- Crude oil analysis: What factors drove the significant drop in prices?

- Further downside could be limited for crude oil

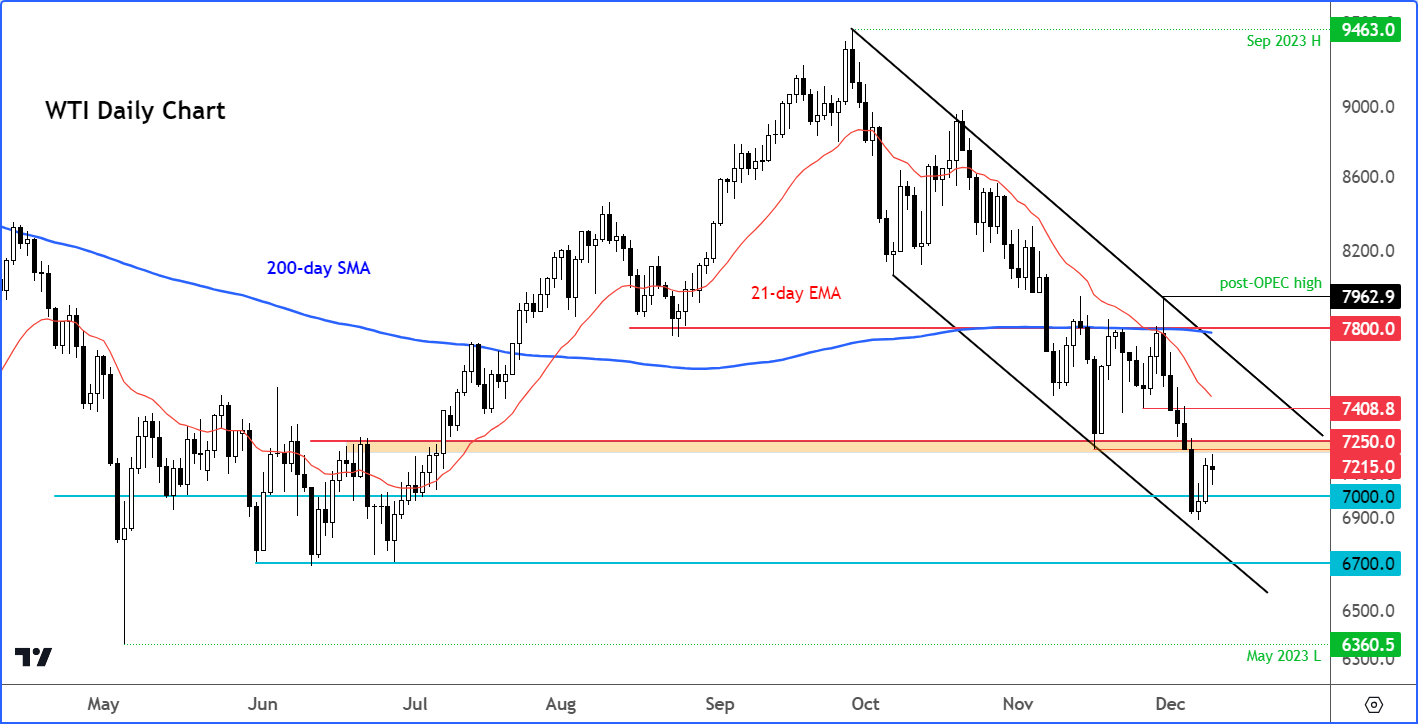

- WTI technical analysis: $70 among key support levels

With seven consecutive weeks of losses, oil is clearly not in a position to be bullish on in terms of momentum, which means the potential for further short-term weakness is there. Nevertheless, the most severe phase of the market decline might be in the past, following a challenging couple of months. Ongoing supply reductions from OPEC and its allies are expected to restrict further downside. If anything, I am inclined to believe that the risks are tilted towards the upside from this point onwards. But we must see a clearer reversal pattern before turning tactically bullish on oil again.

Crude oil analysis: What factors drove the significant drop in prices?

Despite the rebound observed at the close of the previous week, oil prices ultimately concluded the week with a fall, extending the streak of losses to seven weeks. The latest drop was partly attributed to the voluntary production cuts implemented by OPEC+ a couple of weeks ago, which failed to impress the markets. The sell-off gathered momentum as successive support levels gave way, leading to additional technical selling.

Beyond scepticism about the efficacy of OPEC's recent production cuts, investors have also been troubled by signs of increased non-OPEC supply, as indicated by persistent increases in US crude exports. This is exerting pressure on smaller OPEC+ members to concede more market share as part of their supply reduction agreement. Some members are understandably hesitant to further reduce production, fearing a loss of market share to the US.

On top of the supply-side influences, concerns about demand have also contributed to the recent downturn. The global economy remains sluggish due to elevated interest rates, while the lingering effects of past inflation spikes continue to adversely impact both consumers and businesses. The gradual disinflationary process exacerbates these challenges.

Further downside could be limited for crude oil

Despite the economic challenges, the substantial decline in oil prices may not be entirely warranted, considering the inelastic nature of oil prices in response to demand fluctuations. In this context, the predominant influence lies on the supply side of the equation. Therefore, should the OPEC decide to implement further measures to stabilise prices, it could serve as a significant pillar of support. Recent statements from officials in Saudi Arabia and Russia hint at the potential extension or deepening of supply cuts beyond the first quarter.

Even without additional cuts from OPEC+, they are already making significant efforts in terms of supply restraint. As demand recovers, prices are likely to find support again. One could argue that the extent of the sell-off is already questionable given the ongoing intervention by OPEC+ group.

WTI analysis: Technical levels to watch on crude oil

Source: TradingView.com

Since reaching its peak at $95.00 in September, WTI has experienced a persistent downward trend. Oil prices declined in both October and November and have continued to do so this month. With only two positive weeks in the last 12, and 7 consecutive weekly losses, the prevailing momentum is unmistakably bearish. Therefore, before adopting a tactical bullish stance on oil prices, it is imperative to await a confirmed reversal pattern, despite tentative indications of a potential bottom observed at the end of last week. During that period, prices found support, as we saw a brief dip below $69 before recovering to conclude the week well above the $70 mark.

Looking ahead, the $70.00 level is the key level of support to monitor. Beyond its psychological importance, $70 served as the foundation for the last significant rally in July and aligns with the support trend of the bearish channel. This dual role underscores its critical nature as a potential support zone where prices might find a bottom. Below this level, $67 becomes the next reference point, followed by $65 and the May low at $63.64. We will cover these levels if $70 breaks.

In terms of resistance, the range between $72.35 to $74.00 constitutes a crucial zone. This area previously acted as support before the breakdown last week. Thus, a successful recapture of this key zone by the bulls would significantly raise the likelihood of a near-term bottom. However, a clean breakout from the bearish channel would be ideal for additional confirmation.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade