Key takeaways:

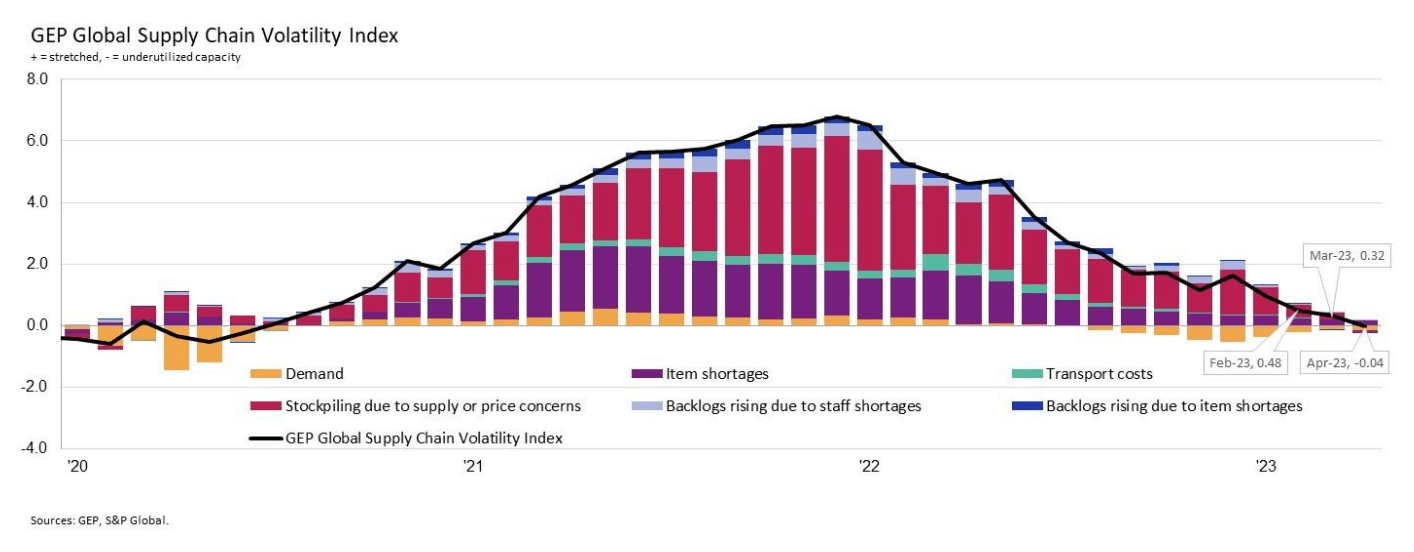

- Global supply chains have excess capacity for the first time since June 2020, according to a report by S&P Global and GEP

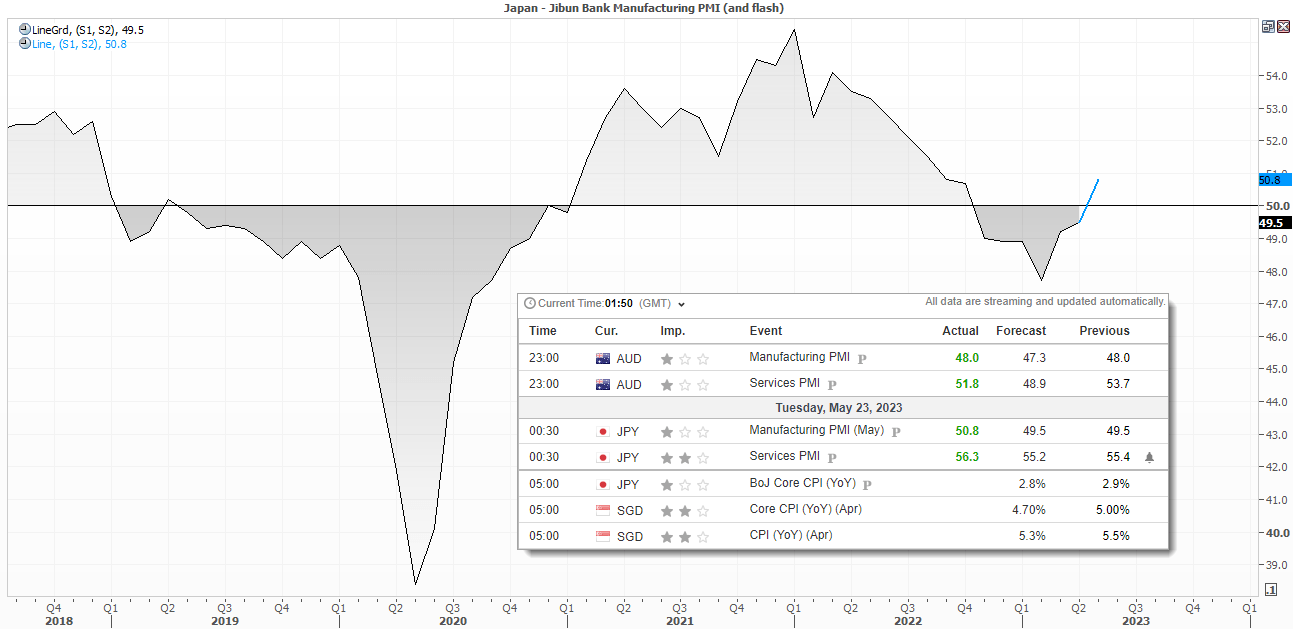

- PMI data for Australia and Japan have been above expectations, which provides a positive lead for flash PMI reports across Europe and the US later today

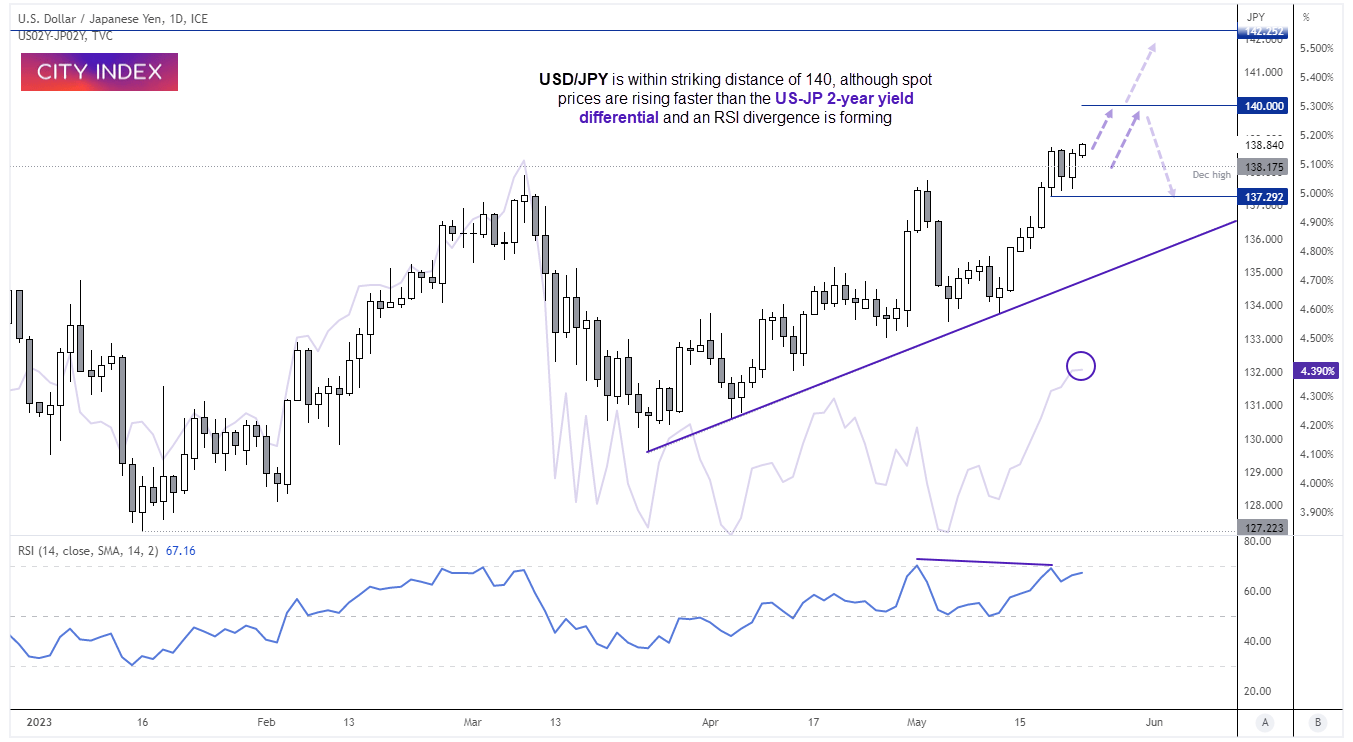

- USD/JPY is within striking distance of the 140 handle, although we note a volume cluster around 135.50, a bearish divergence with momentum and that the US-JP 2-year yield has lagged the recent rally on USD/JPY spot

Global supply chains have excess capacity for the first time since June 2020, according to report compiled by S&P Global and GEP. The headline indicator has contracted following ten consecutive months of demand, lower transportation costs, significantly less stockpiling and few item shortages. And that switches conditions in favours of a ‘buyer’s market’ according to the report, which utilises data from PMI surveys sent to 40 countries and 27k companies.

It is also more evidence of disinflation and softer growth going forward, with demand for raw materials, commodities and components remaining subdued. Whether this will make itself evident in Friday’s PCE inflation report in the US on Friday remains to be seen, but it should provide some relief to central bankers who are crossing their fingers that inflation could trend lower sooner than hoped.

PMI data for May is (so far) above expectations

Economic data is beginning to pick up for the week, with flash PMI data released for Europe, UK and the US over the next couple of forex sessions. Australia and Japan’s PMIs were slightly above expectations for both services and manufacturing, which paints a positive picture for Europe and the US later today as these reports do have a tendency to move in lockstep.

Japan’s composite PMI expanded at its fastest pace since October 2013, manufacturing expanded for the first month in seven and new orders expanded for their first time since June. Interestingly, input and output prices grew at a slower pace for services and manufacturing.

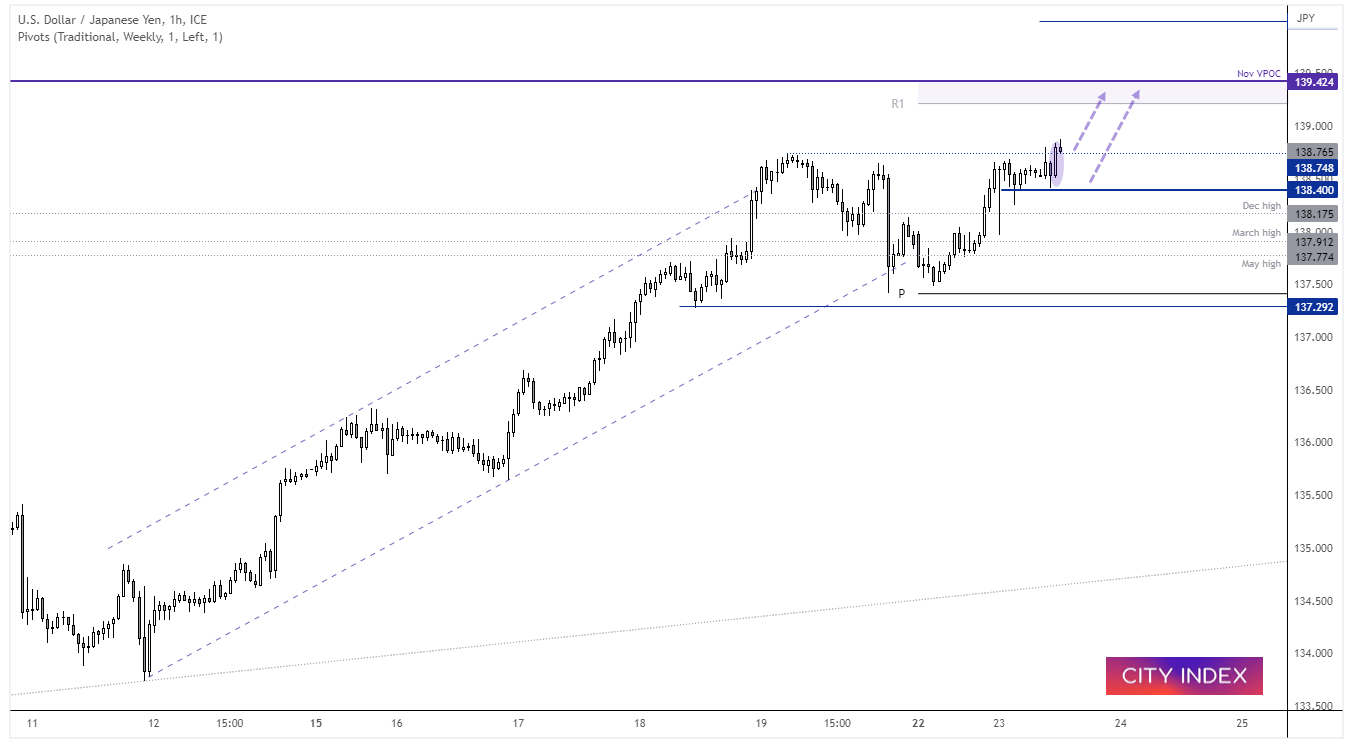

USD/JPY daily chart

The daily chart remains within an uptrend and now within striking distance of the 140 handle. We’ve seen a mild attempt to break to a fresh cycle high in today’s Asian session, after a 3-day consolidation formed above 137.29. We favour a retest of 140 whilst prices remain above those lows, although bulls could use a December high to aid with tighter risk management. Alternatively, bulls could seek bullish setups above or around the December high should we see a low volatility retracement towards it.

However, we’re also cognizant of the fact that a bearish divergence is forming on the RSI (14), and that the US-JP 2-year yield differential has not risen at the same relative rate as USD/JPY spot prices during the recent leg higher. Whilst neither of these points are clues for an imminent top, it is something to be aware of as the trend matures.

USD/JPY 4-hour chart

The four-hour chart shows that prices have continued higher following a volatile shakeout at the end of a bullish channel. A tight consolidation above 138.40 has been complemented with a bullish engulfing candle to suggest momentum wants to break higher. Over the near-term, we’re looking for a move to the daily R1 or historical volume cluster at 139.42.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade