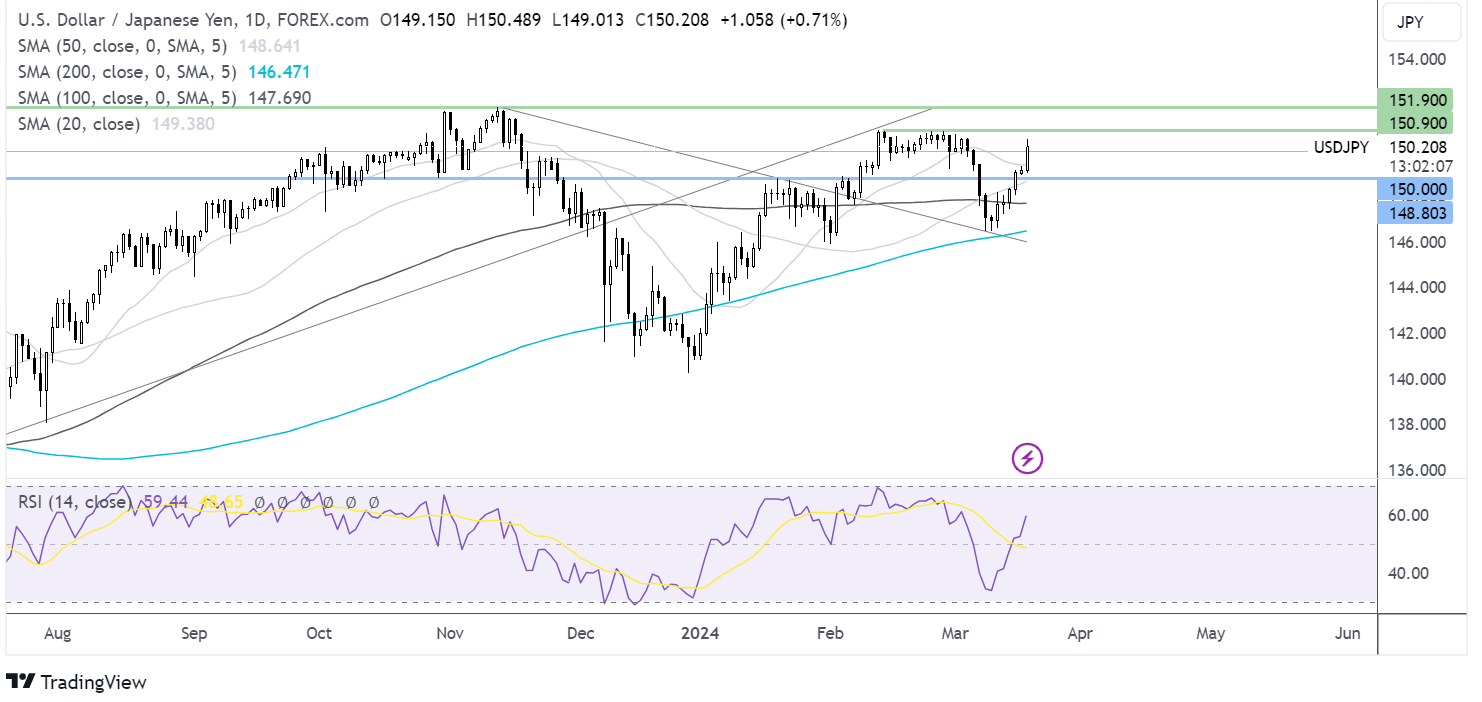

USD/JPY rises despite BoJ hiking rates

- BoJ hikes rates by 0.1% to 0%

- Federal Reserve 2-day meeting begins

- USD/JPY rises to 150.00

USD/JPY has risen above 150.00 after the Bank of Japan hiked interest rates for the first time in 17 years. The BoJ lifted rates by 0.1% to 0% due to growing confidence that a wage inflation cycle is emerging. The central bank also ended its yield curve control policy.

Heading into the decision, the market was largely split over whether the BoJ would move in March or April. Recent developments in the Japanese economy encouraged the central bank to move earlier. Japan's economy narrowly avoided a recession in the final quarter of 2023, and recent wage negotiations saw the largest increase in wages in 30 years, giving the central bank more confidence to begin scaling back its ultra-dovish policy.

However, the yen is falling as the rate hike was only a marginal move away from the Bank of Japan's ultra-dovish stance. Furthermore, the central bank said that uncertainties surrounding the economy could keep monetary policy conditions largely accommodative for the time being.

Meanwhile, the US dollar is charging higher as the Federal Reserve's two-day monetary policy meeting kicks off today with the rate announcement tomorrow.

The Fed is expected to leave rates unchanged but could revise the median dot plot downward to two rate cuts this year, down from three signaled in December’s meeting. The market has also pushed back the start of rate cuts to June or possibly July.

USD/JPY technical analysis

USD/JPY surges above 150.00 towards 150.90, the 2024 high. The bullish engulfing candle, the rise above the 20 SMA, and the RSI above 50 keep buyers optimistic of further upside.

Should buyers push above 150.90, 151.90 the 2023 multi-decade high comes into focus.

On the down side, support can be seen at 150.00, the round number, and 148.80, the January high.

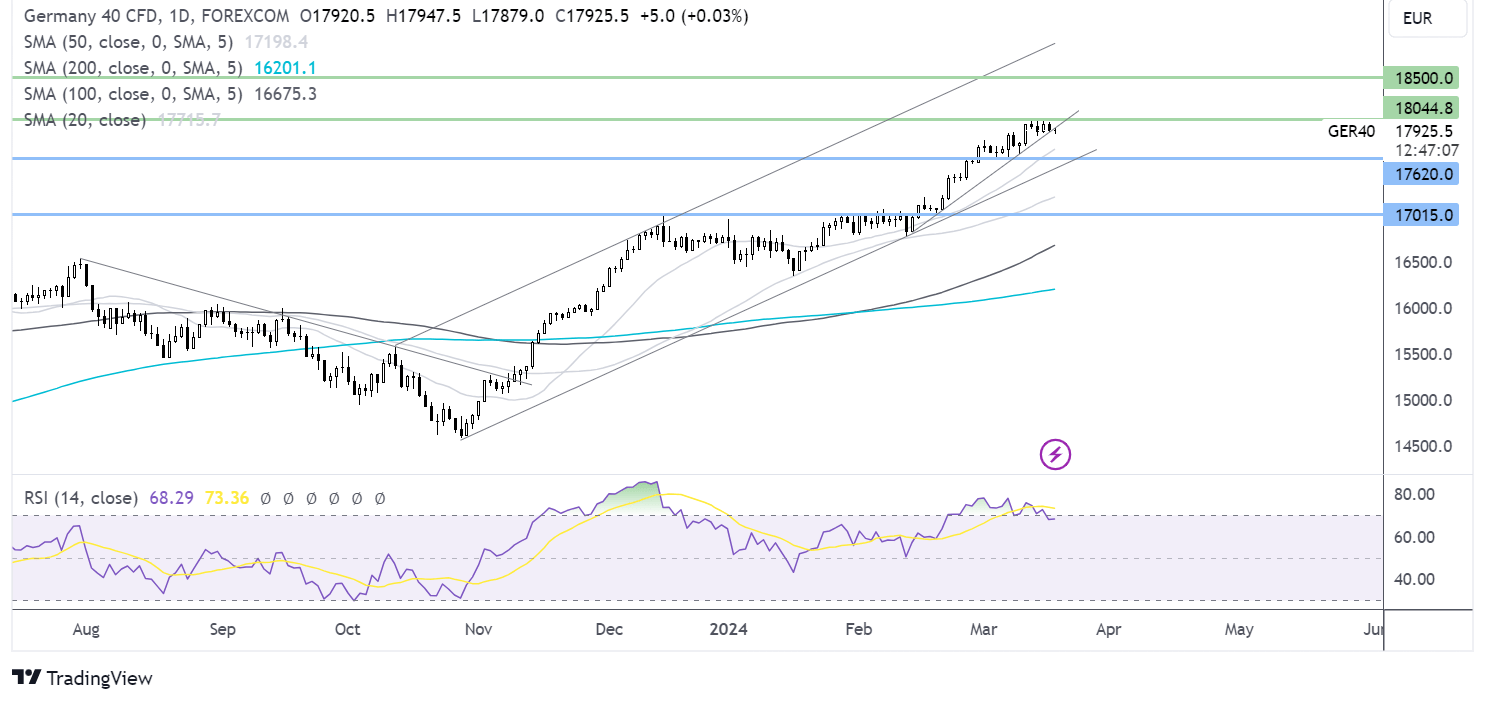

DAX struggles for direction ahead of wage growth & German ZEW economic sentiment data

- Ger. ZEW economic sentiment is forecast to improve to 20.5 vs 19.9

- Eyes on the Fed ahead of the rate decision tomorrow

- DAX eases back from all-time high

European futures are inching lower ahead of eurozone wage data and German ZEW economic sentiment surveys, which could provide further clues on the health of the eurozone economy and when the ECB may start to cut interest rates.

ECB president Christine Lagarde has highlighted wage growth within the region as a reason to be cautious about cutting interest rates. While inflation has eased in the eurozone this year, the ECB said that solid wage growth was keeping domestic price pressures high. Strong wage growth data today could see the markets rain in ECB rate cut bets.

Meanwhile, in Germany, the ZEW economic sentiment is expected to improve slightly in March, marking the eighth straight monthly improvement in morale and signaling better times ahead. However, with PMI data still well in contractionary territory, another few quarters of negative growth could still be on the cards.

Looking ahead, investors will switch their attention to the start of the FOMC meeting, where the Federal Reserve could adopt a more hawkish tone. A downward revision to the number of rate cuts this year could hurt market sentiment, fueling the mantra of higher rates for longer and pulling riskier assets such as equities lower.

DAX forecast – technical analysis

After hovering around 18,000, DAX has eased away from the all-time high, testing support of the rising trendline dating back to mid-February. The RSI is coming out of overbought territory.

Support can be seen at 17600, the March low. A break below here could see the price break out of the multi-month rising channel towards 17000.

Buyers will look to push the price back above 18000 and 18044 to fresh all-time highs.