GBP/USD looks to Jackson Hole, US PCE & GDP Q2 (second reading)

GBP/USD trades is edging lower snapping a three-day winning run

Post Brexit supply chain issues mean food shortages could last well into next year supermarkets warn.

Covid cases continue to rise in the UK and currently stand at over 30,000 new daily cases before the school’s return. Fears of a surge in cases in September weigh on the Pound.

US Dollar rises ahead of the Jackson Hole Symposium in cautious trade, although Fed Chair Powell’s keynote speech is on Friday.

Also due today US PCE data and the second reading of US Q2 GDP.

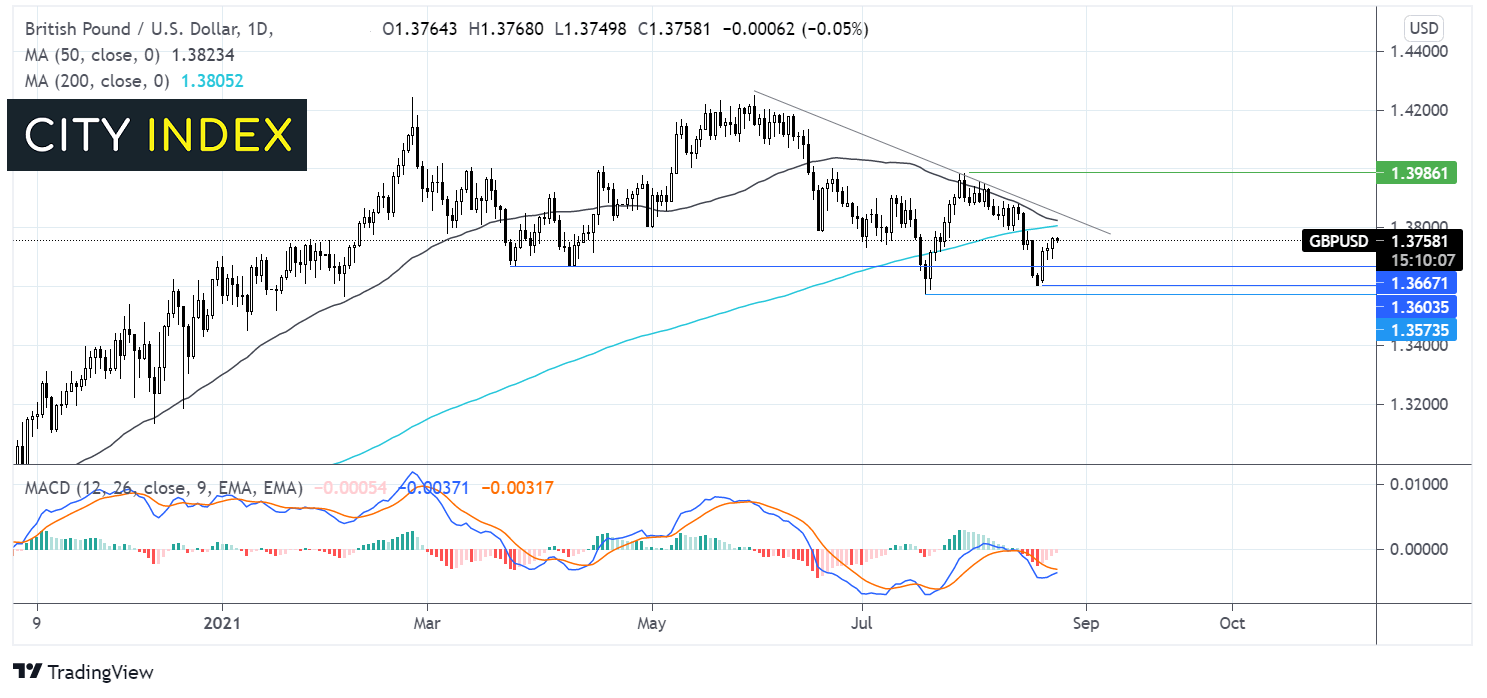

Where next for GBP/USD?

GBP/USD has been trending lower since early June. It trades below its descending trending, 50 sma and its 200 sma.

Whilst the price rebounded off 1.36 last week the recovery failed to break above the 200 sma.

The receding bearish bias on the MACD keeps buyers hopeful although there is a tough wall of resistance to break through at 1.38 -1.3850 comprised of the 200 sma ((1.38), 50 sma (1.3820) and descending trendline support (1.3850). A break above here would see 1.40 come back into target.

Any move lower would need to break below the double bottom at 1.3670 to expose 1.36 the August low and 1.3570 the July low.

Euro Stoxx edges lower as German consumer confidence falls

Eurpean indices are heading lower in cautious trade ahead if the Jackson Hole Symposium.

German GFK consumer confidence came in weaker than expected for September declining -1.2, down from -0.4 in August and below forecasts of -0.7.

ECB minutes are due to be released from the latest meeting. The minutes could help shape expectations ahead of the ECB meeting on September 9th.

The minutes come after dovish comments from ECB chief economist Philip Lane who suggested it was still too soon to consider tapering bond purchases in the PEPP programme.

Cheap borrowing costs for longer is good news for companies.

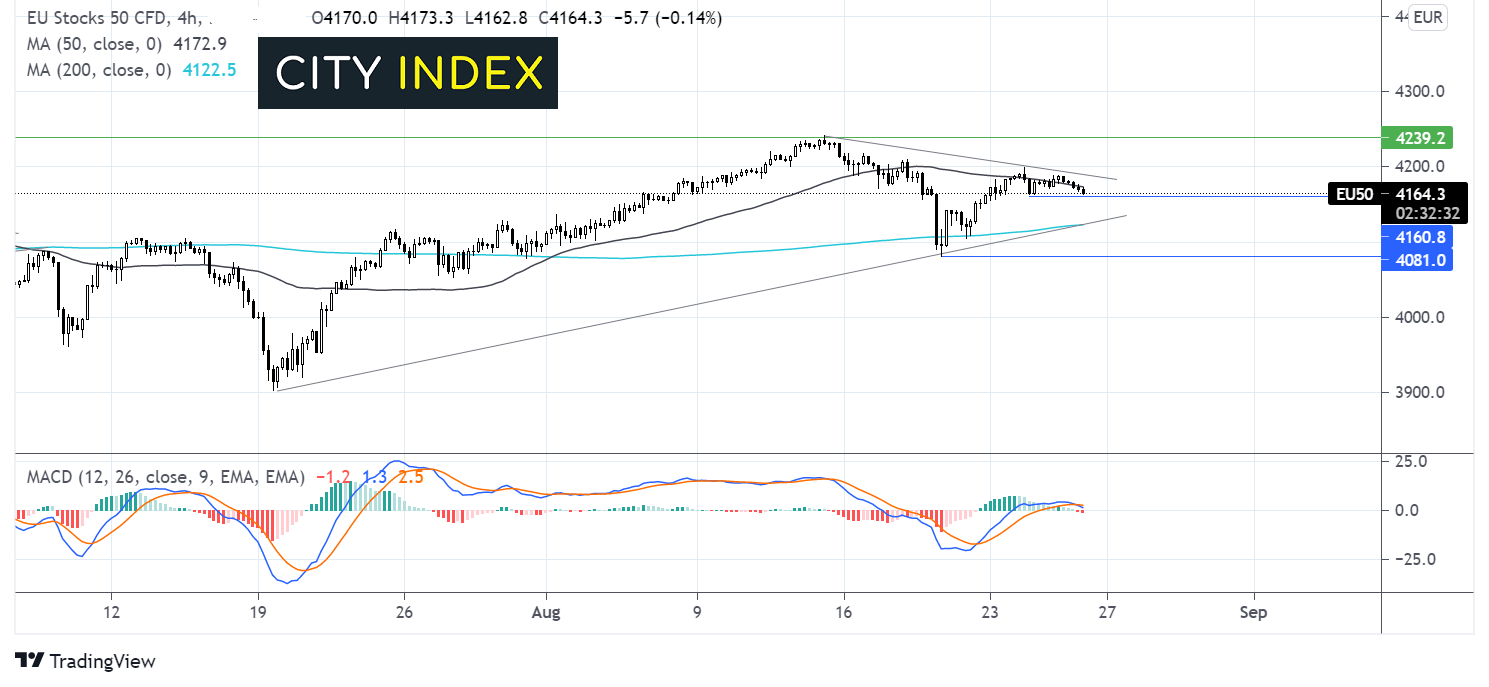

Where next for EU Stoxx 50?

EU Stoxx 50 has eased lower from its all time high of 4239 reached August 13. Although the uptrend from mid-July remains intact.

The bearish crossover on the MACD combined with a move below the 50 sma is keeping seller’s hopeful of further downside.

Any move lower would need to take out 4160 the Tuesday’s low to expose 4120 the 200 sma and the ascending trendline resistance. Beyond here 4080 the August 19 low comes into play

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.