Overview

As recently as last month, we noted that the Federal Reserve’s monetary policy may be predetermined for the next eight (now seven) months, meaning the NFP report would be less likely to move markets. However, with Fed Chairman Powell proclaiming that the central bank would look at accelerating its taper plans, despite the risks of the Omicron variant, the monthly jobs report is once again a key factor for policymakers…and by extension, for markets.

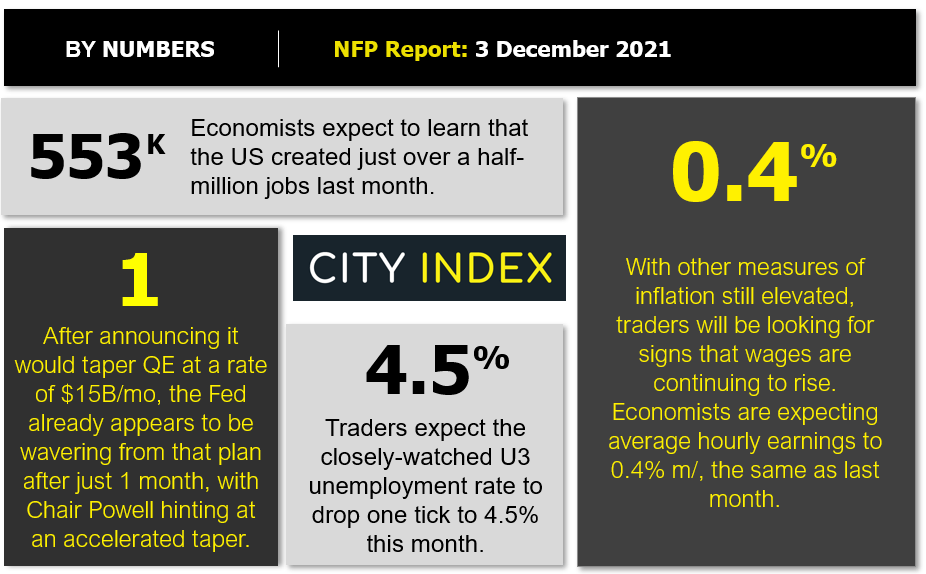

With that background, we note that traders and economists are looking for 553K net new jobs in Friday’s report, with wages expected rise by 0.4% m/m, in the final NFP report of 2021:

Source: StoneX

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP for

ecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report, but given the vagaries of the economic calendar this month, we’ll only have access to three of those labor market measures:

- The ISM Manufacturing PMI Employment component printed at 53.3, up from last month’s 52.0 reading.

- The ADP Employment report came in at 534K net new jobs, a tick below last month’s 570K reading.

- Finally, the 4-week moving average of initial unemployment claims fell to about 239K, down sharply from last month’s 285K figure.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to a slightly below-expectation reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 300-450k range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.4% m/m in October, will likely be just as important as the headline figure itself.

Potential NFP market reaction

|

|

Wages < 0.2% m/m |

Wages 0.3-0.5% m/m |

Wages > 0.6% m/m |

|

< 400K jobs |

Bearish USD |

Neutral USD |

Slightly Bullish USD |

|

400K – 700K jobs |

Slightly Bearish USD |

Slightly Bullish USD |

Bullish USD |

|

> 700K jobs |

Neutral USD |

Slightly Bullish USD |

Strongly Bullish USD |

The US dollar index had a stellar November, rising nearly 2% to its highest level in 16 months above 96.00. Despite the big rally, the world’s reserve currency has seen a pullback over the past week as information about the Omicron variant has trickled out, alleviating any concern about overbought readings and potentially setting the table for the greenback to rally further if the NFP report comes out better than expected.

In terms of potential trade setups, readers may want to consider EUR/USD sell opportunities if the pair remains below previous-support-turned-resistance at 1.14 and the jobs report beats expectations. In that scenario, traders may start to price in an accelerated taper from the Fed as soon as its December meeting, lending further strength to the buck.

On the other hand, a soft jobs report could present a sell opportunity in USD/JPY, which is testing its lowest level in nearly two months near 112.75. A break below that support level in combination with a weak reading on the labor market could set the stage for a selloff in the US dollar as we head into the holiday period.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade