The meeting ended in a stalemate after an agreement to increase production was harpooned by a last-minute objection from the UAE, leaving the crude oil market in limbo. Unsure whether a price spike or price plunge will follow due to the possibility of higher production from some members including the UAE.

Overnight an article in the WSJ journal has further raised the possibility that the UAE is intent on increasing market share to make the most of its reserves, while demand is strong and to aid diversification away from oil revenue.

“Market share is a key factor here,” said a senior U.A.E. oil executive. “We want a bigger market share, to monetize as much as we can from our reserves, especially when we have spent billions developing them.”

Whether comments of this nature are aimed at kick-starting OPEC+ talks or the UAE is signalling a new strategy to sell as much crude oil as possible while crude oil prices are strong remains to be seen.

While most analysts are leaning towards the former, the risk verse the rewards for the crude oil price appear to be towards the downside for now.

This is because should there be a belated agreement to increase supply, it might see crude oil rally $5 from the current price of $72.00 towards this week's $76.98 high. However, if the stalemate continues and members ramp up production, the price of crude oil may fall towards the $61.56 low viewed in late May.

One way to benefit from downside risks in crude oil is by buying USDCAD, which is negatively correlated with the price of oil. USDCAD should also benefit from continued US dollar strength.

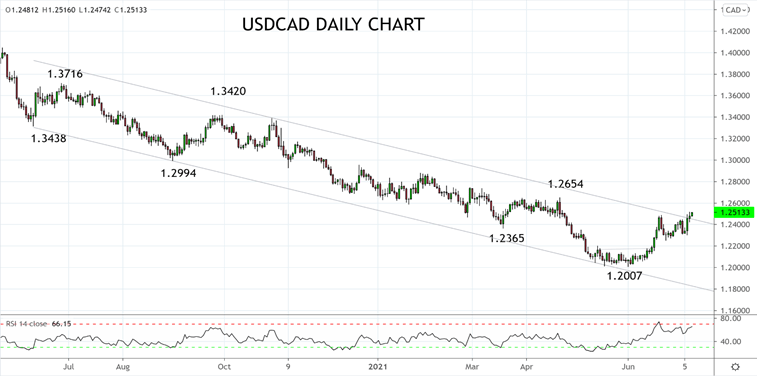

As can be viewed on the chart below, USDCAD has broken and posted a daily close above the trend channel resistance and recent highs at 1.2500.

Should the break higher be confirmed by a second daily close above 1.2500 today, it would be a good indication a medium-term tradable low is in place at 1.2007 and that a rally towards 1.2650 and then 1.2800 is underway.

Source Tradingview. The figures stated areas of the 8th of July 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation