GBP/USD drifts lower amid a lack of data

- GBP/USD holds onto last week’s losses

- A quiet economic calendar could see GBP slip lower

- GBP/USD trades caught between the 20 & 200 SMA

The pound slipped lower last week for a third straight week after a mixed batch of data and is holding onto those losses on Monday as investors look ahead to a relatively quiet economic calendar ahead.

Last week, data showed that the UK economy slipped into a technical recession in the final quarter of 2023. However, a strong rebound in retail sales suggests that the recession could be shallow and short-lived if consumer strength continues.

This week sees very little in the way of economic data, with just GfK consumer confidence and PMI data in focus towards the end of the week. Investors will be watching the services PMI closely for signs of continued strength in the sector, which picked up further in January to 54.3 with a level 50 separating expansion from contraction.

Last week, Bank of England policymaker Catherine Mann and chief economist Huw Pill warned over persistent service inflation continuing to be a major concern for price pressures.

The Bank of England policymakers continue to push back against expectations of an early interest rate cut, which is helping to keep the pound relatively well supported versus the US dollar.

Meanwhile, the US dollar rose again versus its major peers in the previous week, boosted by hotter-than-expected PPI inflation. Meanwhile, Jerome Powell also said that the Fed would like to see more evidence of inflation cooling towards the 2% target before cutting rates.

Today, the US markets are closed for the Presidents Day public holiday, so trading volumes are low. The main focus will be the release of the FOMC minutes on Wednesday, which could provide further insight as to when the Federal Reserve might be considering its first rate cut. According to the CME fed watch tool, the market is pricing in the first rate cut in June.

GBP/USD forecast – technical analysis

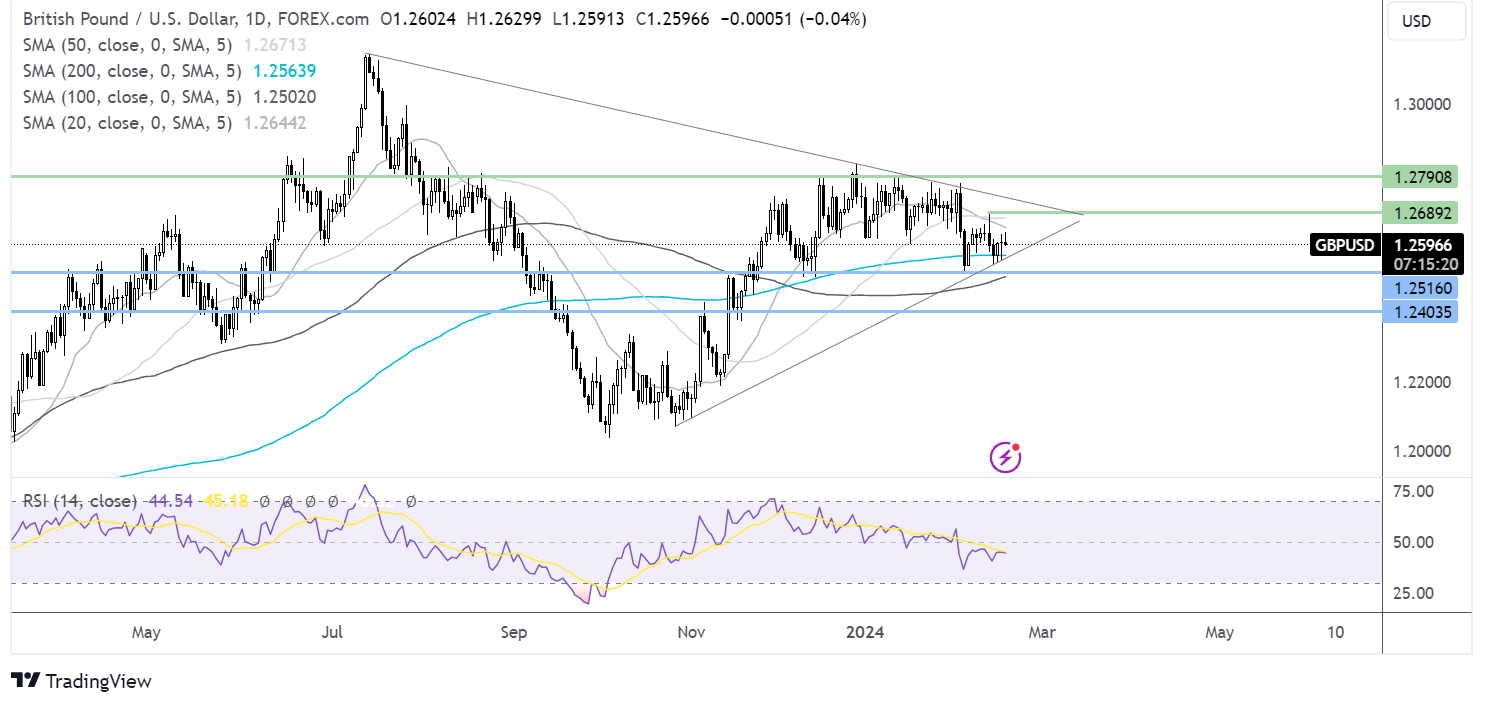

GBP/USD trades towards the lower part of a symmetrical triangle and is caught between the 200 and 20 SMA while the RSI remains in the 40 – 60 zone, pointing to consolidation.

A breakout trade could see sellers look to break below the 200 SMA dynamic support at 1.2565, also the rising trendline support. Below here sellers will look to take out 1.25 to create a lower low and extend losses towards 1.24.

Meanwhile, buyers will look to rise above the 20 SMA at 1.2640 before testing 1.2690, last week’s high, and 1.2730, the falling trendline resistance. Above here, 1.28, the January high comes back into focus.