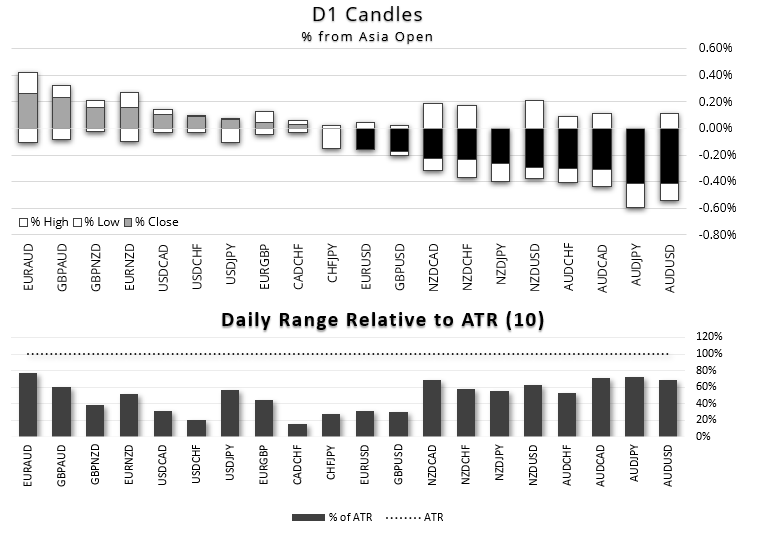

Sentiment has remained sour in today’s Asian session, as it follows on the weak lead delivered by Wall Street. On Wednesday US yields turned higher to break a mere 3-day pullback from multi-year highs and earnings weighed on Tech stocks, earning the Nasdaq 100 its worst daily performance of the year.

Whilst the Asian session started off quietly enough, slowly but surely dark clouds have begun to form to provide an ominous feeling that something could crack. US futures are pointing lower, AUD/USD and the ASX 200 tapped fresh YTD lows and AUD/JPY – a classic barometer of risk - extended its losses for a second day to a 7-day low. USD/JPY has also breached the infamous 150 level either side of the Asian Open as traders try their luck to see if the BOJ bite.

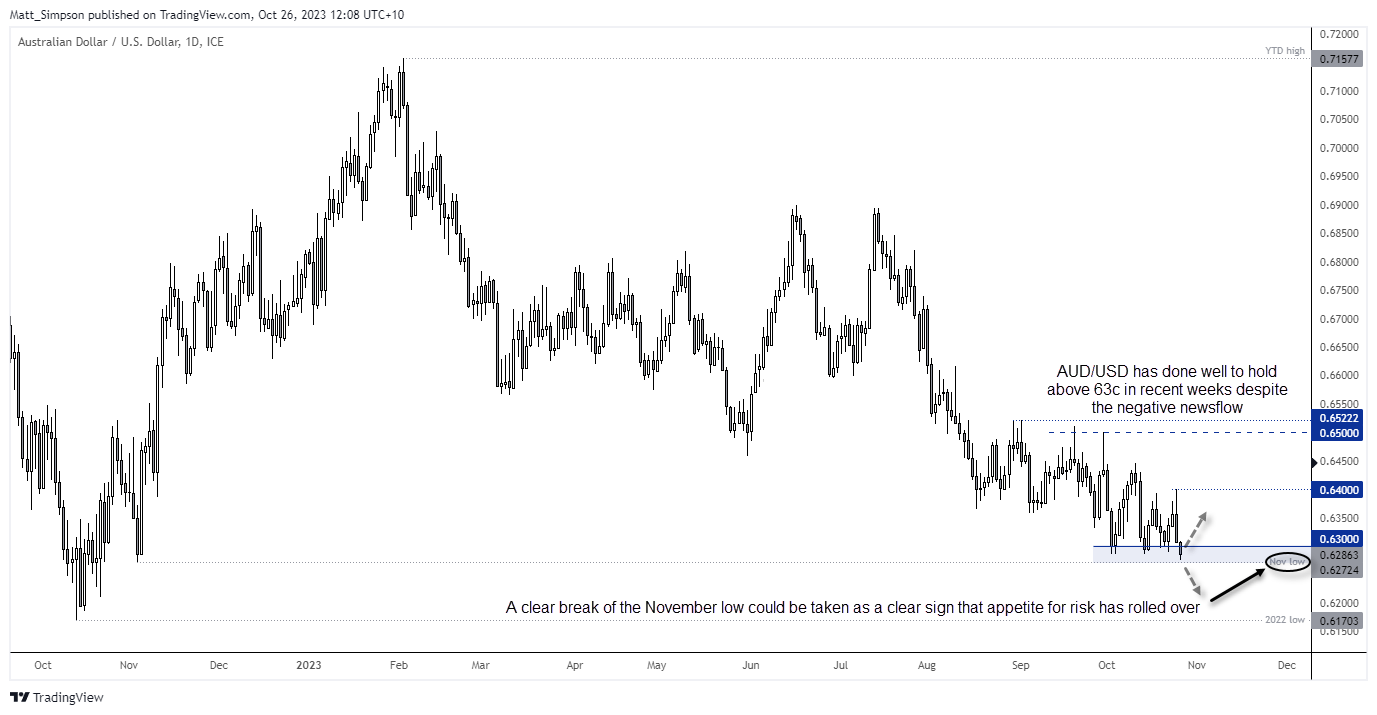

I think the clearest sign that it has all gone wrong is if we see AUD/USD breaks beneath the November low at 0.6270. If you look at the headline risk it has sustained over the past few weeks, it has done well to remain above 63c for most of it. Today’s break to a YTD low could simply be a liquidity purge ahead of its usual reversal higher. But if it can break the November low with momentum, we can safely assume appetite for risk has truly fallen.

There’s a risk that ‘the power that be’ in China may want to pump the market and that could provide a futile burst of risk on, but I suspect it will require a lot more than that to fully revive such sentiment, which means we prefer to fade into minor rallies.

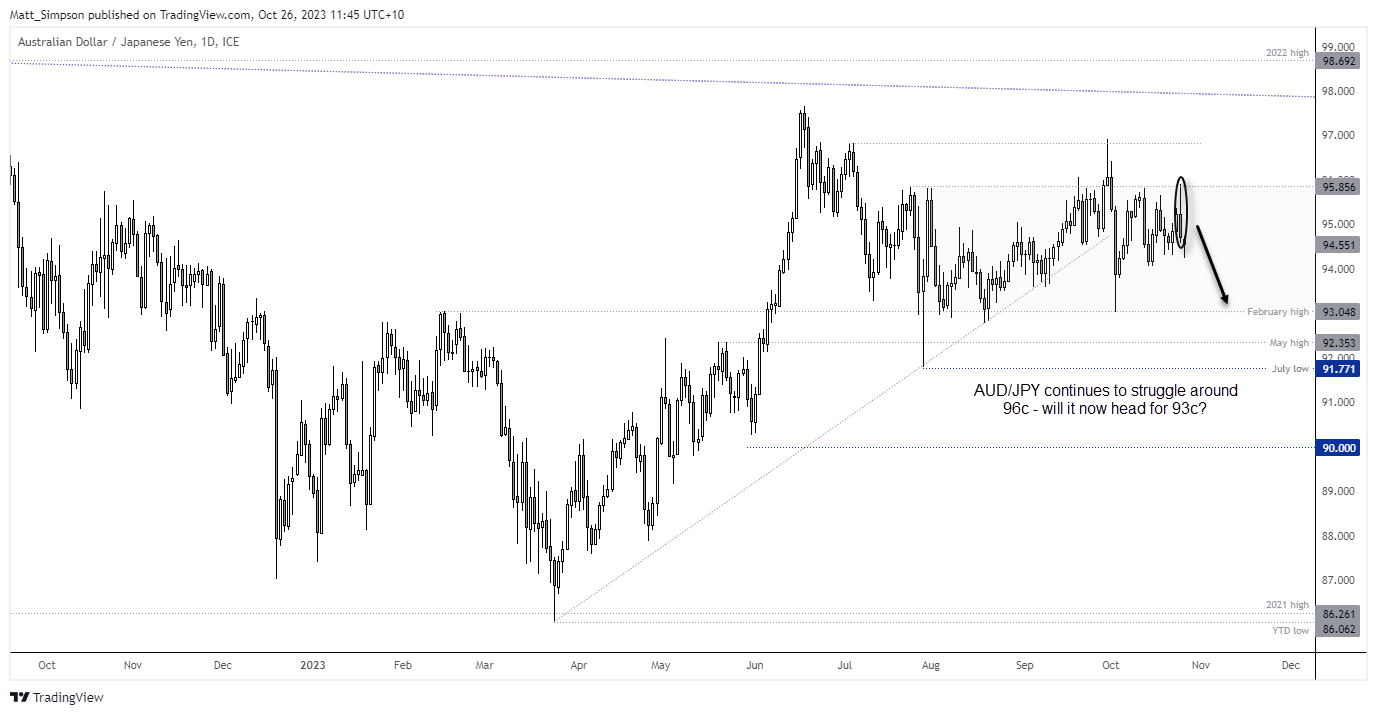

AUD/JPY technical analysis (daily chart)

AUD/JPY is one of those currency pairs that can provide erratic, almost random price action for periods of a time before swiftly kicking into turbo mode and moving in one direction hard and fast. If sentiment falls from a cliff, AUD/JPY is a prime candidate to move sharply lower. Especially if the BOJ intervene to send the Japanese yen broadly higher.

The pair has been mostly rangebound between 96 – 96 since August, and momentum saw a sharp turn lower form 96 yesterday. If sentiment in early Asia is anything to go by, it could be a pair for traders to fade into minor rallies and target the February high around 93.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade