After a stronger start to the day, there was a sudden drop in risk appetite. US equities and bonds dropped in a quick move, which resulted in further strengthening of the US dollar. The quick reversal is a reminder that we are still in a bear market and investors continue to face significant risks with inflation still showing no signs of easing in a meaningful way, and central banks are continuing to tightening their belts.

There wasn’t a single trigger behind the move, but we have been seeing lots of stagflation signs from data released throughout this week, not least those manufacturing surveys. The US Federal Reserve officially started quantitative tightening today and the Bank of Canada hikes rates by 50 basis points to 1.50% as expected. The European Central Bank is set to exit negative rates in next few months. Inflation is continuing to drive the markets and the latest gains for oil prices won’t help price pressures whatsoever.

Unlike before, equity investors will not have the support of the Fed to prop up the stock markets. That’s why this general downward trajectory in stock prices has lasted longer than most of the previous episodes. I expect this trend to continue now that the Fed has started to shrink its balance sheet by $95 billion or so every month for the foreseeable future. This means that any piece of good news will likely be treated as bad news for stocks, since the Fed’s moves will be data-driven.

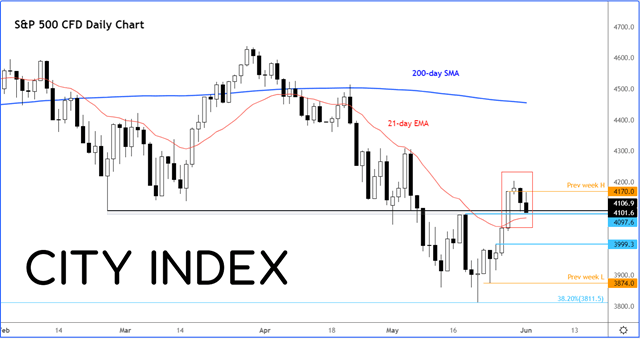

But it is not all doom and gloom yet – the S&P is still holding its own above this key support area around 4100…just:

However, if the above support breaks down then watch out below. A potential drop to 4000 could be on the cards next, which was the base of the previous breakout area.

How to trade with City Index

You can trade with City Index by following these four easy steps:

Open an account, or log in if you’re already a customer

Search for the market you want to trade in our award-winning platform

Choose your position and size, and your stop and limit levels

Place the trade

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM