Last week I highlighted that GBP/USD tends to deliver the strongest returns in April. Today we take a closer look to identify the most bullish phase of the most bullish month.

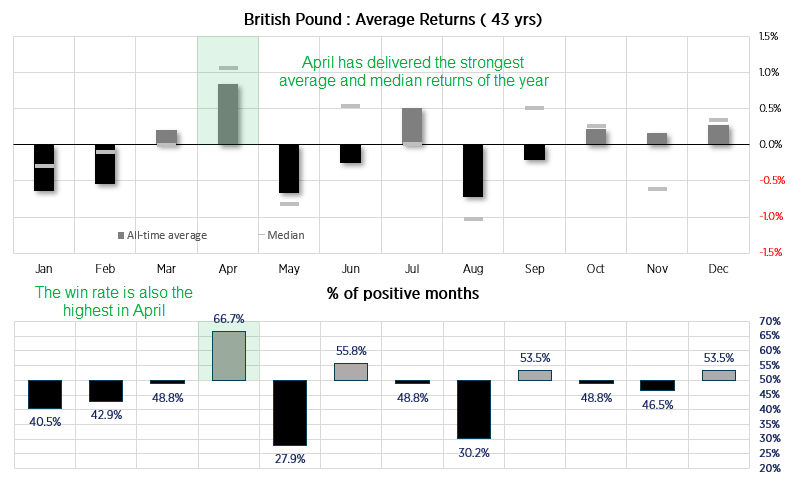

GBP/USD seasonality by month:

As a refresher, GBP/USD has averaged a positive return of 0.85% in April according to data from the past 43-years. Its median return is even higher at 1.07%, which suggests a few negative, outlier returns have weighed the average down in April over the years. Furthermore, GBP/USD has a positive win rate of 66.7% in April, which is its highest win rate of the year.

Of course, we also need to factor in that traders are trying to price in multiple BOE cuts. And if economic data from the UK continues to deteriorate over the coming weeks, GBP/USD could be in for a bearish month (especially if US data remains strong). But there may be another factor at play that could at least support GBP/USD over a particular period of the month.

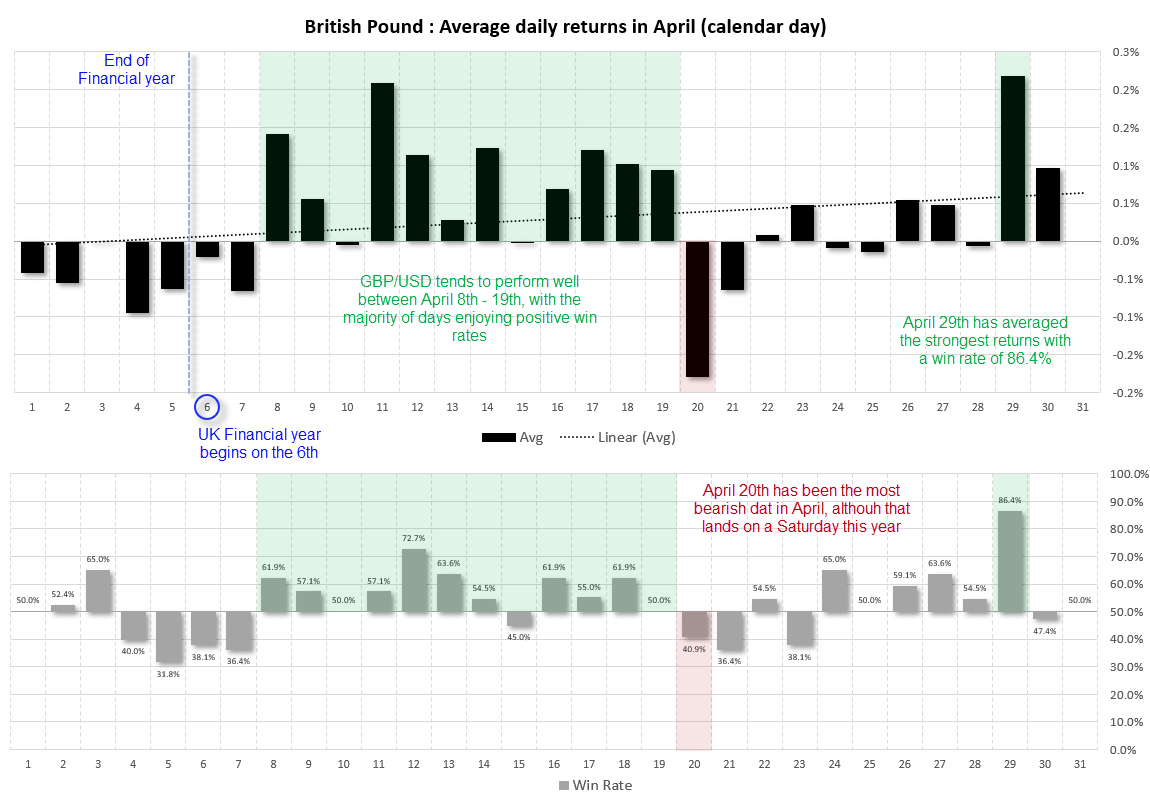

GBP/USD seasonality in April, by the day:

The chart above shows average returns in April for GBP/USD by the day. And it is interesting to note that it tends to perform quite well on the days between 8th – 19th April, most days of which have a positive win rate. Furthermore, that bullish period arrives near the beginning of the financial year which lands on April 6th. Whether there is some sort of repatriation trade occurring for some FTE companies or not, I really have no idea. But it does appear to be a pattern worth keeping in mind as we head into next week, as next Monday lands on April 8th.

The most bearish day of the month lands on April 20th, although as that arrives on Saturday this year then perhaps GBP/USD traders should be on guard for a selloff on Friday 19th April. The most bullish day of the month lands on April 28th with an average return of 0.22% and win rate of 84.6% - and this year it lands on a Friday.

A sidenote on seasonality data:

Seasonality data is certainly nice to know, but it is not a roadmap for the future. It is simply taking an average of past performances, which ignores the individual drivers for its performance over any period of time. And that means traders need to keep a close eye on current and developing themes as they can easily take precedence over seasonality. So it really should just be used as an additional tool alongside other forms of analysis to try and find higher probability events.

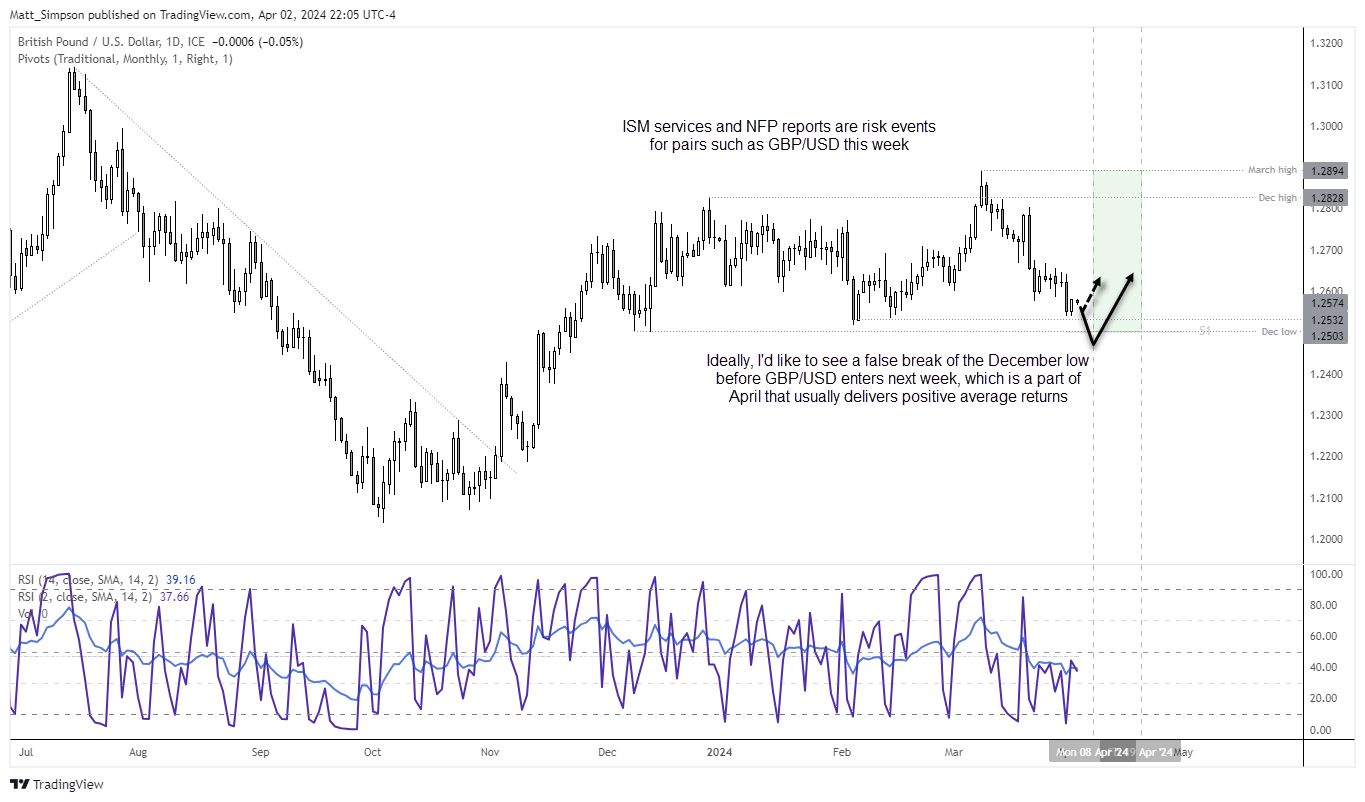

GBP/USD technical analysis:

Cable has fallen over 2.7% since its false break of the December high. It has found support around the February close low and formed a small bullish inside day, which suggests bears are either beginning to cover, bulls are entering or a combination of the two.

Like all FX majors, GBP/USD is likely at the mercy of today’s ISM services report and Friday’s nonfarm payroll data, where weak figures are required to weaken the US dollar, yields and bolster pairs such as GBP/USD.

But the closer GBP/USD traders towards the December low, the more I suspect a bounce could be due. If fact, what I would really like to see is a false break of the December low before the weekend, where bulls could then seek evidence of a bounce next week as it enters the seasonally bullish part of April (represented by the green box).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade