- GBP/USD major risk events: Fed Powell interview, US ISM manufacturing PMI, BoE Catherine Mann speech.

- GBP/USD trades rangebound for a seventh week

- GBP/USD key themes: Interest rate expectations and rate cut timings

Despite several significant events last week, GBP/USD continues to trade range bound for a seventh straight week. The BoE and the Federal Reserve's interest rate decisions and US nonfarm payrolls failed to tease GBP/USD out of its trading range.

Looking ahead to the coming week, the economic calendar is relatively quiet for both the UK and the US. However, there are a few events that could inject some volatility into the pair.

Fed Powell speaks & ISM services PMI

A 60-minute interview by Jerome Powell on Sunday evening will be in focus and could set the week off with some vigor. The markets will watch for comments from the Fed chair after US non-farm payrolls smashed expectations on Friday.

After the Fed Chair firmly pushed back against the March rate cut last week and after the stronger-than-expected jobs data, there is a chance of Powell adopting a hawkish bias, which could see the market push back rate cut expectations, pulling GBP/USD lower.

At the time of writing, the CMEFedwatch is pricing in a 35% chance of a rate cut in March, down from 85% in December. The market is now pricing in a 95% chance of a May rate cut.

US ISM manufacturing PMI data will be released at the start of the week. Recent data from the US has highlighted the resilience of the US economy despite the 22-year high-interest rates. The manufacturing PMI is forecasted to rise to 52 from 50.6.

BoE's Catherine Mann

Meanwhile, Bank of England hawk Catherine Mann will speak on Thursday. Catherine Mann caught the market off guard after she voted to raise interest rates in last week's BoE meeting. With this in mind, commentary from Catherine Mann could have a hawkish tilt supporting GBP. Comments come after Bank of England chief economist Huw Pill warned that an interest rate reduction is still some way off despite signals that borrowing costs could have peaked.

The pound is finding support from views that the BoE will be one of the last major central banks to start cutting interest rates given persistent inflation: A view the BoE reinforced last week and that Catherine Mann could next week.

Since UK data shows that the economy still hasn’t fallen off a cliff, recession fears aren’t dragging the pound lower. Should recession fears become more prominent, GBP could come under pressure.

GBP/USD forecast – technical analysis

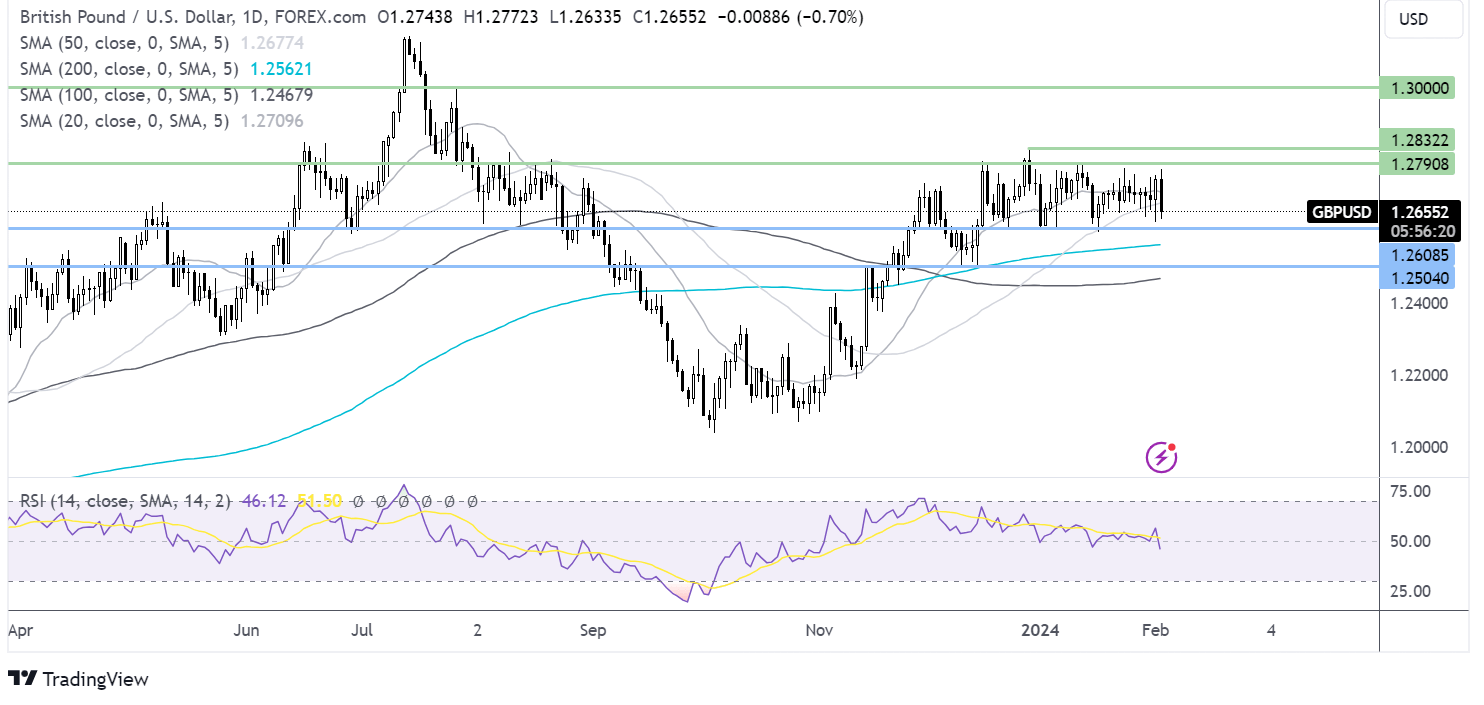

GBP/USD trades in a parallel channel dating back to mid-December, capped on the upside by 1.28 and 1.26 on the lower band.

In a breakout trade scenario, sellers could look for a break below 1.26 to expose the 200 SMA at 1.2550 and 1.25 the December low.

Buyers will look to rise above 1.28 and 1.2830, the December high, to bring 1.30 into focus.