EUR/USD rises, but gains could be limited with ECB President Lagarde’s speech in focus

- ECB-Fed monetary policy divergence in focus

- Eurozone consumer confidence to improve to -14 vs -14.9

- EUR/USD rises but lacks momentum

The euro is attempting to edge higher after modest gains in the previous week as investors look ahead to a speech by ECB president Christine Lagarde and consumer confidence data.

Meanwhile, consumer confidence data is expected to show a modest improvement again in April to -14 from -14.9. However, any gains in the pair could be limited given ECB- Fed divergence in management policy.

The ECB has suggested a June interest rate cut as inflation cools towards the central bank's 2% target. ECB Francoise Villeroy de Galhau stated that the ECB should cut rates in June so higher rates don't damage the economy. Meanwhile, Joachim Nagel, the president of Germany's Bundesbank, commented that the June rate cut is increasingly likely.

This is in sharp contrast to the Federal Reserve, which has dampened rate cut expectations after the U.S. stronger than expected US data and hotter inflation.

Recent Fed speakers have warned about the lack of progress towards cooling inflation to 2% and highlighted that there is no rush to cut interest rates.

On Friday, Chicago Fed President Austin Goolsbee said that inflation progress had stalled and that the Fed's current policy is appropriate. At the same time, Atlanta Fed President Raphael Bostic warned that the US central bank could not cut rates until the end of the year.

There is no high-impact U.S. economic data due to be released today. This week, attention will be on USD Q1 GDP data on Thursday and core PCE figures on Friday, which could provide further clues about the future path of US interest rates.

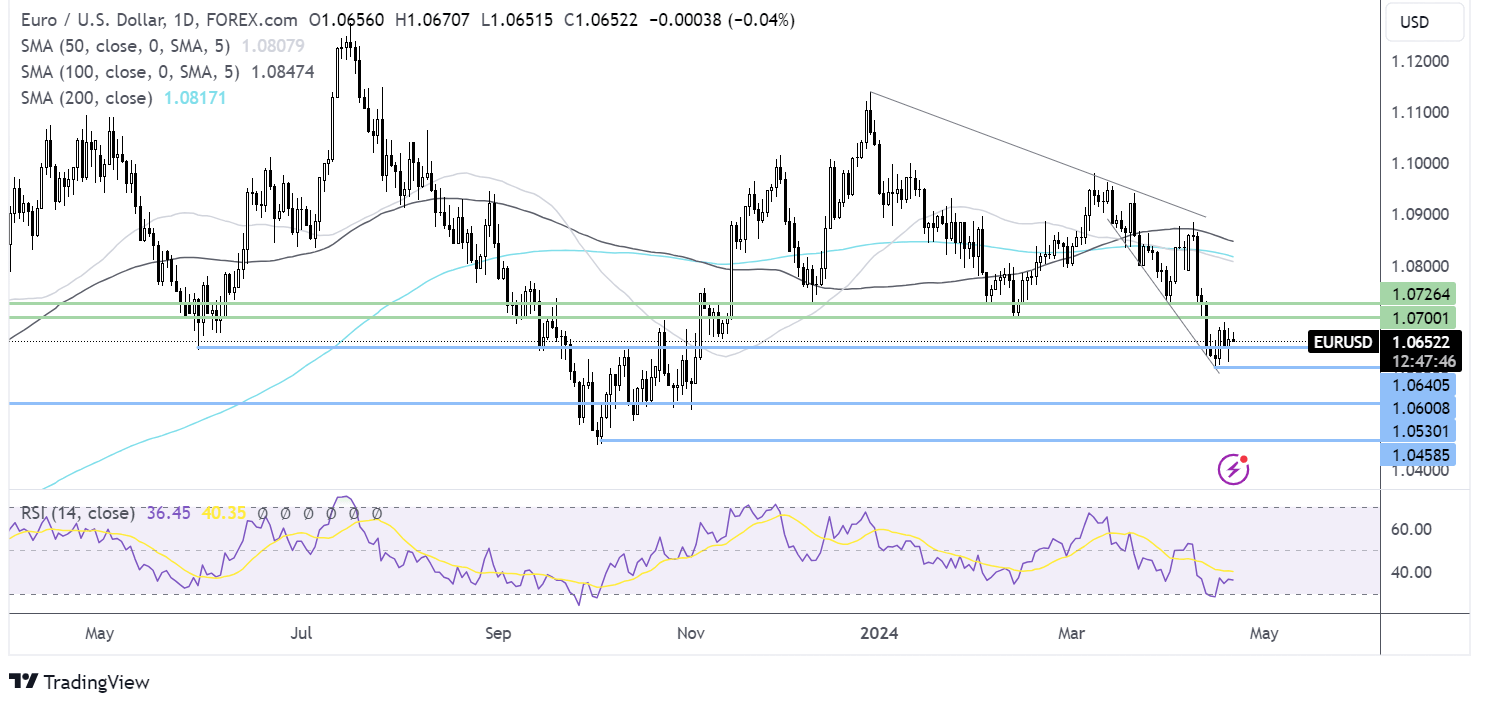

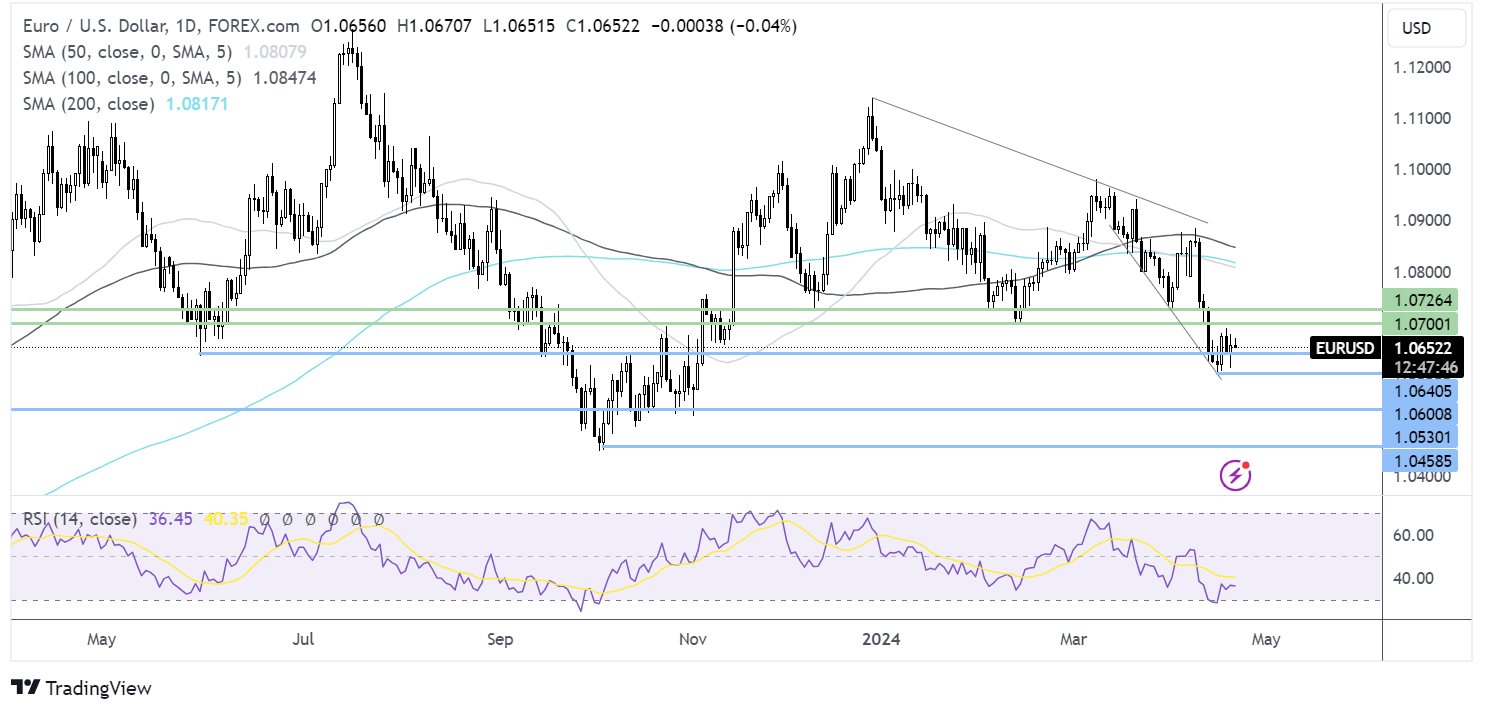

EUR/USD forecast – technical analysis

EUR/USD has rebounded from 1.06, the 2024 low, and has risen above 1.0640, although the recovery appears to be running out of steam.

Sellers will look to break back below 1.0640, the May 2023 low, to extend losses back toward 1.06. A break below here could spark a deeper selloff towards 1.0530.

Meanwhile, a move towards 1.07 could be on the cards if buyers retain control. Above here, 1.0725 comes into focus.

Oil falls as Middle East tensions ease & the demand outlook deteriorates

- Iran plays down the likelihood of a retaliation attack

- Oil demand outlook falls on the prospect of high US rates for longer

- Oil drops towards $80.00 per barrel

Oil prices fell at the end of last week and is falling over 1% at the start of this week as Iran-Israel tensions eased.

After direct attacks between the two Middle Eastern foes last week, Iran has played down the risk of escalation of hostilities following Israel's small attack.

The markets continue to unwind the geopolitical risk premium that was imposed on them due to a potential supply disruption should Middle East tensions escalate, lowering the price.

Attention is also very much on the US demand outlook due to the prospect of higher interest rates in the US for longer. High-interest rates could slow economic growth, which negatively affects the demand outlook. Last week, there was also a large build in US stockpiles, which added to the unfavorable position for oil and the stronger U.S. dollar.

Over the weekend, the U.S. House of Representatives passed her bill containing measures to let the federal government expand sanctions against Iran and its oil production; however, the markets have shrugged off the news.

Oil forecast – technical analysis

Oil prices have extended the decline from 87.75, last week’s high, dropping to 80.00, the psychological level.

The long upper wick on Friday’s candle suggests little buying demand at the higher levels, and the price is now testing the 50 SMA support at 81.00.

A break below here opens the door to 80.00, the psychological level, and the 200 SMA. Below here, the next level of importance is at 77.30.

Meanwhile, any recovery in the price will need to rise above 83.10, the March high, ahead of the 85.000 round number.