EUR/USD falls after German inflation ahead of US NFP

- German inflation falls to 3.2% YoY

- NFP is expected to rise to 180k

- EUR/USD falls towards 1.0750 support

EUR/USD is falling. Giving back yesterday's gains and is on track to lose almost 1% across the week which would mark it second straight weekly decline.

The euro is falling on bets that the ECB will be one of the first major central bank to cut interest rates next year. The market is pricing in bets that the ECB could start cutting rates as soon as March next year. Meanwhile economists at Goldman Sachs expect the ECB to cut rates by 25 basis points each meeting from April 2024.

Dovish ECB bets came after eurozone inflation cooled by more than expected to 2.4% YoY in October. Easing inflation was confirmed today in Germany where the final rate for November was 3.2% as inflation fell -0.4%MoM.

Attention now turns to US nonfarm payrolls which are expected to show that 180,000 jobs were added in November, up from 150,000. Meanwhile the unemployment rates expected to hold steady at 3.9%.

Dollar strength across this week despite softer than forecast ADP payrolls and JOLTS job openings suggest that the market will be looking for a significantly weaker reading in order for the US dollar to extend a move lower.

The data comes ahead of the Federal Reserve's interest rate decision next week where the market will be looking for some form confirmation from the Fed that rate cuts could start next year.

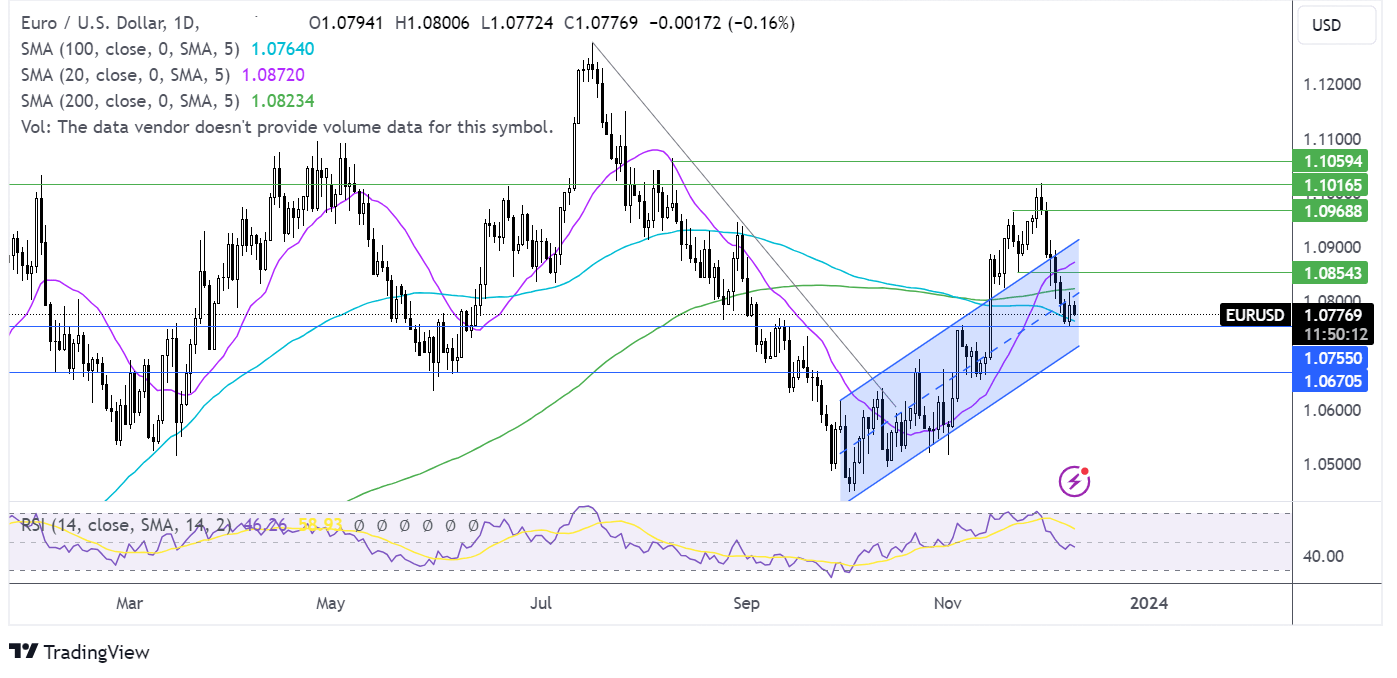

EUR/USD forecast – technical analysis

EUR/USD has fallen below the 200 SMA at 1.0820, which combined with the RSI below 50 keeps sellers hopeful of further losses.

Support is seen at 1.0750 the November 6 high and a break below here opens the door to 1.0710 the lower band of the rising channel.

Buyers will need to rise above the 200 SMA to extend gains towards 1.0850 the November 22 low, before bringing 1.0970 into play.

USD/JPY steadies after yesterday’s slump & ahead of US NFP report

- BoJ hinted to a hawkish pivot

- US NFP set to rise 180k in November vs 150k in October

- USD/JPY support at 141.67

USD/JPY is stabilising around the above 144 after falling over 2% in the previous session following the clearest hints yet from the BOJ that a hawkish pivot could be on the cards.

The Bank of Japan has kept interest rates in negative territory whilst other major banks have hiked rates. However the tables could be turning as the market is convinced that the BOJ is looking ready to bring interest rates above 0, whilst other major central banks may be considering rate cuts next year.

After the sharp sell off yesterday traders will be waiting for further clues from the BoJ before extending those declines. The BoJ December meeting is still 10 days away and the market may have gotten ahead of itself, assuming that the pivot is coming this year.

Overnight, Japanese GDP data was revised lower amid signs that inflation could be impacting consumer spending habits.

Now the focus will be on US nonfarm payrolls.

Given the resilience of the US dollar across this week, it will take a significantly weaker than expected figure to see the USD take another leg lower. Meanwhile an upside surprise could see traders rein in expectations that the Fed will cut interest rates by around 125 basis points next year.

The market is expecting the Fed to cut aggressively and for further weakness in US economy but non-farm payroll numbers at these levels he's still some way from confirming those bets.

USD/JPY forecast – technical analysis

USD/JPY has risen from the 141.50 low yesterday and the long lower wick suggests that there was little appetite at those levels. However, a significantly weaker NFP could fuel the bears and see that level tested again.

Meanwhile, a stronger than forecast NFP could see 145.00 resistance tested, opening the door to 146.50.