US futures

Dow futures -0.35% at 34600

S&P futures -0.20% at 4423

Nasdaq futures +0.25% at 14488

In Europe

FTSE -0.03% at 7470

Dax +0.45% at 15393

Euro Stoxx +0.22% at 4146

Same risks remain, earnings cushion fall

Stocks are heading for a mixed start to the week, with bargain hunters out boosting the Nasdaq. Last week stocks went on a roller coater ride as investors digested rising eaters Europe geopolitical tensions, a hawkish Fed and broadly encouraging US earnings.

The same risks remain heading into the new week, plus the latest data which shows that growth in China continues to slow. Both manufacturing and services growth slowed.

Oil prices are rising again, set for the best January in 30 years, on the back of Russia Ukraine tensions which should see energy stocks off to a strong start today.

On the earnings front, of the 172 S&P500 stocks that have reported so far 81% have met or beaten forecasts. This week is another big week for companies reporting with the likes of Amazon, Alphabet and Exxon Mobile all due to report. Upbeat earnings have helped cushion the rotation out of high growth tech stocks on the back of hawkish Fed expectations.

Looking ahead rate decisions from the RBA, BoE & ECB will be in focus this week and could lay out the market mood for weeks ahead.

In other corporate news:

Citrix Systems has fallen over 3.5% pre-market on a report that Elliot Management and Vista Equity Partners are close to agreeing a deal worth $104 per share to take the company private. This was below Friday’s closing price.

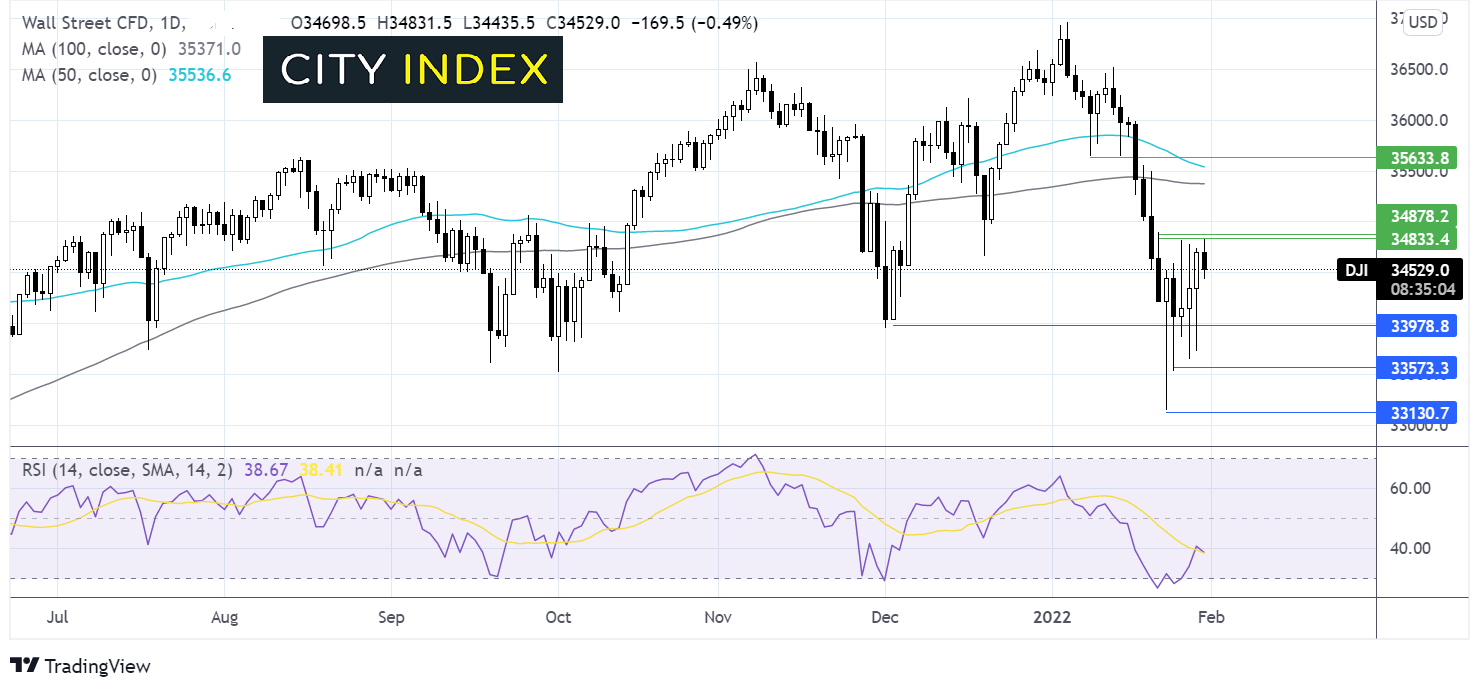

Where next for the Dow?

The Dow Jones extended its rebound from 33145 low hit last week and has run into resistance around 34830 – 34900, a zone it failed to break above despite multiple attempts last week.

After big swings last week, volatility has calmed. The bigger picture remains bearish with the Dow trading below its 50 & 100 sma and the RSI points to further losses.

33980 the December low could offer support on the way down, ahead of 33570 the January 25 low.

Meanwhile buyers could look for a move above 34900 to open the door to the 100 sma at 35375.

FX markets USD slips, EUR gains despite mixed GDP data

The USD is easing lower but remains near the 19-month high last week. The USD was lifted by a more hawkish Fed, stronger than forecast GDP data and higher than expected core PCE figures.

EUR/USD trades mildly higher but failing to really capitalize on the weaker buck after mixed GDP data from the bloc. Whilst the economy grew 0.3% QoQ in Q4, in line with forecasts this was down from 2.3% recorded in Q3. On an annual basis GDP missed forecasts growing at 4.6% YoY against 4.7% forecast

GBP/USD +0.14% at 1.3413

EUR/USD +0.04% at 1.1153

Oil keeps on rising

Oil prices are on the price, adding to last week’s gains and setting oil on track for gains in January of around 17%. This marks oils largest monthly gain in a year as geopolitical concerns and tight supply drive up the price.

Russia Ukraine tensions remain elevated as Russia continues to build a presence of troops on the border, but says it is not looking to invade. A warning from the head of NATO over the weekend that Europe needs to diversify its energy supplies hit the nail on the head. Fears of Europe’s energy security are driving prices higher.

Elsewhere a pipe rupture in Ecuador and tensions in the middle east are combing with eastern European concerns lifting the price.

Supply is already tight, even before these problems, as economies ramping up after Omicron.

OPEC+ meeting this week and are expected to keep output inline with current levels, particularly given that producers failed to reach their output target in December

WTI crude trades +0.6% at $86.78

Brent trades +0.61% at $89.07

Looking ahead

14:45 Chicago PMI

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.