USD/JPY 155 in focus around US inflation, BOJ meeting: The Week Ahead

155 has become the latest 'glass ceiling' for the rapid rise of USD/JPY. And with a key US inflation report, BOJ meeting and potential for risk-off sentiment next week, this key level could be tested and prompt a response from Japan's central authorities.

The week that was:

- Oil prices quickly rose over 4% and gold considered a fresh record high during Friday’s Asian trade, on reports that Israel has stuck an Iranian site with missiles

- Fed Chair Jerome Powell warned that a strong US economy could warrant rates remaining at current levels for as long as needed, and that inflation had showed a “lack of progress” towards their goals

- NZ inflation remained elevated in Q4 which dashed hopes of RBNZ dovish pivot

- Indices across the US, Europe and parts of Asia continued to face selling pressures and racked up a third bearish week

- Yet sentiment for Chinese equity markets had turned around for the better thanks to help from the ‘National Team’, seeing China’s equity markets rally

- China’s GDP comfortably beat forecasts at 5.3% y/y thanks to a slew of policy measures from Beijing in recent months, although retail sales and output suggests the underlying trend remains soft

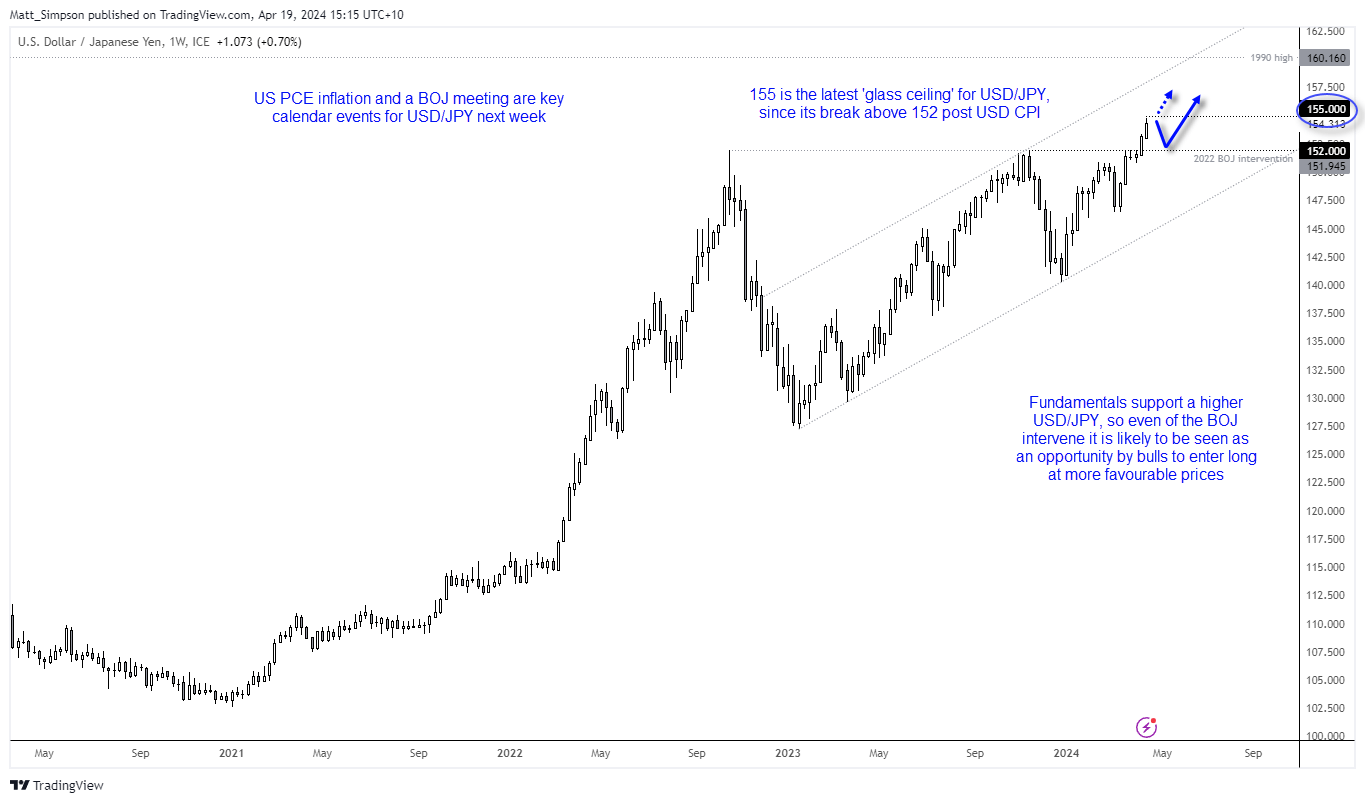

USD/JPY technical analysis:

USD/JPY is on track for its third bullish week, and it will most likely make it. It could also be the second weekly advance since USD/JPY cut through 152 resistance with practically no resistance, following the stronger-than-expected US CPI report.

Japan’s officials were curiously quiet following the break above 152, but they are making noises again as it approach 155 – which is the latest glass ceiling for markets, which was previously 152. Japan’s ex-FX diplomat warned that the BOJ could intervene if prices broke above 155, and on Thursday Korea and Japan vowed to work together on their currency depreciation, due to their “serious concern” of their rapid declines against other currencies.

It is therefore reasonable to assume that any more towards and obviously above 155 brings with it the risk of verbal or actual intervention. And that a hot US PCE inflation report could be the trigger for such a move, ahead of next weeks’ BOJ meeting.

Yet with fundamentals supporting wider yield differentials and a higher USD/JPY, it brings into question as to what level of intervention would be adequate to turn the bullish tide around on USD/JPY? And my guess is they cannot, unless the US also opt to weaken their currency.

Therefore, any intervention-induced pullback is likely to be supported by USD/JPY, eager to buy USD/JPY at a perceived discount.

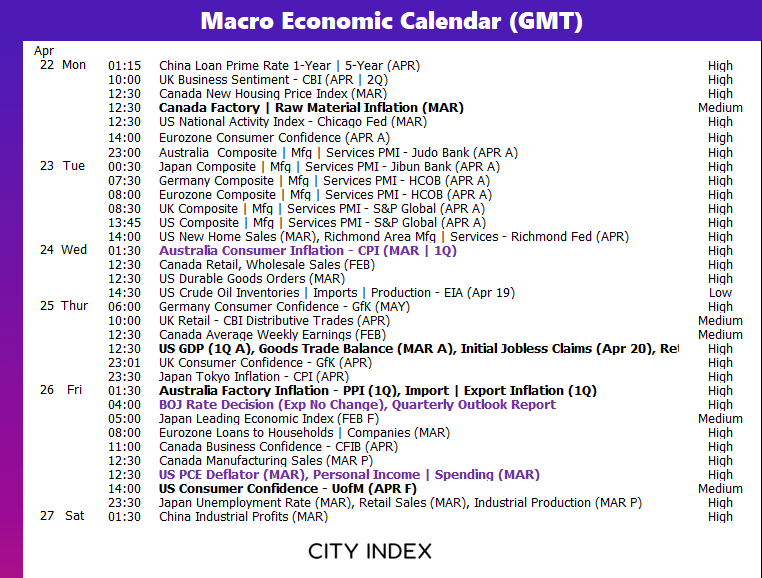

The week ahead (calendar):

The week ahead (key events and themes):

- US PCE inflation

- Australian quarterly CPI report

- BOJ interest rate decision

US PCE inflation

Inflation data remains a hot topic for traders given its potential impact on the Fed’s monetary policy. Yet now markets have slowly unwound bets of multiple Fed cuts to likely none at all this year, I am left wondering how much of an impact next week’s PCE inflation data might actually have on markets.

A volatile market reaction to any data release requires a surprise, one way of another. Yet with PCE inflation data itself being less volatile then headline CPI reads, markets preparing for no or very few cuts and the likelihood that PCE will not soften enough to change these views, it leaves and upside surprise if anything.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

BOJ interest rate decision

The Bank of Japan are unlikely to change policy on Wednesday, and even if they did it won’t be much and is unlikely to be followed up by much else any time soon. At least, if comments from BOJ member Noguchi are to be believed when he said “it’s short-term policy rate adjustment is likely to be slow”.

Markets are pricing in less than a 50% chance of a 10bp hike by July, according to Bloomberg. With that said, the BOJ are not ones to base their policies on market pricing and will ultimately say and do that they want, when they want. Therefor, one should never drop their guard against the BOJ, as the central bank has a history of surprising market – even if once in a very long while.

Trader’s watchlist: USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nikkei 225

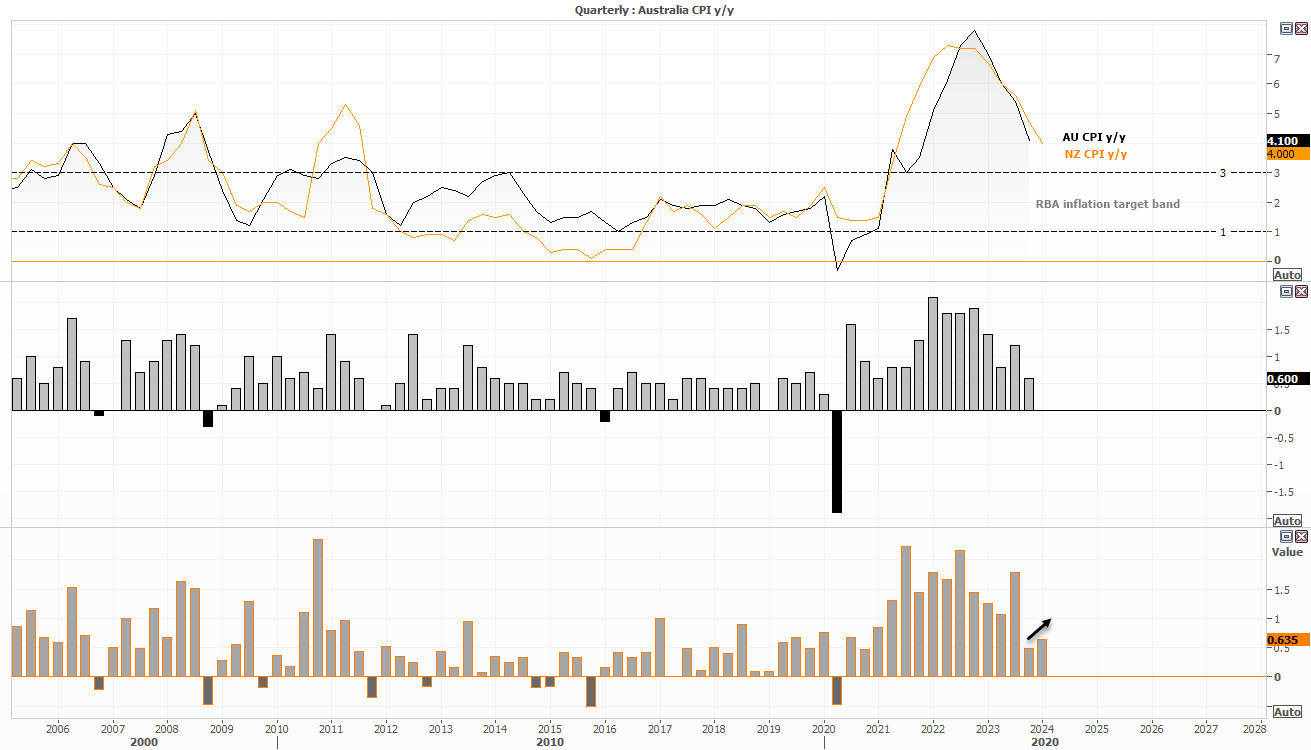

Australian quarterly CPI report

There has been little in the way of economic data for Australia that has swayed opinions that the RBA is likely to hold rates at 4.35% for the time being. However, if any data point next week is to change that it could be the quarterly CPI report. Like many other central banks, the RBA deem inflation to be “too high”, and the quicker if softens the more likely the case builds for a rate cut – although it also needs to be coupled with weaker employment figures to expect any cut to be imminent.

Whilst each has their own domestic drivers of inflation, the headline CPI reports track each other relatively closely over the longer term. And given the New Zealand’s CPI report this week revealed annual CPI to be 4% or 0.6% q/q, it does raise the question as to whether Australia’s CPI rate will fall much from 4.1% y/y or 0.63% in next week report, if it softens further at all.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade