Gold rose 0.4% last week, marking the second straight week of gains. The precious metal found support, as investors become less sensitive to Ukraine headlines, from a weaker USD and cooling expectations that the Fed will act aggressively to rein in interest rates.

Softer inflation data combined with comments from Atlantic Federal Reserve President Raphael Bostic that the Fed could press pause on the rate hiking cycle after two 50 basis point hikes in June and July, should the data suggest it, caused investors to reassess the likelihood of an overly aggressive Fed, which is good news for non-yielding gold.

Currently, the money markets see Fed rate hikes by the end of the year at 180 basis points, down from 193 basis points.

Treasury yields are also at the lowest level since mid-April, which is also keeping the precious metal buoyant.

As investors become more immune to Russia’s war headlines, the risk premium in gold is starting to unwind, which acts as a drag on the price.

Looking ahead

Today Memorial Day holiday in the US means holiday-thinned trade. However, looking out across the week, there is plenty of data to be moving Gold, including ISM manufacturing and non-manufacturing data and, of course, the US nonfarm payroll by the end of the week. Investors will be watching closely for signs that the labour market is starting to slow as recession fears build.

Where next for Gold prices?

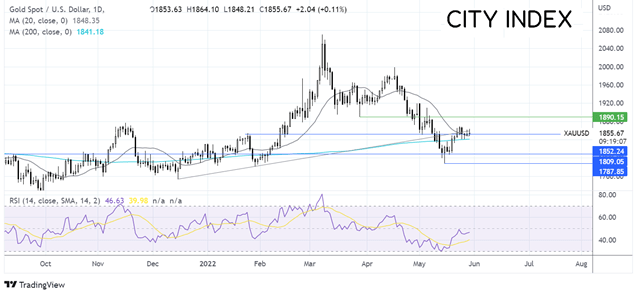

The Gold price continues to trade above the 200 sma and more recently has found support on the 20 sma at 1849, allowing gold to look towards last week’s high of 1870. A move above here could bring 1890, the March 30 low, into play.

However, the RSI remains modestly bearish, keeping sellers optimistic about further downside. Failure of the 20 sma to hold could expose the 200 sma at 1840, ahead of 1810. It would take a move below 1787 to create a lower low.

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade