Key takeaways

- Annual core CPI rose at its fastest pace in 42 years

- Higher prices in April (start of Japan’s financial year) is a slight concern, given retailers usually soften prices

- The yen is stronger as bets are placed of the BOJ tightening policy

- However, the BOJ still see inflation as transitory and fast-falling producer prices may back this view up

Consumer prices in Japan continued to rise in April according to the latest report, which saw core CPI y/y (a key measure of prices) rise to a 42-year high. Food prices jumped 9% from the same period last year, up from 8.2% in March and services inflation rose 1.7% which suggests labour costs are seeping through to the broader economy.

Retail firms tend to soften prices in the new financial year, so to see it rise in April should be a concern for the BOJ who still see current prices rises as transitory (a word the Fed was forced to abandon as inflation was showing no signs of abating).

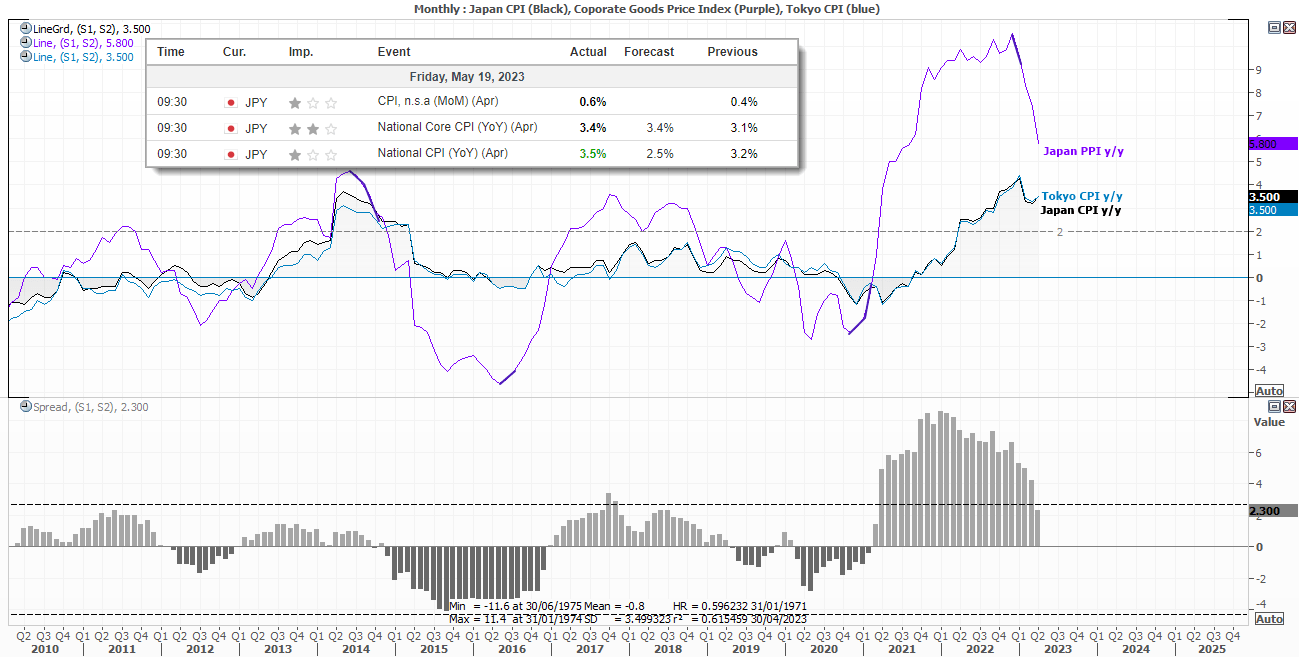

However, the chart above shows that producer prices continue to decline at a rapid pace and that likely explains why the BOJ remain confident that the current pace of rising inflation will not be sustained. The fact that key trade partners such as China and measures of inflation across the world are also slowing is another reason to suspect that the BOJ may be right, eventually. Furthermore, trade data for April continued to decline which is itself could be seen as a form of deflation as demand for products domestically and internationally dwindles.

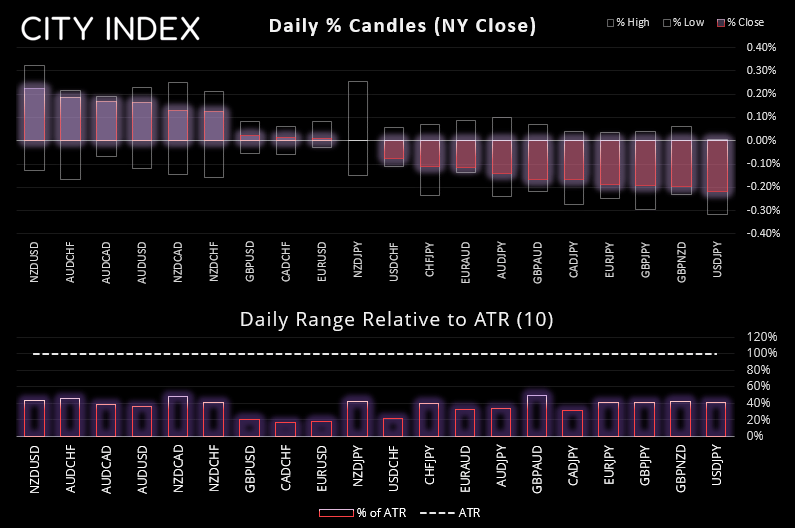

The yen pairs strengthen across the board, but volatility remains low

Regardless, the yen strengthened across the board as traders placed bets that the BOJ could be forced to tighten sooner than later. And perhaps it will, but I doubt it will be enough to turn the tide on recent risk-on gains and hawkish Fed commentary. So, if anything, today’s inflation figure could be seen as the catalyst to help trigger a needed retracement ahead of the weekend, which could leave the potential for trend traders to extend this week’s move in later sessions or perhaps next week if the US debt ceiling is presumably raised.

Besides, we can see on the volatility table above that daily ranges remain well within their ATR’s (average true ranges), so at this stage the moves are assumes to be corrective.

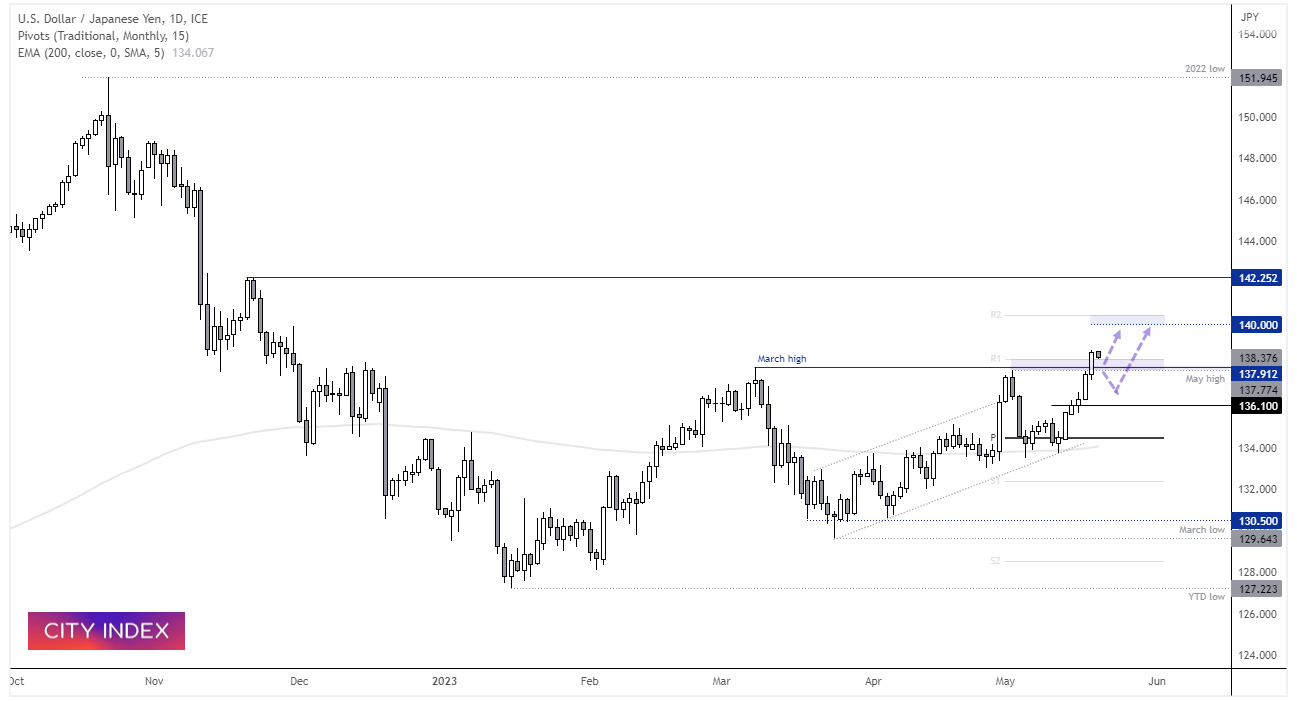

USD/JPY daily chart:

USD/JPY rallied for a sixth consecutive session to 9-month high, making light of the previous YTD high in March. Prices are now retracing from yesterday’s highs but holding around the monthly R1 pivot, although the march high at 137.91 and May high at 137.78 nearby to provide potential support. A risk to the downside could be if debt-ceiling talks get a setback and weigh on appetite for risk.

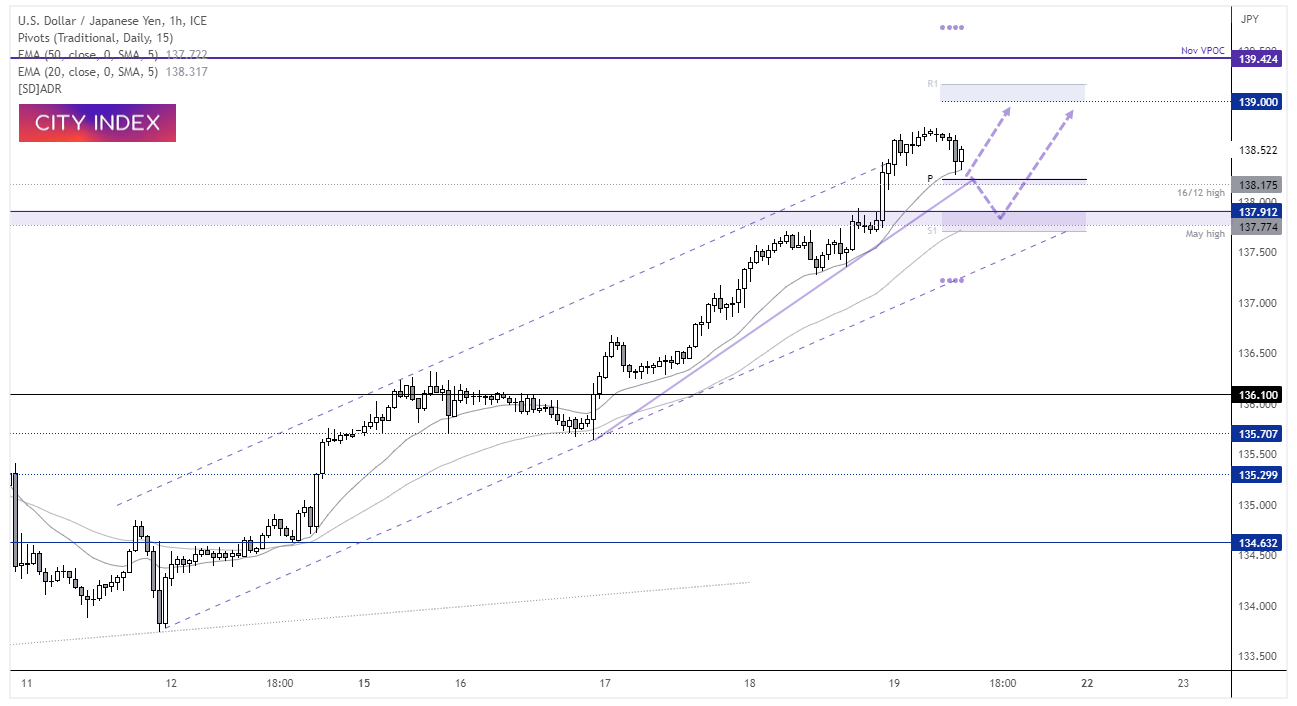

USD/JPY 1-hour chart:

Yesterday’s retracement was shortly lived, before reverting higher after finding support at the 20-bar EMA. Prices are making attempt to break higher from the daily pivot point, and head for the 139 handle, just beneath the daily R1 pivot. Take note that the upper ADR (average daily range) band is just below 140.

However, we may find that prices could recycle lower, in which case bulls could seek evidence of a base around the May high (137.91) or May high before momentum potentially reverts higher.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade