Highlights from the RBA’s cash rate statement

- Inflation is expected to peak later this year and then decline back towards the 2–3 per cent range.

- Medium-term inflation expectations remain well anchored, and it is important that this remains the case.

- The Bank's central forecast is for CPI inflation to be around 7¾ per cent over 2022, a little above 4 per cent over 2023 and around 3 per cent over 2024.

- An important source of uncertainty continues to be the behaviour of household spending.

- …the full effects of higher interest rates yet to be felt in mortgage payments.

- Price stability is a prerequisite for a strong economy and a sustained period of full employment.

- The Board expects to increase interest rates further over the months ahead, but it is not on a pre-set path.

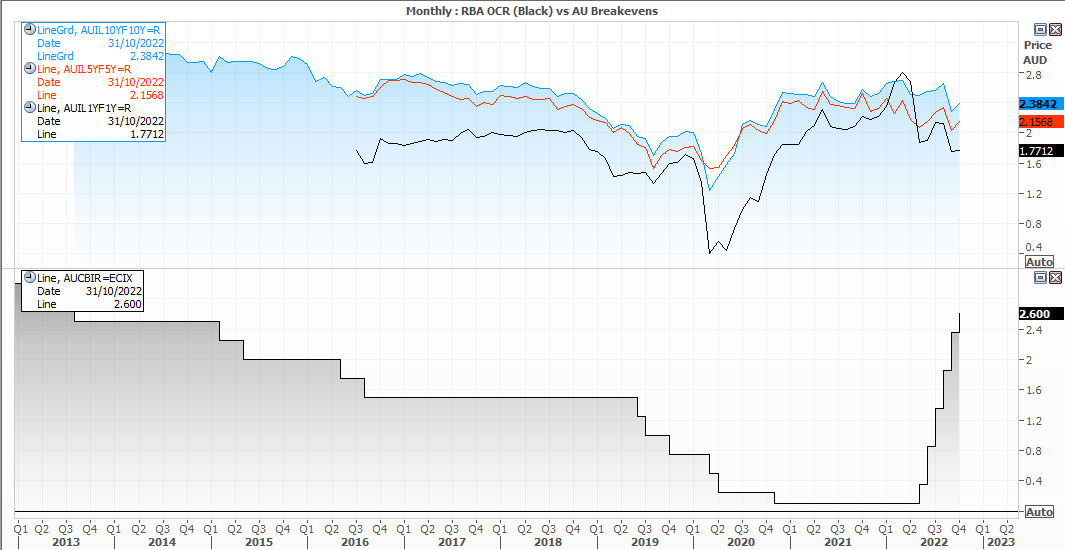

The RBA hiked rate by 25bp to 2.6% - their highest level in 9 years, although this was below expectations of 50bp. Still, they have now hiked rates by 250bp since their record low of 0.1% in April. Its’ the most aggressive tightening cycle we’ve seen from the RBA as they play catch-up with other central banks, yet already that trajectory is dying down.

The fact the RBA didn't hike by 50bp really shows that they're nervous about rocking the economic boat - with household budgets remaining ‘an important source of uncertainty’, and the full effect of higher mortgage rates yet to be felt.

As mentioned in their September statement, inflation is expected to be “around 7.75% over 2022”, which is still more than 2.5 times the current cash rate. Yet as Philip Lowe said during his subsequent testimony to parliament on September the 8th, inflation expectations are around 2.5% and it makes more sense to base policy adjustments relative to inflation expectations over the current inflation level. Let’s hope he’s right.

Breakeven rates – which are a market proxy for inflation expectations – are below the current cash rate, which suggests the policy is restrictive. And as long as inflation expectations remain capped, the case for the RBA to pause and perhaps even confirm the end of their tightening cycle increases.

A recent poll tipped the RBA to hike rates to 3.35% (or higher) by the year end. And with two meetings left on the calendar this year it seems economists favour a single 25bp hike at their November and December meeting. But I suspect we may even see the RBA pause in December and reassess in February, which leaves a 25bp hike in November and for rates to sit at 3.1% by the year end.

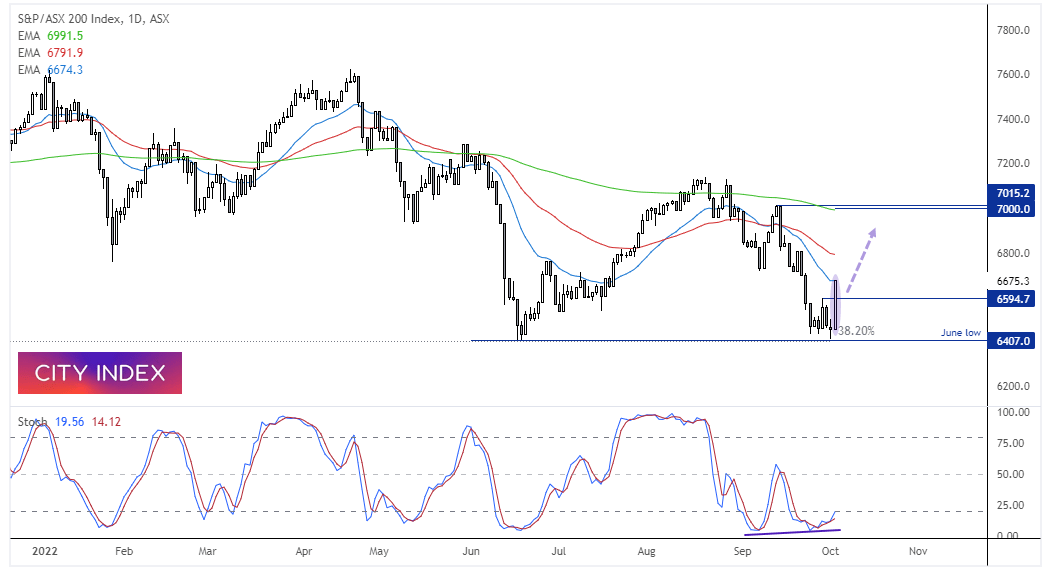

The ASX extends its rally post RBA meeting

It’s been a solid session so far for the ASX 200 with the local market opening at the day’s low and now sitting proudly at the day’s high. Even bears need to take a break from profits once in a while, and the short-covering rally which began on Wall Street has clearly helped support the ASX today. In fact the ASX has outplayed its US counterparts by holding above the June low and not entering a technical bear market. So if this is the beginning of a risk-on bounce, the ASX may be the better bet for bulls over the S&P 500.

A bullish divergence formed on the stochastic oscillator as the market rallied form the June low. A move back towards 7,000 / the 200-day EMA may not be out of the question, so we prefer to seek dips until sentiment sours once more.

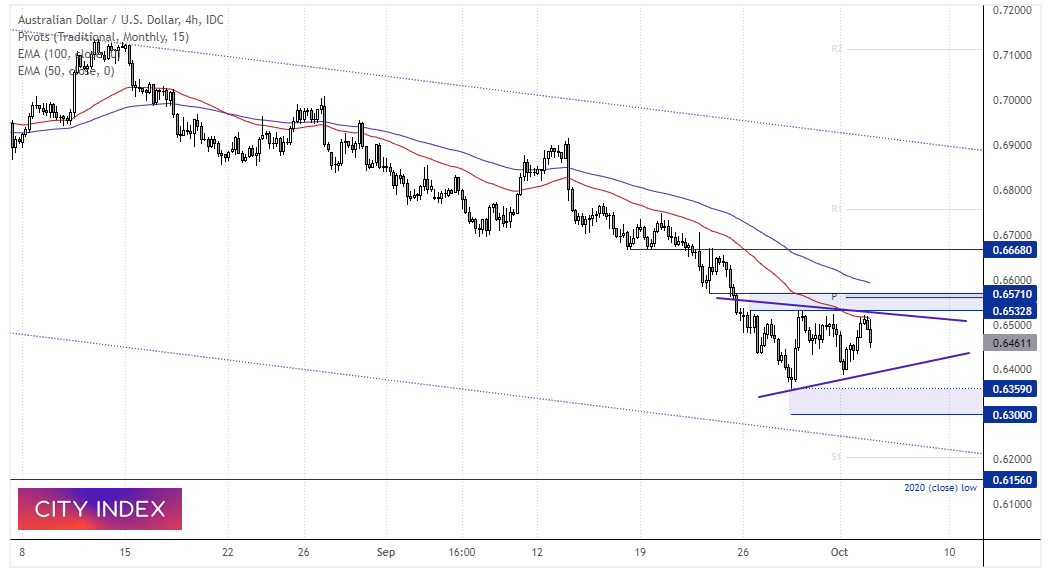

AUD/USD 4hour chart:

The Aussie remains within an established downtrend and within a wider bearish channel on the 4-hour chart. The 50 bar-EMA is capping as resistance on the 4-hour chart and a potential symmetrical triangle is forming beneath the monthly pivot point. Given the Fed remain hawkish with a higher base rate and the RBA are taking their foot off of the gas, the bias remains bearish and we prefer to see breaks of new lows of seek bearish reversals around resistance.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade