Asian Indices:

- Australia's ASX 200 index fell by -30.6 points (-0.42%) and currently trades at 7,199.80

- Japan's Nikkei 225 index has fallen by -296.36 points (-0.88%) and currently trades at 33,236.73

- Hong Kong's Hang Seng index has risen by 3.11 points (0.02%) and currently trades at 17,933.66

- China's A50 Index has fallen by -18.74 points (-0.15%) and currently trades at 12,579.17

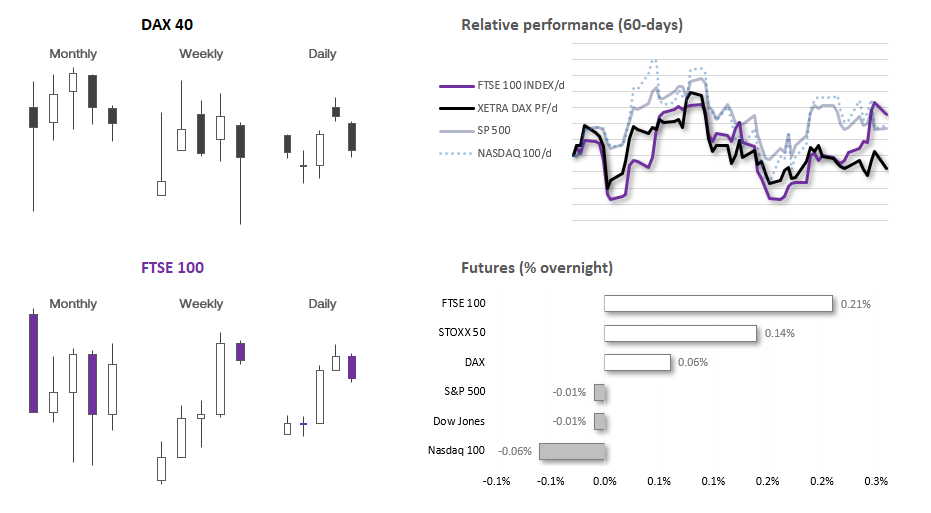

UK and Europe:

- UK's FTSE 100 futures are currently up 11.5 points (0.15%), the cash market is currently estimated to open at 7,664.44

- Euro STOXX 50 futures are currently up 3 points (0.07%), the cash market is currently estimated to open at 4,248.88

- Germany's DAX futures are currently up 2 points (0.01%), the cash market is currently estimated to open at 15,729.12

US Futures:

- DJI futures are currently down -7 points (-0.02%)

- S&P 500 futures are currently down -1.25 points (-0.03%)

- Nasdaq 100 futures are currently down -11.25 points (-0.07%)

Events in focus (GMT+1):

- 10:00 – European CPI

- 13:30 – US building permits

- 14:30 – Canada’s CPI

With the ECB effectively confirming that they are done with hiking interest rates, it could take a particularly strong set of inflation figures for markets to expect otherwise. Even if CPI data is slightly hotter than expected, it doesn’t remove that fact that Europe is staring down the barrel of a recession, and if inflation is too high it is likely recessionary anyway.

And that may make Canada’s inflation data the more interest release of the two, as it’s not unreasonable to suspect CPI may surpass expectations and rekindle bets of another Bank of Canada (BOC) hike.

Rising energy costs are expected to send CPI up to 3.8% y/y from 3.3%, although the monthly read is inly expected to rise 0.2% versus 0.6% previously. So if there is to be any surprises, it’s likely to be the m/m read for CPI. Also keep an eye on Median and Trimmed Mean CPIs, as these are the preferred measures for the BOC and have remained relatively high at 3.7% and 3.6% y/y respectively.

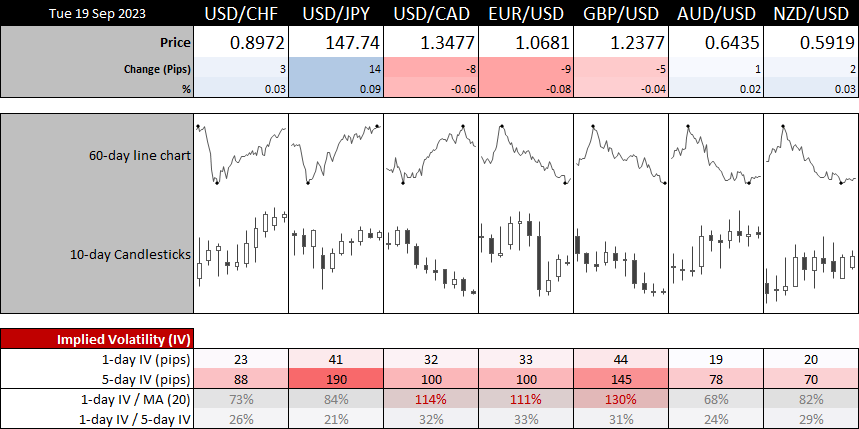

Currency ranges may remained limited and price action choppy, with an FOMC meeting less than 48hrs away. And that is being reflected in 1-day implied volatility levels, with USD/JPY, USD/CHF, AUD/USD and NZD/USD IVs below their 20-day average. USD/CAD and EUR/USD 1-day IVs are also only slightly above their 20-day average.

GBP/CAD is teasing its 3-month cycle lows after closing firmly beneath its 200-day EMA yesterday. CAD/JPY is probing its 11-month high and looks keen to try and test 110, just beneath the October and 2022 highs.

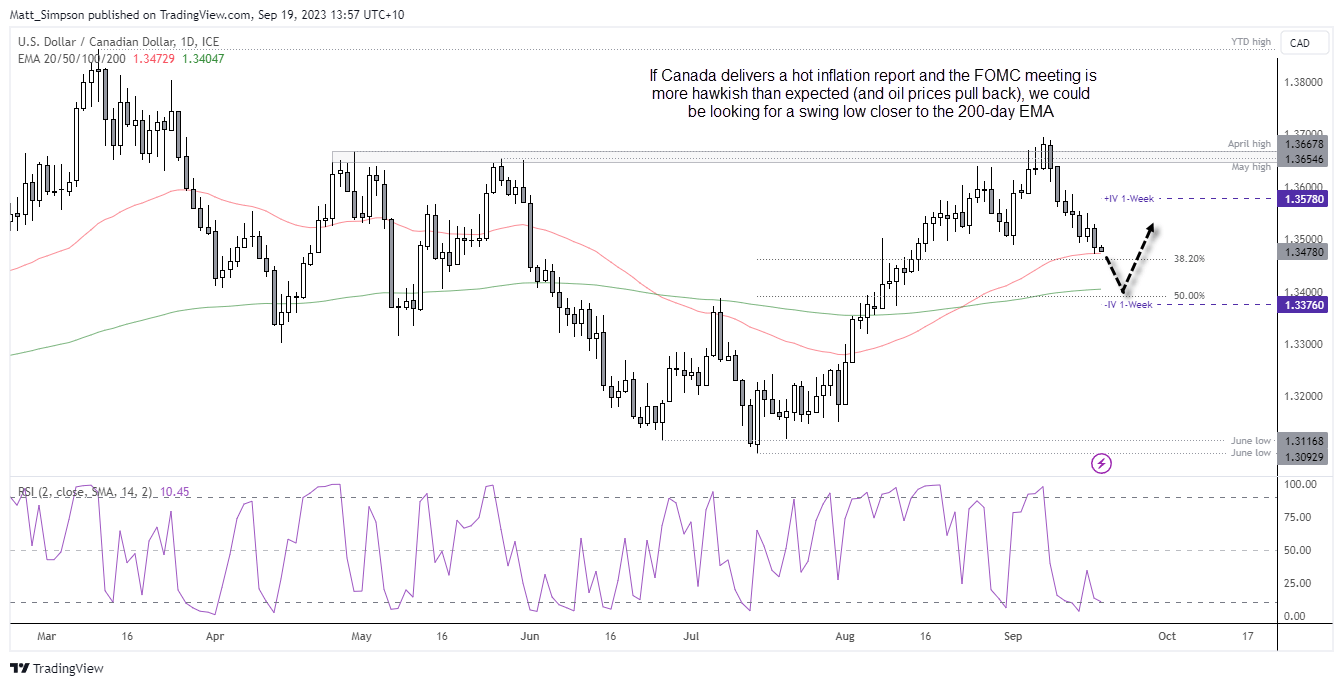

USD/CAD technical analysis (daily chart):

USD/CAD finally saw the bearish reversal I had pencilled in, after bulls failed to hold on to gains around the April and May highs. A 2-bar reversal pattern formed at the highs and the pair has pulled back to its 50-day EMA, just above the 38.2% Fibonacci level. A slight bullish divergence is trying to form on the RSI (2), which reached oversold (below 10) on Thursday.

USD/CAD is likely to be driven by today’s CPI data for Canada and tomorrow’s FOMC meeting, so volatility can be expected. The 1-week implied volatility levels suggest a 66% chance of USD/CAD closing within the 1.3376 – 1.3578 range, although take note that the 50% retracement level and 200-day EMA sit just above the lower range.

And with risks that Canada’s inflation may surprise to the upside, perhaps we’ll a break beneath the 50% level and head for 1.3400. However, there’s a decent chance that the Fed meeting may not be as dovish as some hope and, with oil prices looking set for a pullback, perhaps USD/CAD can carve out a swing low following the FOMC meeting.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade