DAX adds to last week’s gains on Ukraine optimism

Along with its European peers, the DAX is heading for a stronger start on the open on hopes of a peaceful end to the Ukraine crisis.

The next round of peace talks is due today, and both sides sound the most positive yet over the prospects for the negotiations.

According to US Deputy Secretary of State Wendy Sherman, Russia showed signs of willingness to progress negotiations. That said, the fighting continues on the ground.

There is no high impacting German data due; investors will remain focused on Russia Ukraine developments.

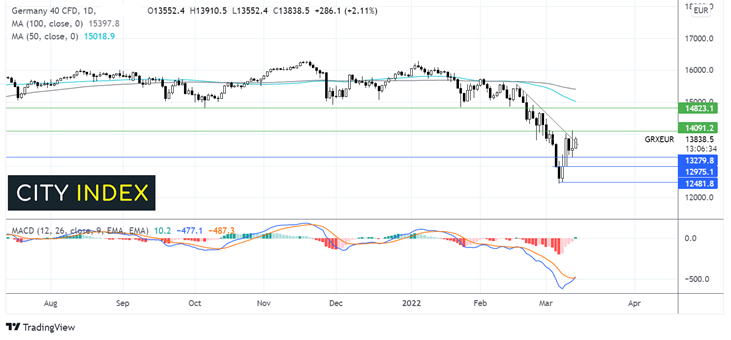

Where next for the DAX?

The DAX is extending its rebound from 12480 to the 2022 low. The move over the falling trendline dating back to mid -February and the bullish crossover on the MACD keep buyers hopeful of further upside. A move above 14090 last week’s high is needed to test 14800, a level that has offered support several times over the past year.

Meanwhile, sellers are still encouraged by the 60 SMA crossing below the 100 SMA. Sellers would be looking for a move below 13250 Friday’s low to open the door to 13000 round number. A move below 12500 could spark a steeper selloff.

EUR/GBP rises on upbeat mood, BoE moves into focus

EURGBP is heading higher at the start of the week, adding to gains from last week.

The improved sentiment surrounding Ukraine is helping to buoy the euro. Meanwhile, the pound is falling ahead of the BoE rate decision later in the week.

Spanish retail sales rebounded strongly in January, jumping 4% after falling 2.3% in December.

The BoE could hike rates for a third straight meeting as inflation continues to surge. However, fears of the BoE acting aggressively to tighten monetary policy, as growth is set to slow, potentially sending the UK into recession, weighs on GBP.

There is no high-impact UK data due today.

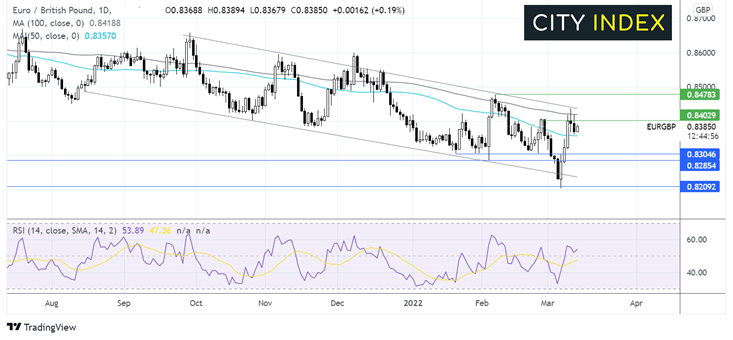

Where next for EUR/GBP?

EUR/GBP trades within a falling channel since late September. The pair rebounded off a 5 year low of 0.82 last week, retaking the 50 sma before hitting resistance at the falling trendline resistance and easing lower.

The pair trades trapped between the 50 and 100 sma. The RSI is supportive of further upside. Buyers will need to reake 0.84 round number in order to expose the 100 sma at 0.8415 and 0.8440, the falling trendline resistance. A move above 0.8480 the 2022 high could see buyers gain momentum.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.