- Crude oil analysis: Middle East concerns should keep downside limited

- Demand concerns intensified on weaker Chinese industrial data and prospects of higher interest rates for longer

- US crude oil stockpiles rise for fourth week

- WTI technical levels to watch include $82 on the downside and $84.00 on the upside

Today saw crude oil prices fall about 3%. Oil was already under pressure on fears about demand following the weaker Chinese industrial data that was released on Tuesday and the larger crude build in the US as was reported by API last night. But prices fell further after official data from the EIA showed a build of 2.7 million barrels, its fourth weekly build. The fact that these macro factors pushed crude oil below key short-term support at around the $84.00 - $84.50 area, this gave rise to further technical selling. Still, with the Middle East situation at the forefront of investors’ minds, the downside could be limited from here.

Crude oil analysis: Middle East concerns should keep downside limited

Today we haven’t heard anything new related to the situation between Iran and Israel. UK’s foreign secretary and former prime minister David Cameron visited Israel’s PM Benjamin Netanyahu to help prevent escalation. Cameron said: "We hope that anything Israel does is as limited and as targeted and as smart as possible. It's in no-one's interest that we see escalation and that is what we said very clearly to all the people I've been speaking to here in Israel." However, Netanyahu wasn’t having it, telling Cameron that Israel would "make its own decisions" over how to respond to Iran’s attack, vowing to do everything necessary to defend the nation.

So, there was no fresh support for oil concerning potential supply disruptions in the Middle East, leaving traders to concentrate on other factors. They realised that the demand outlook for oil is not so rosy after all. So, they sold crude along with stocks and even gold declined.

Demand concerns arose after weaker economic data was released from China on Tuesday, while the possibility of prolonged higher interest rates are also casting a shadow on the global economic recovery, and thus the oil demand outlook.

Federal Reserve Chair Jerome Powell's recent more hawkish stance has tempered hopes for significant rate cuts this year, potentially leading to a slowdown in economic growth, which could further dampen the outlook for oil demand. With the US dollar has surging to a five-month high this week, this is amplifying the cost of oil for foreign buyers.

Still, the decline in oil prices is likely to be limited. Ongoing geopolitical tensions in the Middle East, particularly concerning Israel's response to Iran's recent weekend attacks, is something that could support prices and push them higher in the event of a strong counterattack by Israel.

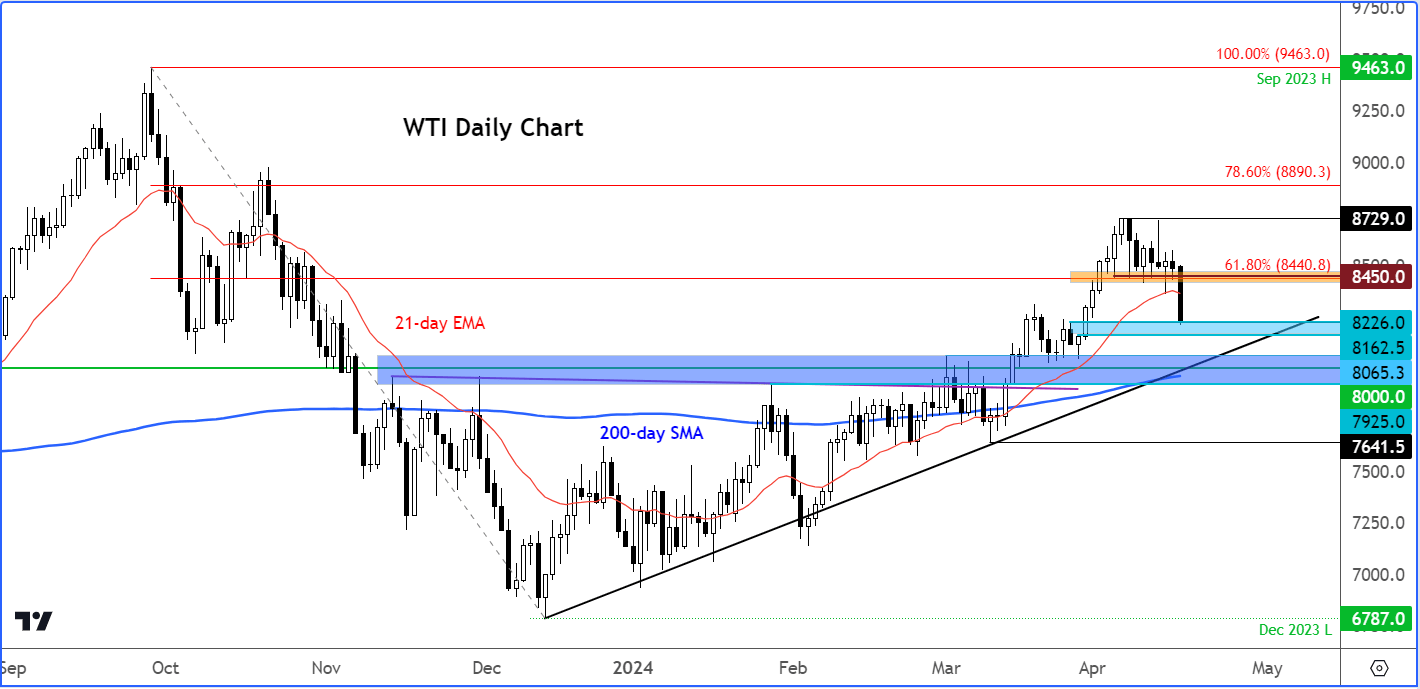

Crude oil analysis: WTI technical levels to watch

Source: TradingView.com

While the short-term trend for oil may not appear bullish, the longer-term bullish technical outlook remains intact, and will remain that way until we see a major lower low form.

Today’s selling got a boost after prices fell below the technically important $84.00 - $84.50 support area. This $84.00 - $84.50 region is now key in terms of potential resistances to watch moving forward.

The next key support level to watch is around $82 area on WTI, where the last rally around the end of last month started. Below here is the longer-term bullish trend line that comes in around the $80.00 area or so.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade