Is it time for bears to step in USD/JPY?

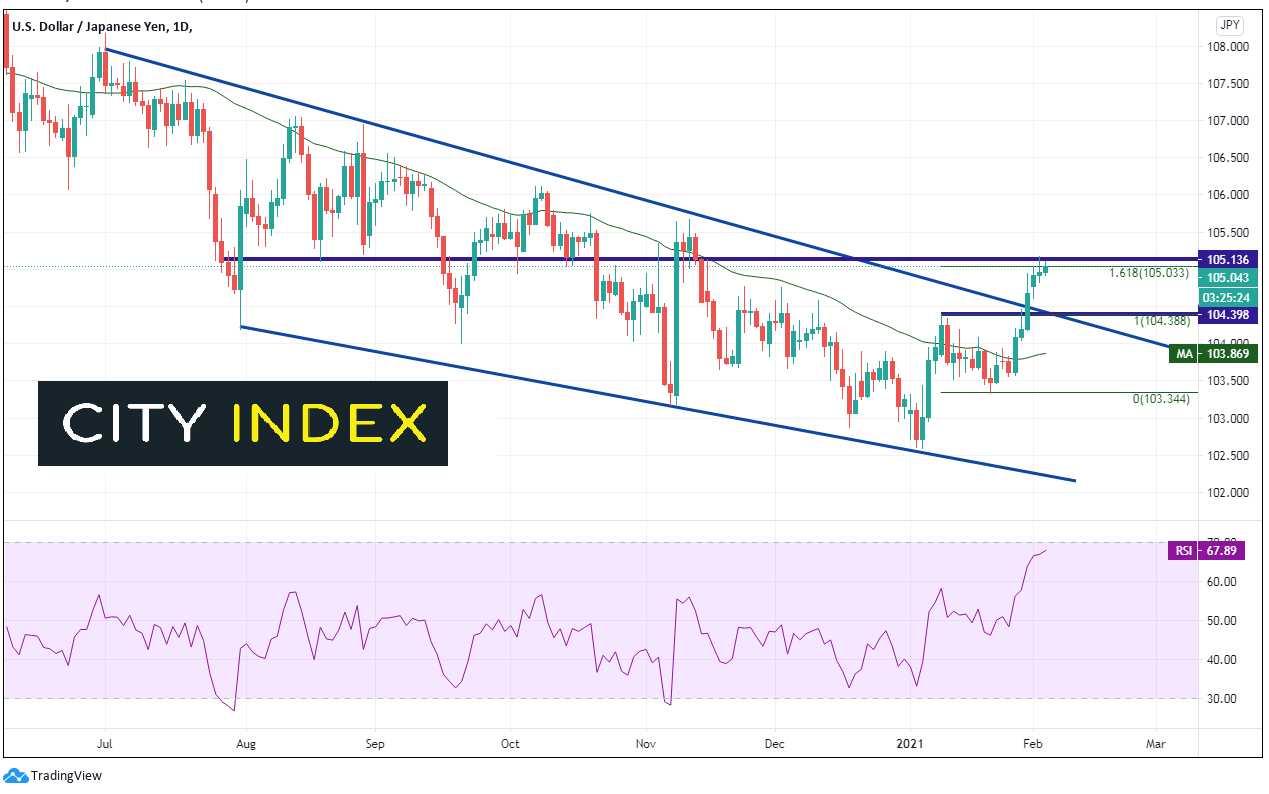

USD/JPY has been moving lower since 2015! On a daily timeframe though, the pair has been in a descending wedge since mid-summer 2020. However, on January 29th, USD/JPY broke out of the top of the wedge and moved up to the 161.8% Fibonacci extension from the highs on January 12th to the lows on January 21st. Horizontal resistance also crosses near that area. The pair has also moved up for 6 days in a row, and over the last 3 days the ranges have been getting smaller and smaller.

Source: Tradingview, City Index

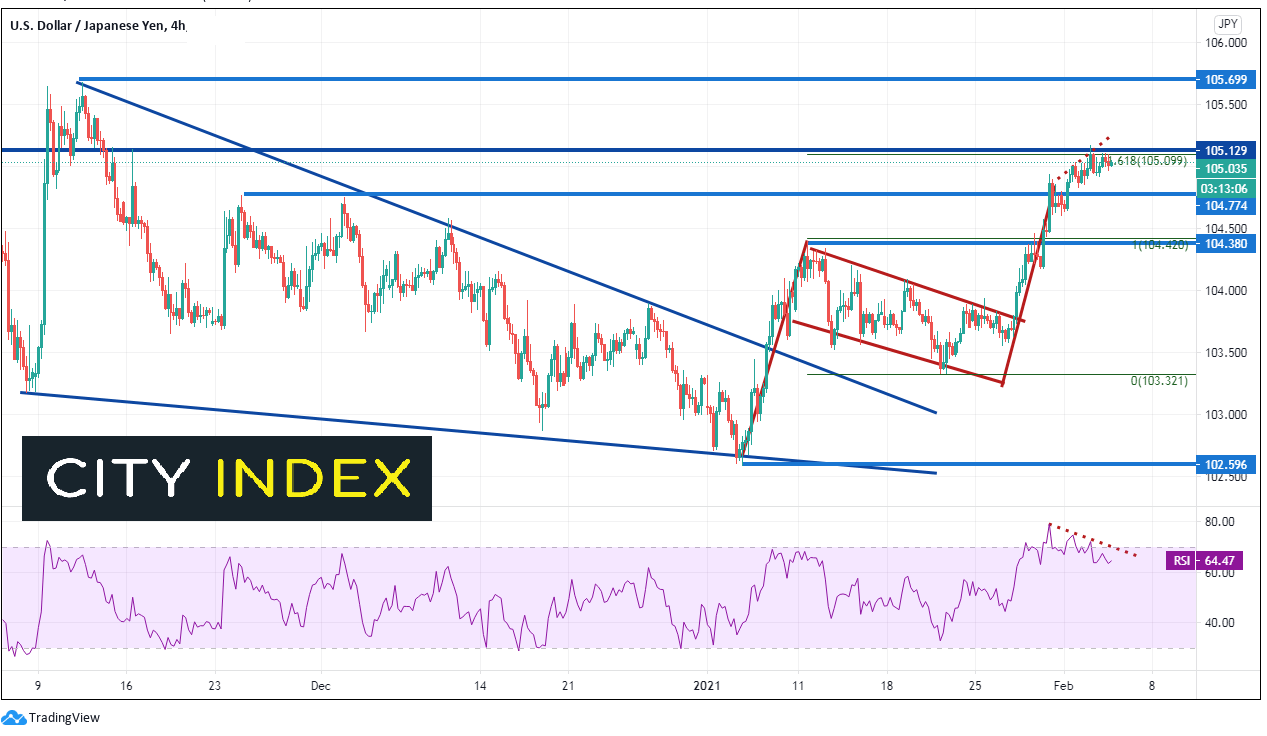

On a 240-minute timeframe, USD/JPY had been moving in a smaller descending triangle of its own and broke out on January 7th , only to form a flag pattern (red). The pair reached the target at horizontal resistance and crept higher to the previously mentioned 161.8% Fibonacci extension. The RSI is diverging with price from overbought conditions.

Source: Tradingview, City Index

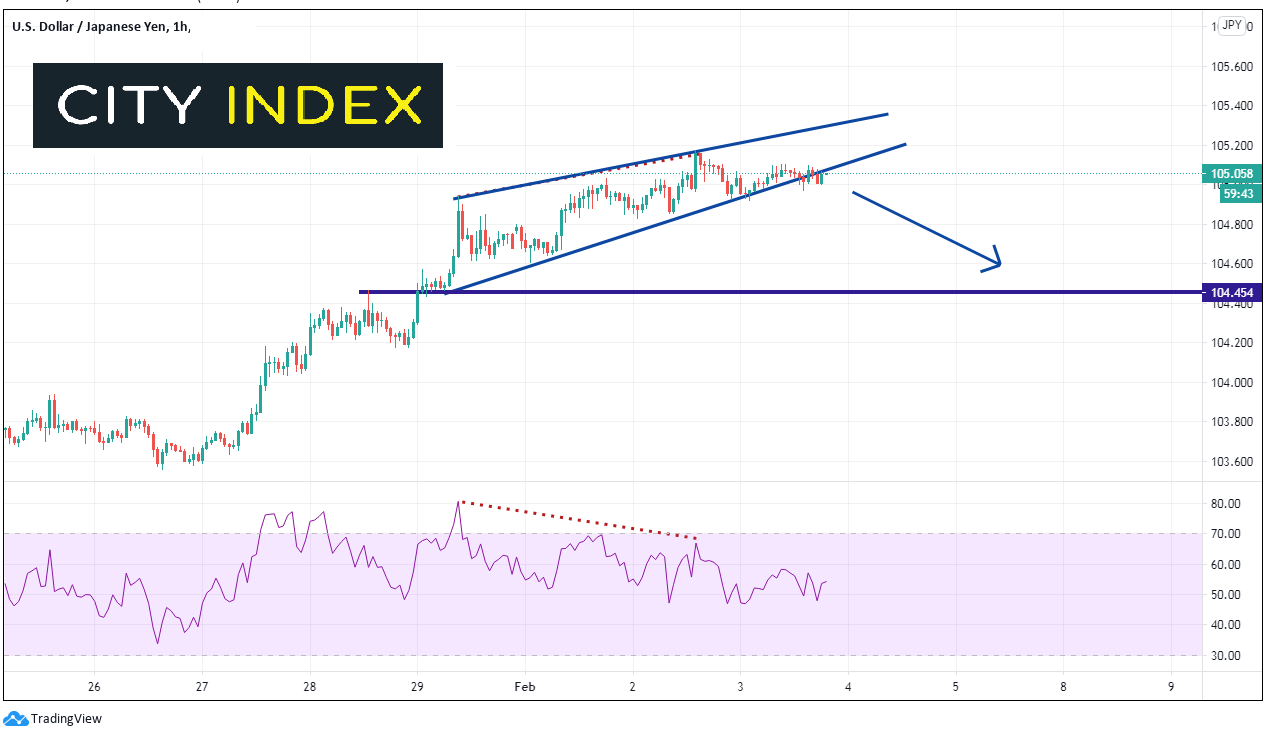

The 60-minute timeframe shows price breaking lower from an ascending wedge as well, which targets 104.45.

Source: Tradingview, City Index

Bears will be looking to take advantage of the horizontal resistance, 161.8% Fibonacci extension and the diverging RSI to sell USD/JPY above 105.00, with a potential target of horizontal support and the top downward sloping trendline of the descending wedge on the daily timeframe, near 104.35/45. Stops could potentially be placed above the horizontal resistance near 105.25.

USD/JPY has been moving higher since January 21st, however at near-term resistance, it may be time for bears to step in.

Learn more about forex trading opportunities.

Everything you should know about the Japanese Yen (JPY)