- GBP/USD analysis: Why has the cable been so stable?

- FOMC, BoE and NFP all to come this week

The GBP/USD is facing a key test this week from multiple sources. Among these, we have rate decisions from both the UK and US central banks, while the nonfarm payrolls data on Friday will cap a week full of important economic data. The cable is therefore our currency pair of the week, as it could be in for a roller coaster ride.

GBP/USD analysis: Why has the cable been so stable?

The GBP/USD has been fairly resilient this year considering the recovery in the dollar against other currencies. The cable has found support largely because of the Bank of England’s hawkish stance, as UK inflation once again proved to be hotter than it is in most other developed economies. Traders have pushed back their expectations about an imminent rate cut in the UK. The GBP/USD has also been supported to some degree by the positive risk appetite. However, the upside for the cable has been capped due to an even stringer-performing US dollar so far in 2024.

The focus for GBP traders will on the Bank of England’s rate decision on Thursday. Ahead of the BoE meeting, we saw UK PMI data come in stronger than expected last week. But significant pressure on consumers remained with average earnings coming in weaker and CPI was hotter at 4% annual rate. The result of the squeeze on household incomes was evidenced by a 3.2% slump in monthly retail sales data. The BoE will not want to push too hard against rate cut bets as it could damage confidence and weigh further on the economy. Yet, with inflation remaining sticky, it won’t be able to cut rates as soon as the markets want. So, there’s a risk the BoE could keep rates high for longer, causing more damage to an already-struggling economy.

GBP/USD analysis: Can GBP outperform the USD this week?

While there is the potential that the BoE could send the GBP surging higher on Thursday, the bigger risk is a potential rally for the US dollar first, owing to a potentially hawkish FOMC rate decision on Wednesday.

If so, this could keep the dollar on the front foot, with the Dollar Index climbing in almost every week of this year, although it has paused around the 200-day average and key resistance around 103.50 ahead of key US data and the FOMC rate decision.

I reckon, the GBP/USD may struggle to climb out of its multi-week consolidation zone around 1.27 to 1.28 area this week. This is because economic growth in the US is allowing the Fed to ease up on immediate rate cuts expectations. Wednesday's FOMC meeting might see the Fed maintaining a firm stance against excessive dovishness.

A slew of stronger US data in recent weeks has pushed the odds of a Mach rate cut to below 50% from above 90% at the end of December. Last week saw consumer spending and GDP for the fourth quarter come in much better. GDP printed +3.3% on an annualised format, compared to 2.0% expected and 4.9% in Q3. Previously we had seen stronger-than-expected CPI, jobs and retail sales reports, keeping the dollar supported. Will Fed Chair Jerome Powell echo the sentiment from his other FOMC colleagues and push back against rate cuts bets more forcefully come Wednesday?

Meanwhile, the US Treasury's Quarterly Refunding announcement is another factor that could drive the dollar higher, if investors demand a higher rate of return for lending to the government. Thus, there is a risk that we might see higher US Treasury yields and potentially a stronger dollar.

And let’s not forget about Friday’s US jobs report. If we see further evidence of a resilient US labour markets, then this would further reinforce the rationale for the Fed’s cautious approach to rate normalisation. But if we start to see weakness creep into the jobs data then the market may once again start to believe in its earlier conviction that rate cuts may come sooner, after all. That said, it will take more than one jobs report to turn the tide again.

GBP/USD technical analysis

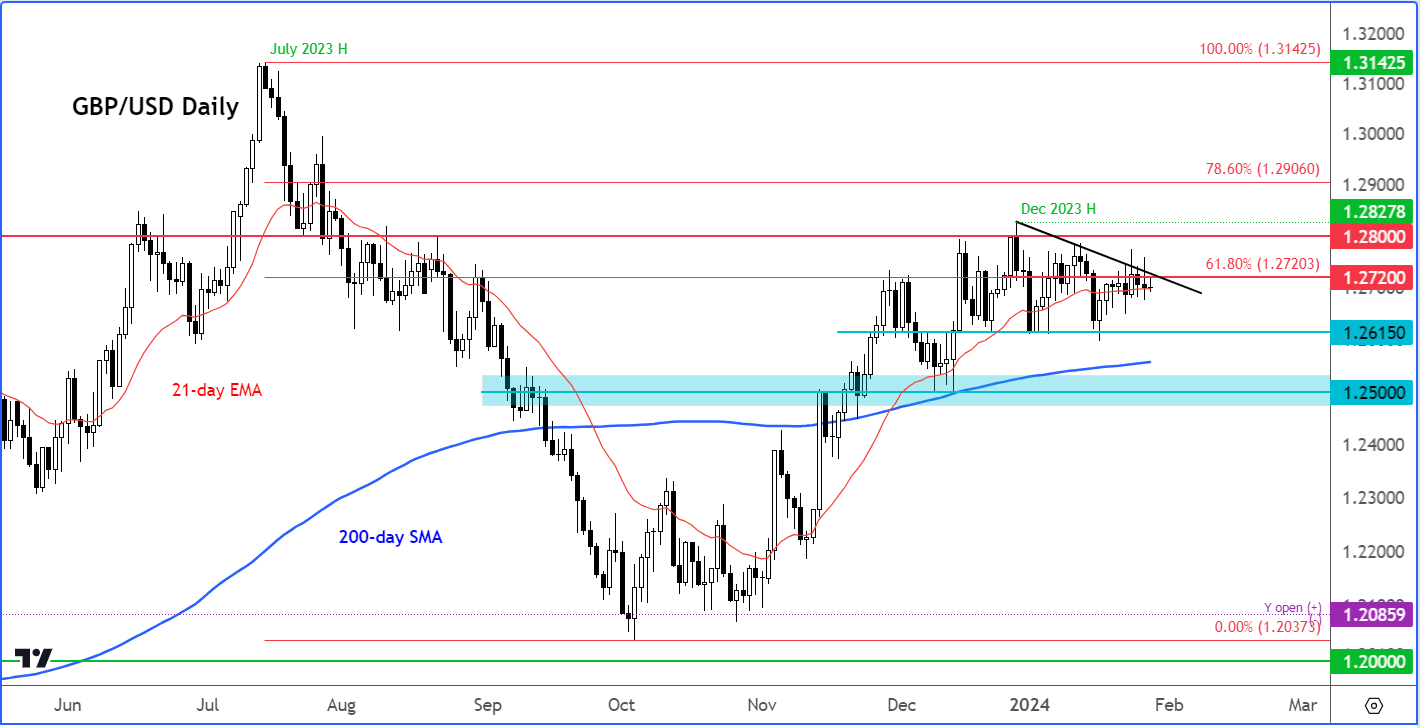

Source: TradingView.com

From a technical point of view, the GBP/USD’s ability to hold its own near 1.2720 to 1.2800 resistance area for the last two months is a sign of strength. Yet, the lack of any further upside momentum suggests traders are waiting for a big stimulus to drive rates outside of the current consolidation zone. Technical traders will be watching for a couple of scenarios, regardless of how the macro situation unfolds this week. A daily close above 1.2720 would be a bullish sign as that will break the short-term bearish trend line that has been in place since December. If so, we could see some follow-up technical buying to drive rates towards the December’s high of 1.2828 where many sellers’ stop orders will undoubtedly be resting. Conversely, if resistance continues to hold here around the 1.2720 area, let’s say by the middle of Thursday’s session when both central bank decisions are out of the way, then in that case I would favour the potential for a drop towards 1.2615 or even 1.2500 first.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade