EUR/USD falls after the ECB meeting & ahead of US inflation data

- ECB left rates unchanged but the market brought forward rate cut bets

- US core PCE is expected to ease to 3% from 3.2%

- EUR/USD breaks down 200 SMA

EUR/USD is under pressure below the 200-day moving average as the market continues to digest yesterday’s ECB meeting.

While the central bank left interest rates on hold at the record 4%, as expected, ECB president Christine Lagarde gave away no clues over the possible timetable for future rate cuts.

While she acknowledged that inflation continued to trend lower, she also said that any change in monetary policy would be data-dependent.

The market thinks that the ECB will be forced to move to cut rates earlier than what it is saying, forecasting 142 basis points of cuts in the interest rate in 2024, which is up from 125 prior to the meeting. Meanwhile, the first cut is 76% priced in to be in April.

As well as the ECB meeting, German consumer confidence is also dragging on the euro after unexpectedly slumping in February as the tick higher in inflation dampened consumer morale.

Meanwhile, the US dollar has been powering higher following robust data and as investors look ahead to US core PCE.

US GDP grew stronger than expected at 3.3% annualized in Q4, ahead of the 2% forecast.

Meanwhile, core PCE, the Fed's preferred gauge of inflation, is expected to ease to 3% YoY, down from 3.2%. Robust growth and still above-target inflation would give the Fed few reasons to consider cutting interest rates sooner.

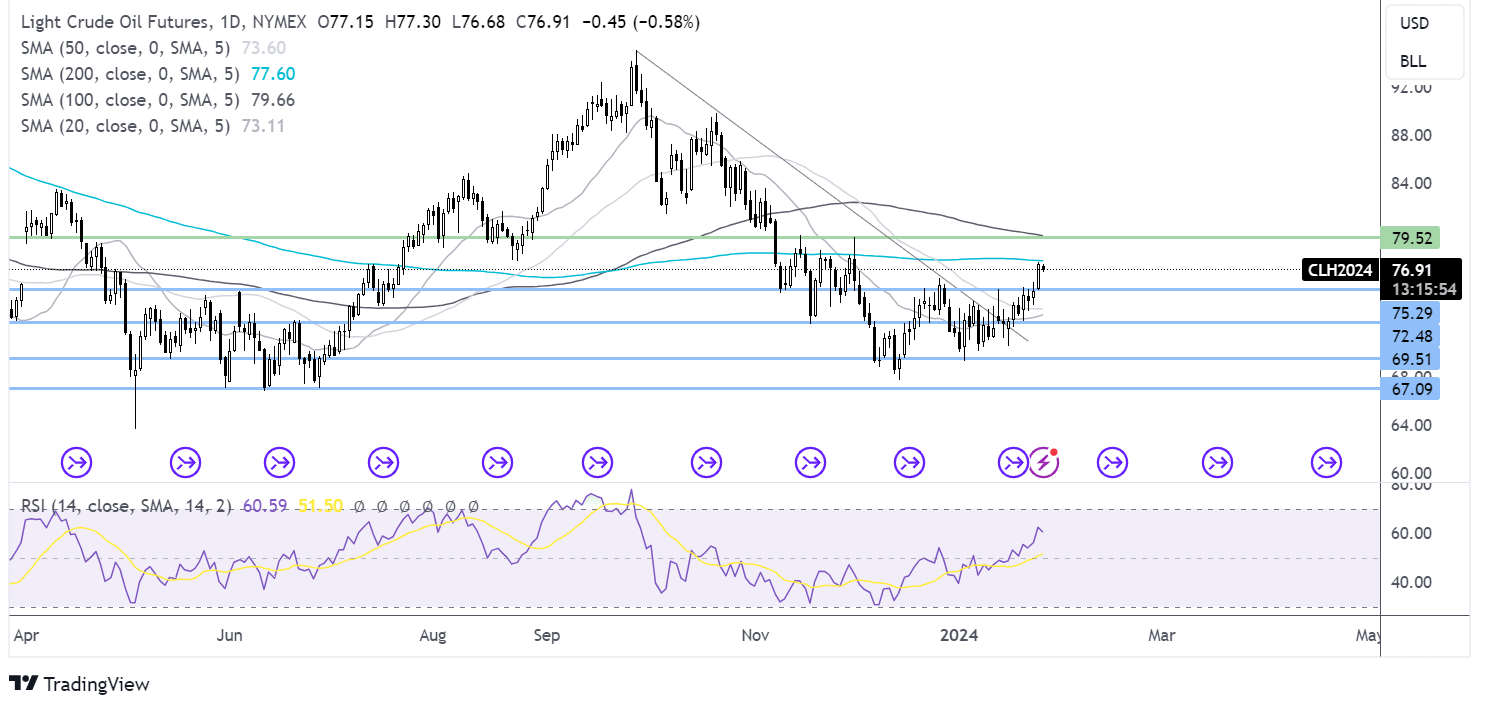

EUR/USD forecast – technical analysis

EUR/USD is testing yearly lows at 1.0820. A break below the 200 SMA and the RSI below 50 keeps sellers optimistic of further losses.

Sellers will look to take out the 1.0820 low and 1.08 round number to test 1.0750, the early November high, ahead of 1.0665, the June low.

Any recovery would need to rise above the 200 SMA at 1.0845 to extend gains towards 1.0930, the weekly high, and 1.10, the psychological level.

Oil hovers around a 2-month high

- Oil demand outlook boosted by US GDP data

- China pressures Iran to stop shipping attacks

- WTI rising towards 200 SMA

Oil prices are just edging lower but still hovering around a two-month high and are on track to book their biggest weekly gain since October.

The price has been boosted following a larger-than-expected draw in US crude inventories last week and an improving demand outlook.

The demand outlook received a boost after stronger-than-expected U.S. economic growth in the fourth quarter and after top oil importer China announced plans to ramp up stimulants to lift growth and shore up the fragile economic recovery.

Today, prices have come off slightly amid signs that tensions in the Red Sea could ease as China pressures Iran to curb attacks. While oil supply hadn't been directly affected by the events in the Middle East, the geopolitical risk premium had boosted the price, which is now unwinding slightly today.

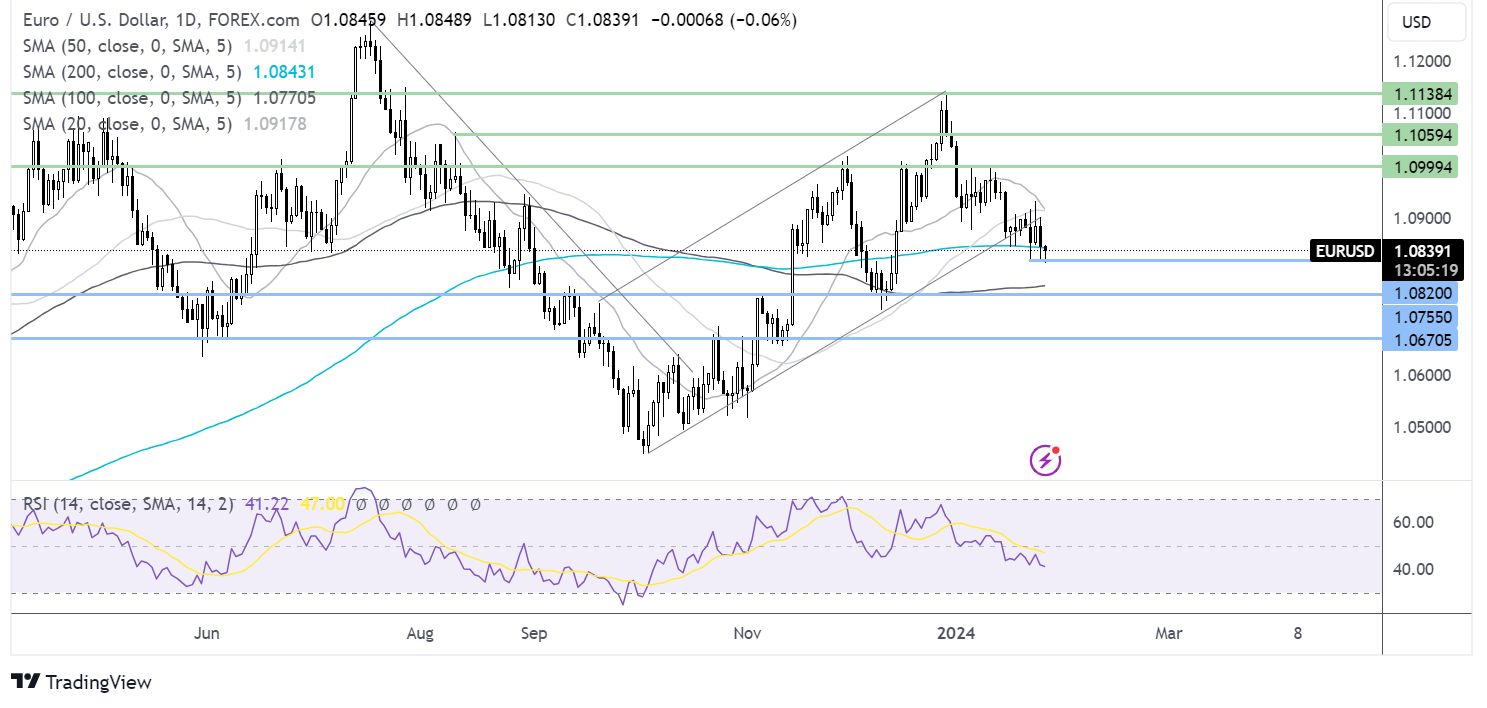

Oil forecast -technical analysis

Oil has extended its recovery from 72.70 at the start of the year, rising above the falling trendline resistance, and has paused for breath at the 200 SMA resistance at 77.60.

Buyers, supported by an RSI above 50, will look to rise above this level to bring 80.00, the psychological level, into play.

Failure to rise above the 200SMA could see a test of support at 75.30 ahead of 72.50.