The Reserve Bank of New Zealand has today raised the Official Cash Rate by 50 basis points to 2.50%. It is the RBNZ’s third straight 50bp hike in a row, in a tightening cycle that started back in October.

The move was widely expected by economists and means the RBNZ has become one of the first central banks to hike past neutral, thought to be about 2% in its fight to tame inflation.

At 2.50%, the cash rate is now 150bps from the 3.9% terminal rate forecast by the RBNZ in May, which it is expected to reach by mid-2023 (from 3.35%). Whether this terminal rate is reached is debatable.

Next Monday, Q2 inflation data inflation is expected to see the CPI rise above 7.1%, and employment data to be released in early August is expected to show the labour market remains tight.

“The Committee is resolute in its commitment to ensure consumer price inflation returns to within the 1 to 3 percent target range.”

However, fears of a global recession are escalating, and there is preliminary evidence that the RBNZ tightening cycle is having an impact. Consumer and business confidence has plunged against a backdrop of households facing higher mortgage repayments.

REINZ housing data released this morning showed the housing market has continued to cool, as sales slumped 38.1% from a year ago.

Nonetheless, the RBNZ have again reiterated their hawkish forward guidance and are likely to remain hawkish until it sees firm evidence that inflation has turned lower.

“The Committee agreed it remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and support maximum sustainable employment.”

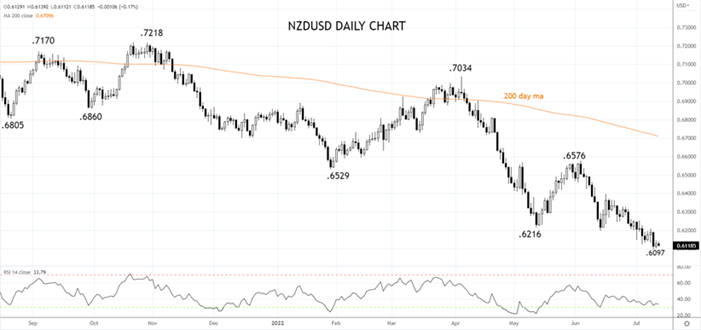

Following the announcement, the NZD slid from .6130 down to a low of .6112, before rebounding back to .6130.

However, the NZDUSD remains hostage to fears of a global recession, weak risk sentiment, commodity prices, and a surging U.S dollar. A sustained break of .6100c would open up a move towards the psychologically important .6000c area.

Source Tradingview. The figures stated are as of July 13th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade