Key takeaways

- Busy week for US shop chains, with retail sales data due out before Home Depot, Target, Walmart and others report earnings.

- Retail sales set to grow for fourth consecutive month, but clouds linger over the horizon

- Uninspiring outlook for Home Depot in 2023 has already been priced-in

- Target earnings to return to growth, which may boost its depressed valuation

- Walmart is at all-time highs, setting a high bar ahead of its results

- Retailers make up 17% of the S&P 500, so it will be highly influential on the index

US retailers under the spotlight this week

The US retail sector takes centre stage this week and markets will be on the lookout for how the American consumer is faring. Below is a calendar outlining the key events from the sector:

|

Tuesday August 15 |

|

US Retail Sales Data |

|

Home Depot Q2 Earnings |

|

Wednesday August 16 |

|

Target Q2 Earnings |

|

TJX Q2 Earnings |

|

Thursday August 17 |

|

Walmart Q2 Earnings |

|

Ross Stores Q2 Earnings |

Let’s have a look at what to expect from the biggest events…

US retail sales preview: July 2023

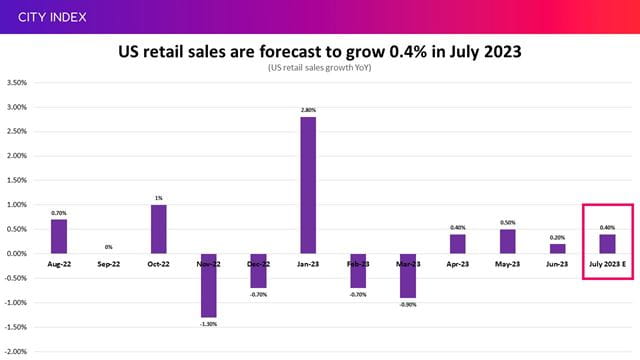

US retail sales are forecast to rise 0.4% month-on-month in July, which would mark the fourth consecutive month of growth to suggest consumer spending remains resilient in the current environment.

The addition of Amazon Prime Day will provide a boost compared to June. We already know that the first day of the two-day sale was the biggest event to date.

However, economists warn that the outlook remains challenging and that the anticipated boost in July may not persist as we move forward. “Increased use of ‘buy now, pay later’ services suggests consumers are feeling the strain of higher prices, including a surge in gasoline prices and interest rates. Sales likely cooled in the second half of July,” said Bloomberg economist Eliza Winger. “We expect overall consumer spending to cool this fall, adding to fears of a recession.”

Consumers have remained resilient in the face of a shaky economic outlook, but there are fears that their position is starting to weaken as elevated inflation and higher interest rates bite. Jamie Dimon, the boss of the largest US bank JPMorgan, has warned he expects US households to burn through whatever savings they have left by the end of 2023, which could lead to tighter consumer spending and fuel a potential recession. However, the jobs market remains strong and wages keep growing, suggesting it could hold up better than anticipated.

Home Depot Q2 earnings preview

Home Depot and other DIY retailers are feeling the pressure this year. Consumers spent big on upgrading their homes as they were forced to spend more time locked-down during the pandemic but this is now unwinding, while a pullback on spending on discretionary goods and plunging lumber prices are also not helping. Home Depot has already warned that sales will be down 2% to 5% in 2023 and that earnings will be down in the range of 7% to 13%. That will mark the first annual drop since 2010, when the industry was left reeling from the great financial crisis.

As a result, Home Depot is expected to report its second consecutive quarter of lower revenue and earnings. Revenue is forecast to fall 3.9% from last year to $42.1 billion, with same-store sales seen declining for a third consecutive quarter, this time by 4.1%. Adjusted EPS is estimated to drop 11.7% to $4.46. Margins are forecast to improve sequentially but still be down from last year as costs keep climbing, including wages for staff.

Where next for HD stock?

The outlook for the rest of the year may be uninspiring for Home Depot but at least this has been priced-in and reduced the risk of any negative surprises this week. Home Depot has made a comeback after rising over 17% since its last set of results, although it is still way behind the markets after rising just 5% since the start of 2023. The stock is trading below its historic average but in-line with the wider industry.

The bulls have been firmly in charge since its last set of results, with the share price having risen in-line with a parallel channel. The RSI remains in bullish territory and all three moving averages are trending higher.

The stock has slipped into the bottom-half of the channel since pulling back after hitting a five-month high late last month. The immediate job is to break back into the upper-half with a move above $334, which would allow new highs to be set. From there, the upper end of the channel can be tested as it climbs toward the 50% retracement.

On the downside, we can see $326.50 has provided some support and the recent, albeit brief, slip we saw back to the 38.2% retracement at $324 swiftly attracted buyers back into the market.

Target Q2 earnings preview

The first major general retailer to report this week is Target, which has massively underperformed its rivals and the wider markets in 2023. Sales are forecast to fall 2.3% this quarter to $25.1 billion, marking the first drop in around three-and-a-half years as its focus on general merchandise bites. Same-store sales are expected to drop 3.5%. Target is trying to lean more into groceries and everyday items to appeal to cost-conscious consumers but it is still ultimately known for its general merchandise, where sales are faltering as consumers are forced to spend more on necessities.

However, Target is expected to report its first growth in earnings in almost 18 months. The company has said it is targeting adjusted EPS of $1.50 this quarter, which would mark a large jump from the $0.39 produced the year before. However, this will largely be down to the fact it is coming up against easier comparatives, taking the shine what would otherwise be stellar growth. Plus, analysts have doubts and think it could fall short considering the consensus points toward earnings of $1.46.

Where next for TGT stock?

Target shares have continued to struggle since rebounding from three-year lows in June. We can see the stock has been stuck rangebound for the past two months. Sellers have been keen to sell at $138 while buyers have reliably re-entered the market at $130 during this period and markets are awaiting a breakout.

The stock is currently at the bottom of this range. Any slip below here will bring that three-year low of $126.50 into play. On the upside, the immediate job is to break above the midway point at $134 before the top-end of the range is back in play. A sustained move above that $138 ceiling could lead to a big rally, potentially toward the 100-day moving average.

Target has had a tough few years and this is reflected in its discounted valuation, with the stock trading at less than 15x forward earnings. That is about one-third lower than the industry average, and below its five-year historic average.

Walmart Q2 earnings preview

Walmart is the largest grocer in the US and this has kept shoppers flowing through the doors this year, while its focus on value has also proven popular. That has allowed it to keep growing both sales and earnings while its smaller rivals struggle to adapt to rapidly-changing consumer habits.

That has made Wall Street more optimistic about Walmart compared to rivals like Target. Sales are forecast to rise 4.3% from last year to $159.5 billion, ahead of its 4% growth guidance. However, it is not immune to the challenging conditions and that would be the slowest growth in over a year, while the forecast for US same-store sales to grow 4.2% would be the slowest rise since early 2022!

Plus, earnings are forecast to drop for the first time in a year as higher interest rates push up the cost of servicing debt, with adjusted EPS seen declining 4.7% from last year to $1.69. Walmart is likely to lower prices as quickly as the inflationary environment allows it to so it can maintain or grow market share. Walmart is aiming to grow operating profit faster than revenue over time, although this tactic may hit profitability in the near-term.

Where next for WMT stock?

Walmart’s reliability and outperformance in recent years has left it trading at a premium to its rivals. The company trades at over 24x forward earnings, some 63% above its rival Target! It is also trading above its five-year historic average.

The stock is trading at fresh all-time highs in premarket trade today. That, plus the premium valuation, suggests the bar could be high ahead of the results and that Walmart will need to impress to keep the rally going. Plus, we can see a rising wedge forming to suggest there are bearish signals on the horizon.

We could see $158, marking the resistance we saw in June and July as well as around the previous all-time highs set in 2022, provide some initial support should it come under pressure. A steeper decline would bring the resistance-turned-support of $153.50 into play.

S&P 500 outlook: Where next?

The retail sector accounts for about 17% of the S&P 500, making it an important sector that has great influence over the index.

The index has been under pressure for two weeks now but the parallel channel that can be traced back over five months remains intact. We could see the index slip further and test the bottom of the channel if this persists, although the 50-day moving average has the potential to provide some more immediate support.

On the upside, a break back above 4,500 is needed to move back above the midway point of the channel while also moving back above the 78.6% retracement.

How to trade the S&P 500 and US retail stocks

You can trade US retail stocks and the S&P 500 with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the stock or index you want in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.