After a big drop earlier in the week, WTI has staged an impressive bounce off their lows in the last couple of days. Yet it remains to be seen whether this crude oil rally is driven by just short-covering, or actual buying in the hope that prices have bottomed. If we do get some confirmation, this would certainly boost the WTI outlook, especially in light of the OPEC’s big supply cuts and falling US oil inventories.

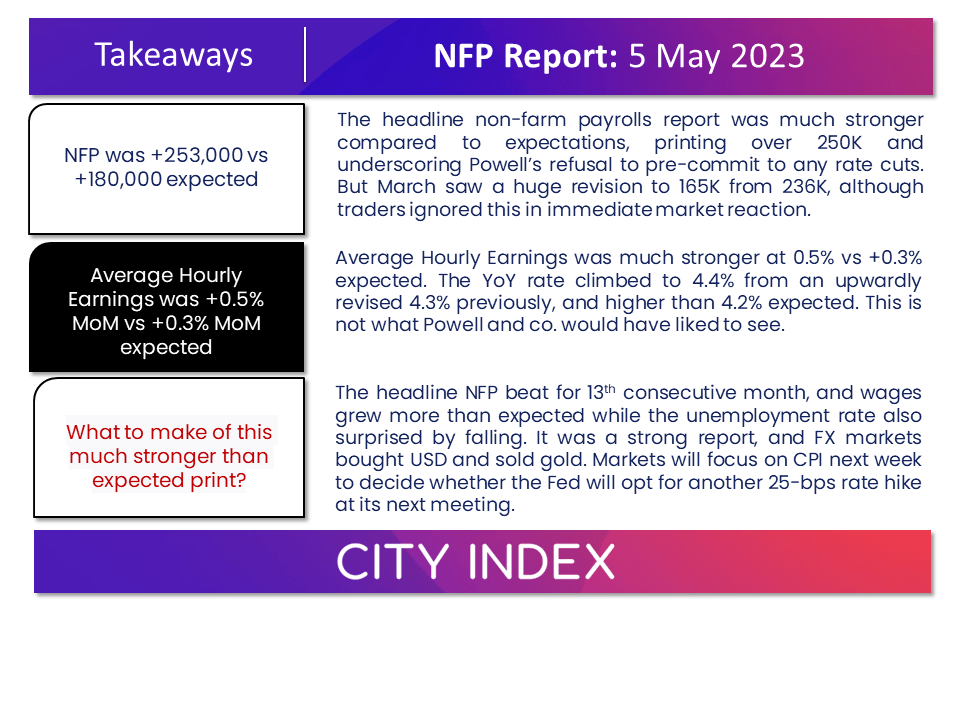

Given that it is an NFP day, traders usually tend to lighten up on their positions ahead of the data release. So, it is quite reasonable to attribute the earlier recovery to short-side profit-taking from speculators. But after the release of the data, oil has continued to push higher, suggesting that perhaps the market had overestimated the downside risks to demand.

In fact, we have seen a similar bullish reaction across some other risk assets, with European indices and US futures rallying in the first half of the session. If the markets close around current levels or higher, this will point to continued strength in the week ahead.

In recent days, tumbling regional bank stocks, mixed global data and a sharp slide in crude oil prices all had highlighted financial stability and recession risks. But in pre-market, shares of troubled lenders like PacWest Bancrop, Western Alliance Bancorp and First Horizon Corp were all up sharply after a bruising week. The major indices then rallied further on the back of a strong NFP report.

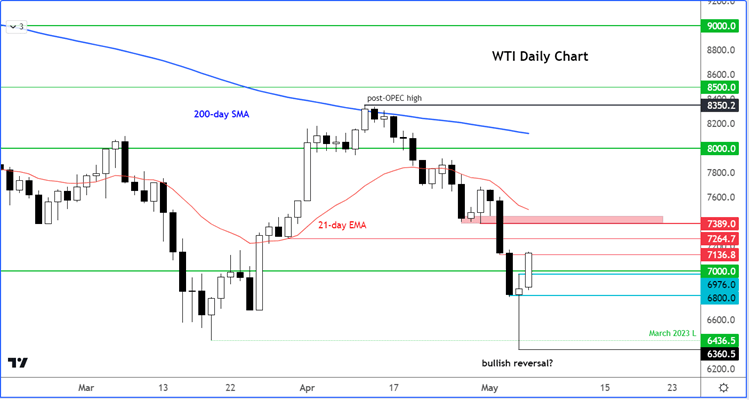

WTI outlook: Technical analysis

Today’s gains come hot on the heels of the hammer-looking candle WTI formed on its daily chart after its earlier dip below the March low at $64.46 proved to be short-lived. Was that a false break reversal? Judging by the upside follow-thru above $70 today, it looks that way, but more price action is needed to confirm.

WTI faces potential resistance around $71.35 (which was being tested at the time of writing) and then just below the $74.00 handle where it had previously found interim support, before the big drop. If it manages to recapture these levels, then the bulls will become more confident in buying the dips in the week(s) ahead.

The bullish-looking price action from Thursday has encouraged dip buyers to step in aggressively today, while the bears have probably also rushed for the exits. As a result, we have seen a 3% or so rebound in oil prices, boosting bullish hopes that prices may have bottomed. But the trend is bearish, so the onus is on the bulls to show willingness that they are happy to remain in control of price action.

Going forward, dips back to support levels around $70.00, $69.75 and at worst $68.00 will now need to hold, for otherwise the bulls will be in trouble again – as we saw with the prior such ‘bullish’ candles in the last week of April.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade