US dollar weakness might be short lived: The Week Ahead

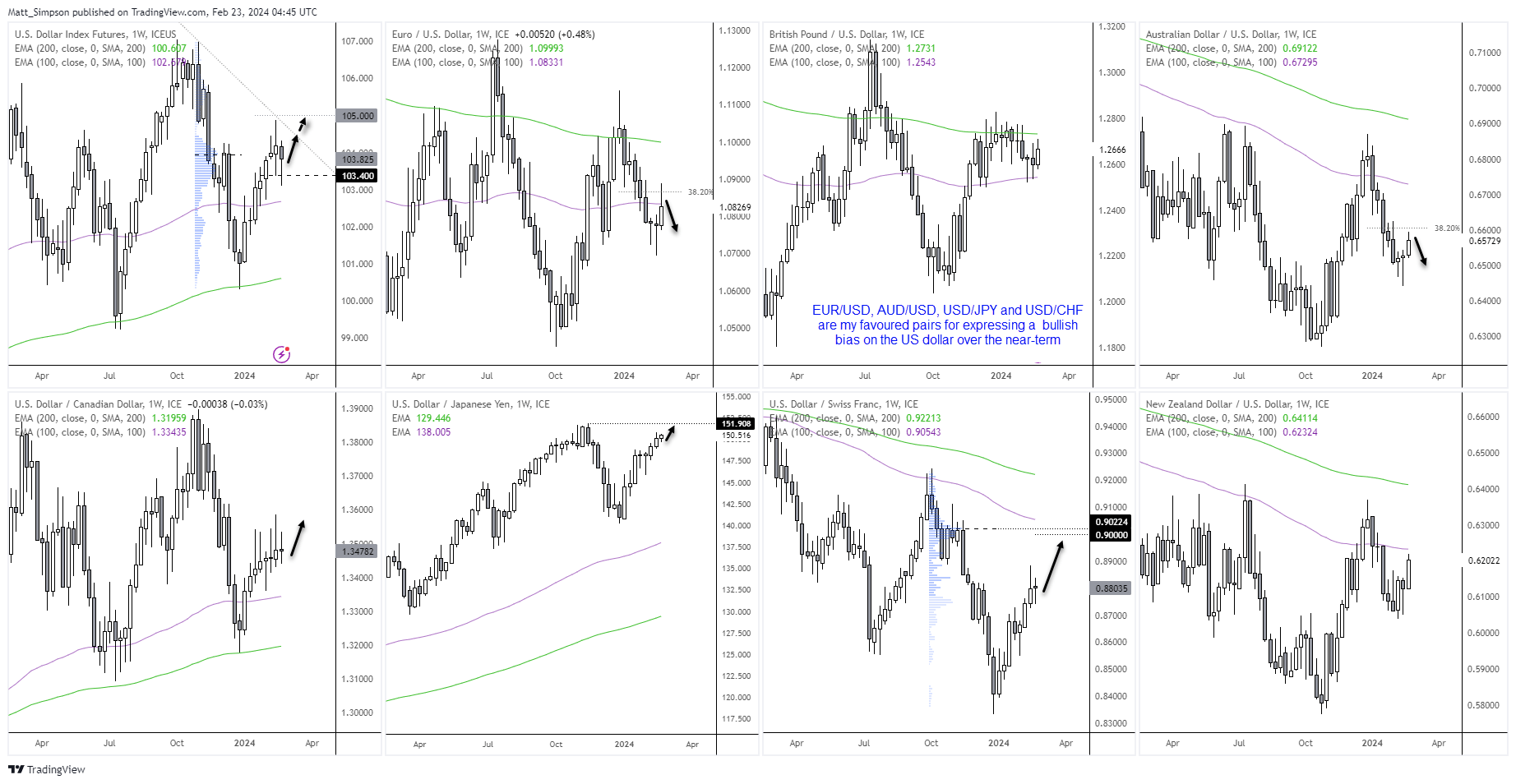

I had been anticipating a retracement on the US dollar index, given it had risen in a relatively straight line from the December low before printing bearish reversal candle around trend resistance, a volume cluster and the 105 handle. This week we saw the US dollar weaken and break beneath the Doji low, yet most of its early-week losses have been recouped and incoming data along Fed speak makes it hard to justify an overly bearish view on the USD.

With that said, I am not yet convinced the US dollar index will simply rally from here and break above 105. But a glance across the FX majors could help reveal the better pairs to bet against with US dollar strength in mind.

Source: TradingView

- AUD/USD is on track to rise for a third week after two marginally bullish pinbars, yet price action on the daily chart suggest a swing high may have formed around its 200-day EMA

- EUR/USD also formed a bearish pinbar on Thursday, although we’d prefer to wait for a break below 1.08 to confirm a swing high, given the pinbar formed just above the 200-day EMA

- USD/CHF is currently flat for the week, yet a nice trend has formed on the daily chart to suggest further gains could await, which brings the volume cluster around 0.90 into focus for bulls

- USD/JPY has formed a bullish trend on the 1-hour chart, and its retracement into a support zone suggests a swing low may have formed and that it wants another crack at rising towards 150.80

The week that was:

- Nvidia beat Q4 earnings estimates by 7% which saw the stock rise over 15% during after-hour trade and help Wall Street index futures pare losses of the prior two days

- The Nikkie 225 reached a record high with a break above its 1989 high, which paved the way for Dax futures to also print a record high ahead of the S&P 500, Dow Jones and Nasdaq 100

- The FOMC minutes saw most Fed members agreed over concerns of cutting interest rates too soon

- Fed Waller urged patience on rate cuts in a subsequent speech, sending US yields higher (US02yr is at a 10-week high at the time of writing)

- China’s equity markets rallied for a second week as it became apparent that Beijing had taken further steps to protect the market and make it easier for the ‘plunge protection team’ to do its jobs

- Canada’s inflation data came in broadly lower than expected, which initially sparked hopes of a less-hawkish Fed (but those hopes did not last)

The week ahead (calendar):

The week ahead (key events and themes):

- US PCE inflation, ISM manufacturing

- Australian CPI, retail sales

- RBNZ cash rate decision, press conference

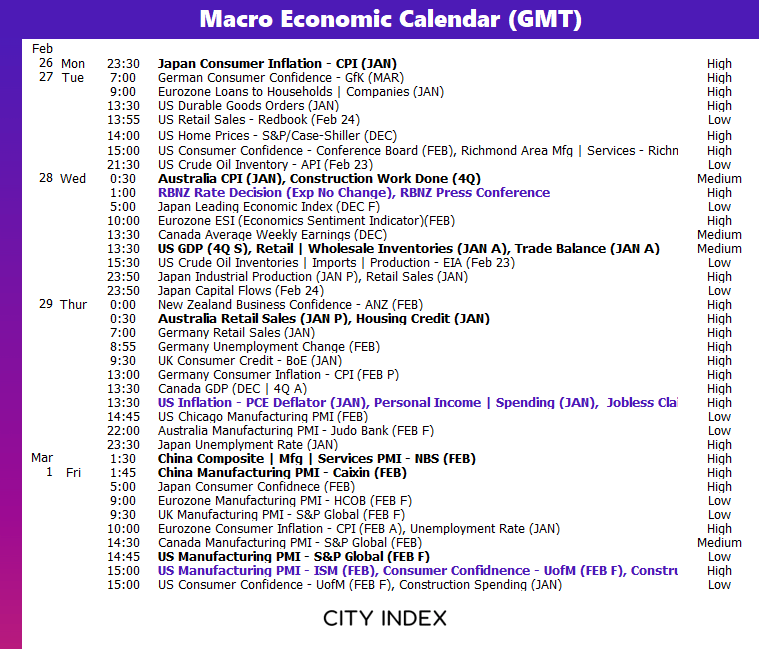

US PCE inflation, ISM manufacturing, GDP

Fed members have managed to keep the doves at pay as money markets have mostly scaled back bets of multiple cuts from the Fed this year. Yet they are still trying to price a cut or two in. So traders will keep a close eye on several data points next week to see how the economy is holding up and assess if inflation could move higher.

The key event next week is easily the PCE inflation report on Thursday. We already saw headliner CPI figures come in higher than expected, so it is not impossible to see PCE data follow suit – even if it is generally the less volatile data set of the two. If higher core PCE is to rise and then be followed by an expansive ISM manufacturing report, the US dollar is likely to catch a bid as bets of a cuts this year are all but eradicated. Also note that new orders, prices paid and employment sub-indices expanded last month, all of which points towards the inflationary forces doves do not want to see.

Trader’s watchlist: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

Source: Refinitiv

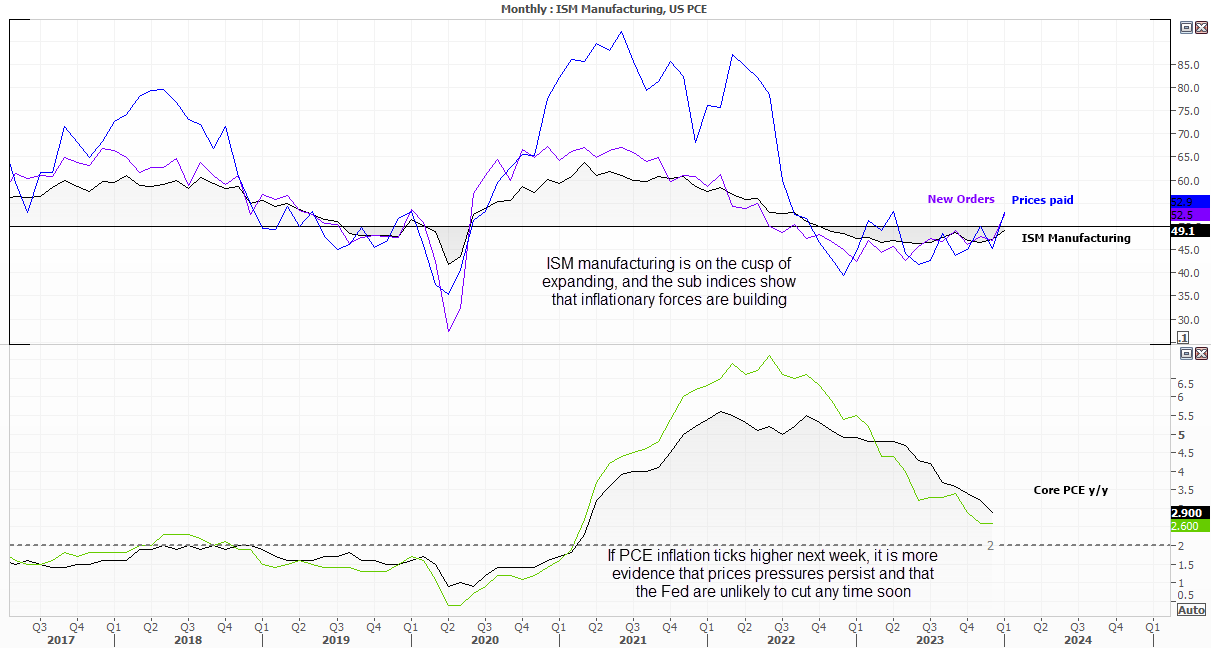

RBNZ cash rate decision, press conference

The RBNZ will hold their first monetary policy decision of the year next week. The thought of the RBNZ potentially hiking rates again this year was not on the radar a couple of weeks ago, yet ANZ’s call for two more 25bp hikes this year has sent NZD pairs higher in recent days. The ANZ admit that their call has been made with lesser-known and obscure data sets, but the concern is that inflation is not under control and the economy could be susceptible to another round of higher prices.

The cash rate is currently 5.5%, and the OIS curve shot higher on the day the ANZ announced their OCR revision. At the time of writing, the 3-month OIS estimates a ~60% chance of a 25bp hike by May which would send the cash rate to 5.75% - the highest among FX major central banks.

Although it is very likely the RBNZ will holds their cash rate next week, it will be interesting to hear the RBNZ’s view on the inflation situation in light of ANZ’s hawkish cash-rate revision.

As a reminder, the RBNZ’s November statement reiterated that “inflation remains too high” and that “interest rates will need to remain at a restrictive level for a sustained period of time”. This translates to higher for longer rates without a hawkish bias, so if little is changed to the statement it assumes the ANZ are on the wrong side of their own bet.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

Source: Revinitiv

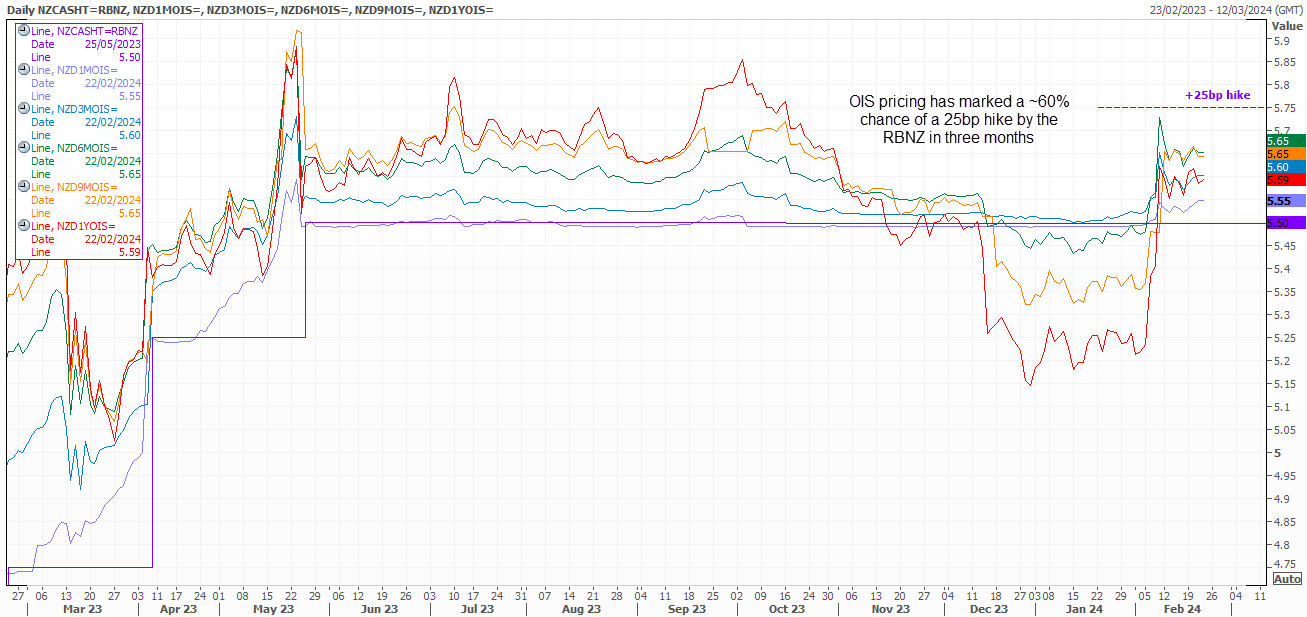

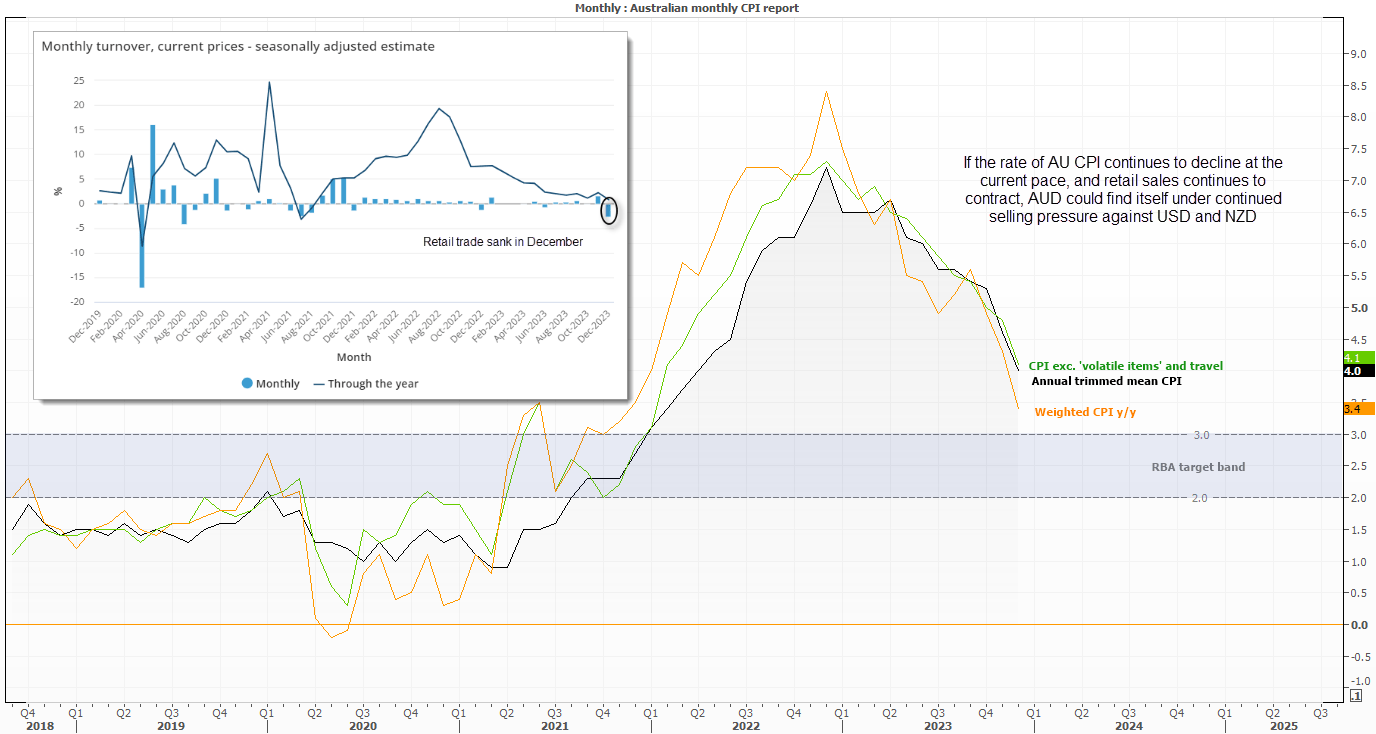

Australian CPI, retail sales

In all likelihood, these data points won’t move the RBA’s needle in either direction unless they move one way or the other in tandem. The RBA retained their hawkish bias despite few expecting further hikes from them, so it is really a case of seeing whether further signs of a slowing economy surface to justify the removal of the pesky hawkish bias.

The official quarterly inflation report may be the preferred measure for the RBA, but the newer monthly CPI report helps them keep a more timely check on the potential direction of the quarterly report. However, take note that the ABS (Australian Bureau of Statistics) also revise their CPI basket, which runs the risk of services items gaining a greater weighing which could make services inflation stickier.

Also keep an eye out for retail sales which dipped noticeably in December. Any further signs weakness here points towards a strained consumer, and less case to hike and more of one to cut at some time in the future.

Trader’s watchlist: AUD/USD, NZD/USD, AUD/NZD, NZD/JPY, AUD/JPY, ASX 200

Source: Refinitiv

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade