US futures

Dow futures +0.2% at 35282

S&P futures +0.22% at 4480

Nasdaq futures +0.25% at 15319

In Europe

FTSE -0.19% at 7111

Dax -0.15% at 15776

Euro Stoxx -0.05% at 4167

Learn more about trading indices

Futures higher ahead of Powell

US stocks are set to open on the front foot ahead of Powell’s key note speech at the annual Jackson Hole Symposium. Without any question of doubt this has been the central focus for the markets across the week and across the quiet summer month of August. The event isd often used as a platform to signal a change in policy.

Will Fed Chair Powell give any clues over how and when monetary policy will be eased?

The broad expectation is that Fed Powell will provide some guidance, particularly after the hawkish comments from Fed speakers yesterday. However, there is also a very real risk that the market is going to be disappointed here. Powell bringing nothing new to the table and kicking the can down the road into Autumn, due to the rise of delta cases and slowing economic recovery, could drag the US dollar lower whilst boosting stocks to record highs.

Prior to the speech investors will be watching US PCE inflation numbers closely. These are the Fed’s preferred measure of inflation. Core PCE is expected to rise to 3.6% YoY in July up from 3.5% as it remains around a 30 year high.

Where next for the Dow Jones?

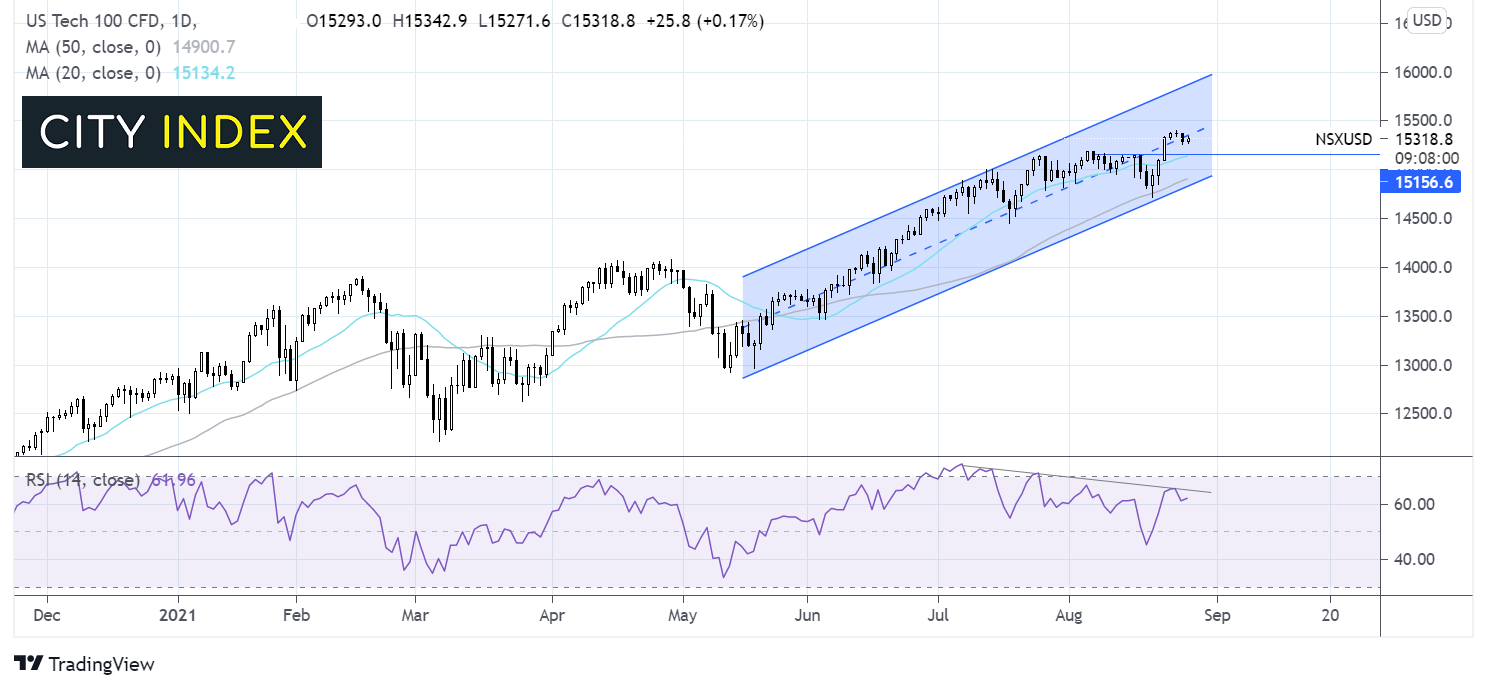

The Nasdaq has been trending higher within an ascending channel since mid-May. The price currently trades arounds the mid-point of that channel, hitting an all time high of 13400. However the bearish divergence in the RSI points to slowing momentum. Meanwhile the Doji candle highlights indecision ahead of Powell’s speech. A move above 15400 is needed to reach fresh all-time highs with15875 the upper band of the channel as a potential channel. On the flip side a move below 15150 could negate the near term up trend whilst a move below 14900 the 50 sma and lower band of the channel could see sellers gain traction.

FX markets muted ahead of Powell

There is very little going on in the FX markets as traders sit on the sidelines ahead of a key afternoon for the US Dollar.

The US Dollar is holding steady with all eyes on PCE data and Fed Chair Jerome Powell’s speech later today at Jackson Hole. The greenback holds onto gains from the previous session following a strong of hawkish commentary from Fed officials.

AUD/USD is outperforming peers although that’s not difficult given the lack of movement across the majors. The Aussie is tracing metal prices higher shrugging off weaker than expected retail sales data. Retail sales contracted -2.7% in July, down from -1.8% in June amid expanding lockdown restrictions.

AUD/USD +0.22% at 0.7252

GBP/USD +0.05% at 1.3711

EUR/USD +0.06% at 1.1760

Oil set for almost 10% gains this week

Oil is resuming the uptrend after a dip lower in the previous session. Oil is pushing higher amid expectations of production disruption as a storm approaches the Gulf of Mexico, an area which accounts for around 17% of US crude oil output.

Crude oil trades up around 10% so far this week as China appears to have won the battle against its most recent covid wave, on a weaker US Dollar and as expectations rise that OPEC+ will hold off from any production increases at its upcoming meeting.

US crude trades +1.6% at $68.40

Brent trades +1.4% at $71.21

Learn more about trading oil here.

The complete guide to trading oil markets

Looking ahead

15:00 Jackson Hole Symposium

15:00 Michigan Consumer Sentiment

18:00 Baker Hughes Rig Count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.