US futures

Dow futures -0.5% at 33570

S&P futures -0.5% at 4350

Nasdaq futures -0.6% at 14170

In Europe

FTSE -2.8% at 7019

Dax -3% at 13900

Euro Stoxx -3.5% at 3838

Learn more about trading indices

Ukraine worries hit the market, NFP smashes forecasts

US stocks are heading sharply lower after Russian forces bombed then took control of a Ukraine nuclear energy power, station, the largest in Ukraine, and as investors digest the latest non-farm payrolls.

Whilst fears of an environmental disaster have been eased as radiation levels remain unchanged, concerns over how far Putin is willing to go to achieve his aim are hitting risk sentiment. Meanwhile, more companies are pulling out of Russia in a stand against the attacks on Ukraine.

Russia, Ukraine headlines continue to drive risk sentiment in a very volatile week. European shares have seen their biggest outflow ever. US stocks have fared a little better but not so much so.

The impressive non farm payroll report helped pick futures off session lows. 678K jobs were added in February, well ahead if the 400k forecast. Unemployment dropped to 3.8% from 4% and wages remained unchanged. The data suggests that the US economy is strong enough to handle rate hikes.

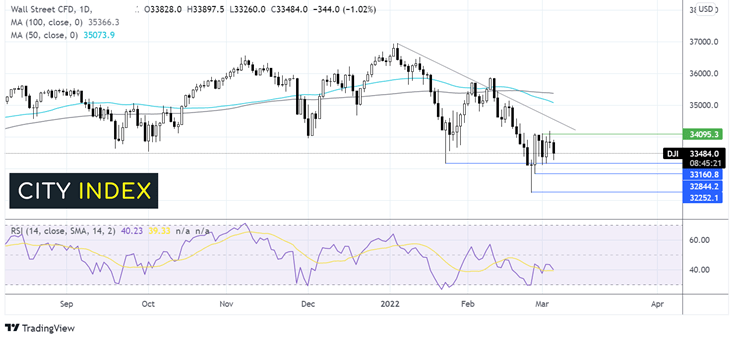

Where next for the Dow Jones?

The Dow Jones is consolidating around 33160 and 34100. It trades below its 50 &100 sma and the 50 sma has crossed below the 100 sma in a bearish signal. The RSI supports further losses. Sellers will be looking for a move below 33160 to target 32900 and 32250 the 2022 low. On the flip side, a move over 34100 could give buyers hope of further gains towards 34500 the falling trendline support

FX markets USD rallies, EUR slumps lower.

USD is rallying hard on safe-haven flows following the latest developments in Ukraine. The US dollar index is set to rise over 1.8% this week.

AUD/USD the Australian dollar is outperforming its major peers once again, trading at a 2022 high, as it traces metal and commodity prices higher.

EURUSD trades below the key psychological support of 1.10 at the lowest level in almost two years. Demand for the common currency has plunged amid fears of stagflation in the eurozone and as the US dollar roars higher on safe-haven flows

GBP/USD -0.6% at 1.3266

EUR/USD -1.1% at 1.0937

Oil jumps over 20% this week.

Oil prices are again rising, after falling from decade highs in the previous session. Oil is set to gaun around 20% across the week.

Today oil supply fears are offsetting any optimism surrounding a nuclear deal with Iran. Pressure is growing on Biden to start applying sanctions to Russian oil exports as the conflict in Ukraine intensifies.

Optimism that Iran’s 2015 nuclear pact will be revived is helping limit gains in oil for now, but the market will want to see progress quickly.

WTI crude trades +2.7% at $109.30

Brent trades +2.1% at $112.30

Learn more about trading oil here.

Looking ahead

18:00 Baker Hughes Rig Count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.