EUR/GBP slips despite EZ inflation reaching a new record level

Eurozone inflation rose to 9.1% YoY in August, up from 8.9% in July and above the 9% forecast. The fresh record-hit inflation print supports the case for a jumbo-sized rate hike from the ECB in the September meeting.

9.1% inflation is well ahead of the ECB’s 2% target and is being driven by soaring energy and food prices. Core inflation which excludes more volatile items such as food and fuel, rose 4.3% YoY, up from 4% in July. Perhaps more worryingly was the rise in goods inflation to 5% from 4.5%

No matter how you look at it, the outlook for the region is pretty bleak, with few signs that peak inflation is passing. Instead, the markets are bracing themselves for inflation to keep rising to double digits, possibly as soon as next month.

With German PPI at 37.2% and energy prices soaring even before the colder weather arrives, any hope of inflation cooling appears to be misplaced.

The data favours a big rate hike from the ECB as the hawkish calls from the central bank grow. Even if the ECB does hike by just 50 basis points, more rate hikes are likely across the remainder of the year as the ECB attempts to stop inflation from becoming entrenched.

Hawkishness from the ECB is already priced in. The euro is struggling to push higher amid rising concerns about the Nord Stream gas flow cut-off for three days, starting today.

European gas prices jumped over 5% after two days of declines. Comments from Germany and France that gas storage was ahead of target had pulled gas prices lower. As long as gas prices keep rising, the outlook for the eurozone is grim, and EUR will struggle to push beyond 1.010 versus the USD.

However, rising recession fears in the UK after the Ofgem energy price cap increase could keep the pound out of favour.

Where next for EUR/GBP?

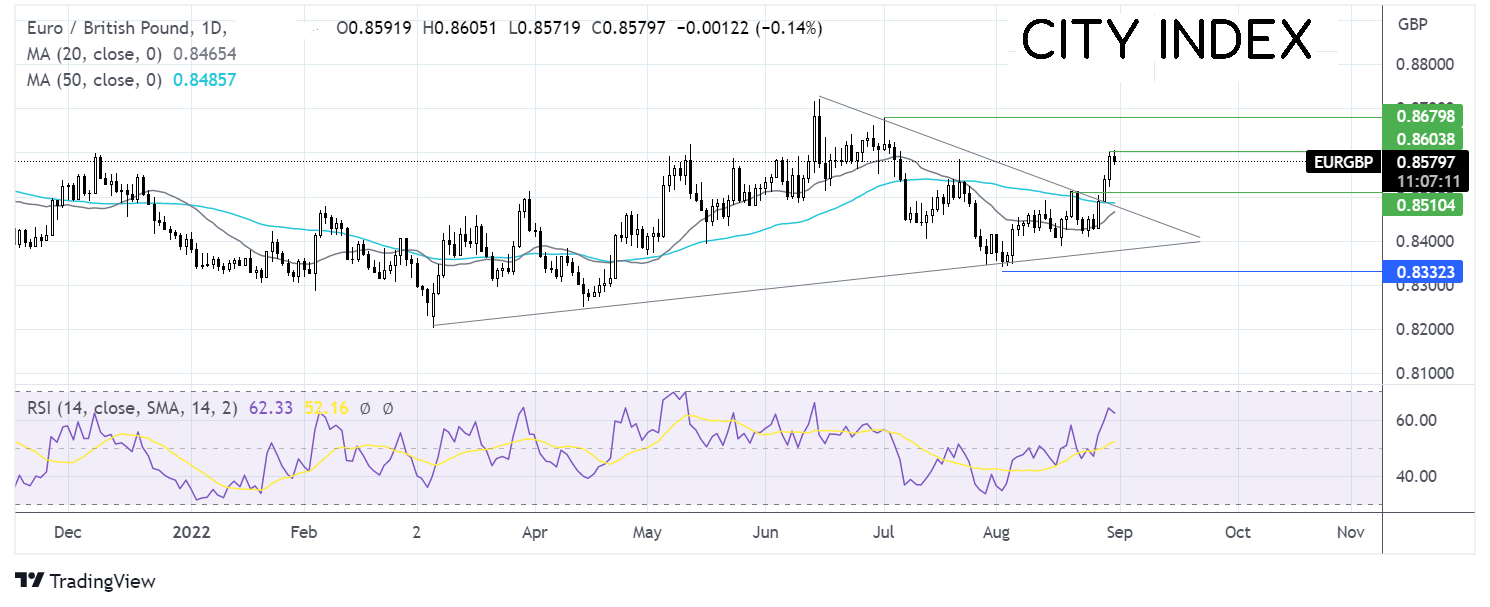

EUR/GBP broke out to the upside of a triangle pattern before running into resistance at 0.86. The bullish RSI supports further gains.

Buyers will need to rise above 0.86 and 0.8680, the July high, to bring the 2022 high of 0.8640 into target.

On the flip side, sellers would look for a move below 0.85 to negate the near-term uptrend. Further support is seen at 0.8585 the 50 sma.