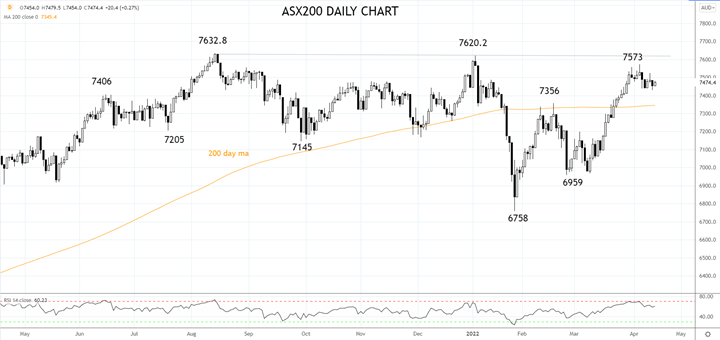

The ASX200 has added 28 points today to be trading at 7482 at 3.00 pm Sydney time.

Comments by Russian President Putin that peace talks with Ukraine were at a "dead-end" propelled the price of crude oil back above $100 p/b overnight and, with it, energy stocks.

Beach Energy (BPT) added 2.24% to $1.60, Santos (STO) lifted 1.4% to $8.12, Origin Energy (ORG) added 0.50% to $6.48, and Woodside Petroleum (WPL) added 0.12% to $32.10.

A rebound in the iron ore price back above $155 p/t on reports that Chinese authorities will again ease monetary policy to support their stagnant economy helped boost iron ore miners.

Rio Tinto (Rio) lifted 2.38% to $120.90. Fortescue Metals (FMG) added 1% to $21.38. BHP Group (BHP) added 0.4% to $51.92. Mineral Resources (MIN) added 3.90% to $61.46. Gains also for coal miners, New Hope Corporation (NHC) which added 1.1% to $3.77, and Whitehaven Coal (WHC) lifted 2.7% to $4.52.

A 30 cents per litre plunge in petrol prices at the bowser over the past fortnight has provided motorists with welcome relief ahead of Easter and a boost for consumer-facing stocks.

Flight Centre (FLT) added 2.74% to $20.27, Webjet (WEB) added 3% to $5.47, Wesfarmers (WES) added 0.9% to $48.40, while Harvey Norman (HVN) added 0.8% to $5.13.

A lower-than-expected core US CPI print overnight has raised hopes that peak inflation may be close. After a meteoric rise, U.S yields have eased, bringing some respite to tech stocks after the recent carnage.

Appen (APX) added 4% to $6.61, Life 360 (360) added 2.6% to $5.13. Afterpay owner Block (SQ2) added 0.80% to $165.10, while cloud computing company Megaport (MP1) added 1% to $12.04. There was no respite for ZIP Co (Z1P), which lost another 1.3% to $1.30 at fresh cyle lows, or Sezzle (SZL), which dropped 3.4% to $1.14.

A mixed day for the banks. Westpac (WBC) added 0.54% to $24.26, National Australia Bank (NAB) added 0.1% to $32.95, ANZ added 0.1%% to $27.54, while Commonwealth Bank (CBA) fell 0.5% to $106.20.

In the fund management space, Perpetual (PPPT) fell 2.3% to $31.41 after its bid for Pendal (PDL) was rejected.

The yoyo price action for Lithium miner Lake Resources (LKE) continues as its shares surged 10.6% to $2.04. Galan Lithium (GLN) added 3.3% to $2.02. Iluka (ILU) added 1.5% to $12.62 on news of plans to demerge their mineral sands business in Sierra Leone.

The AUDUSD is trading at .7447 ahead of tomorrow's Australian Jobs report for March. Expectations are for a 25k rise in employment and the unemployment rate to fall again to 3.9%

Source Tradingview. The figures stated are as of April 13th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade