Asian Indices:

- Australia's ASX 200 index fell by -77.8 points (-1.04%) and currently trades at 7,396.60

- Japan's Nikkei 225 index has fallen by -412.41 points (-1.45%) and currently trades at 28,076.72

- Hong Kong's Hang Seng index has fallen by -250.61 points (-1.03%) and currently trades at 24,179.16

- China's A50 Index has fallen by -143.87 points (-0.94%) and currently trades at 15,108.57

UK and Europe:

- UK's FTSE 100 futures are currently down -47.5 points (-0.63%), the cash market is currently estimated to open at 7,516.35

- Euro STOXX 50 futures are currently down -45 points (-1.05%), the cash market is currently estimated to open at 4,270.90

- Germany's DAX futures are currently down -114 points (-0.71%), the cash market is currently estimated to open at 15,917.59

US Futures:

- DJI futures are currently up 25 points (0.07%)

- S&P 500 futures are currently up 1 points (0.01%)

- Nasdaq 100 futures are currently up 1.5 points (0.03%)

Asia tracks Wall Street lower

Asian equity markets tracked Wall Street lower as investors finally decided (with a day’s delay) that higher rates aren’t actually great for their equity portfolios. The Korean KOSPI 200 was the weakest performer after the BOK hiked interest rates, and with the exception of Singapore’s STI the pattern was clearly a bearish once with all major benchmark trading lower on the day.

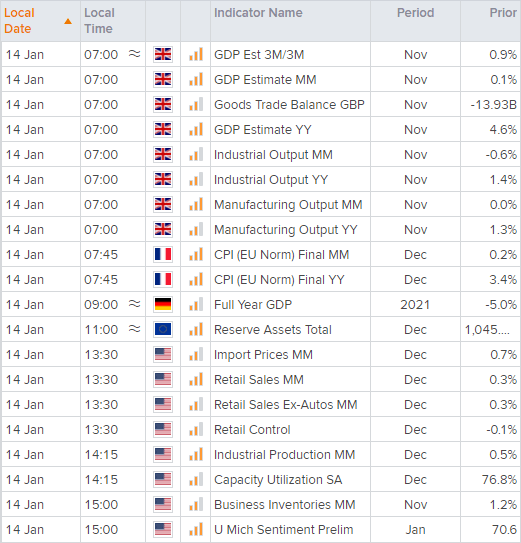

US retail sales and consumer sentiment could dictate sentiment after lunch

With European futures markets opening lower it looks like we’ll have a weak start today. And that leaves the question as to whether we’ll see a continuation of selling on Wall Street at the US open, just after lunch. And a potential trigger could come from either US retail sales at 13:30 or the University of Michigan consumer sentiment report at 15:00 GMT. Warning signs have been present in consumer sentiment for several months that things could get worse for the US. So, another weak print today could be another blow for equity bulls, especially since the survey hasn’t captured consumer reactions to yesterday’s eye-watering 7% inflation read. Although it’s likely to already present in Biden’s (dis)approval rating.

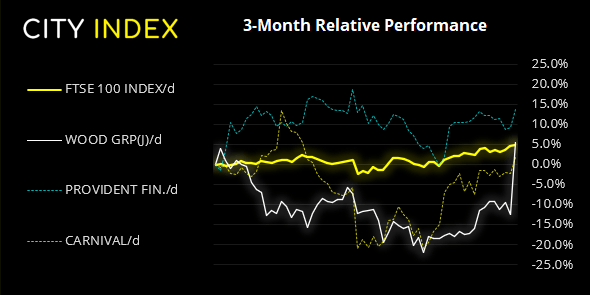

FTSE 350: Market Internals

FTSE 350: 4296.99 (0.16%) 13 January 2022

- 137 (38.92%) stocks advanced and 195 (55.40%) declined

- 14 stocks rose to a new 52-week high, 14 fell to new lows

- 51.99% of stocks closed above their 200-day average

- 47.16% of stocks closed above their 50-day average

- 23.01% of stocks closed above their 20-day average

Outperformers:

- + 20.5%-John Wood Group PLC(WG.L)

- + 4.21%-Provident Financial PLC(PFG.L)

- + 4.15%-Carnival PLC(CCL.L)

Underperformers:

- -20.7% - Countryside Properties PLC (CSPC.L)

- -7.91% - Marks and Spencer Group PLC (MKS.L)

- -6.41% - JD Sports Fashion PLC (JD.L)

GBP to look beyond data and politics?

We finally get some economic data in the European calendar, with the baulk of it coming from the UK with GDP, industrial and manufacturing production released at 07:00 GMT. Not that the British pound has taken much notice of economic data recently mind, as inflationary forces remain the key reason why traders are on guard for a potential BOW hike in February. And as GDP is backwards looking and Omicron already feels like old news, we may find that today’s economic data has little to no impact on GBP today.

And that GBP/USD continues to rally also shows the lack of concerns traders have over Boris’s latest faux pas (to put it lightly), and that he may well cling onto his job despite wide support for his ousting. Whilst ‘Teflon Boris’ may not stick as a name, he may be around for a while longer yet.

Guide to Pound sterling

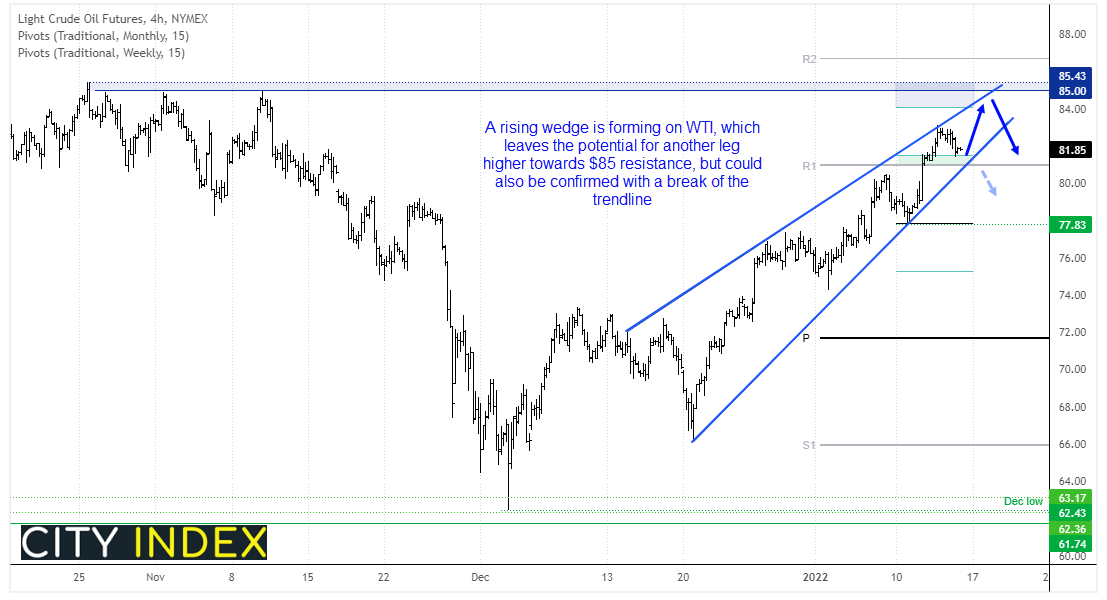

Potential rising wedge on WTI

The rally on oil prices has been strong of late, yet we note a potential rising (bearish) wedge forming on the intraday charts as prices approach resistance around $85.0. Yet we haven’t lost sight of the fact the bullish trend is strong, and as support has been found around the monthly R1 and weekly R1 pivot points, our bias is for another leg higher. But we’d be surprised if prices simply broke above the $84 - $85 region immediately, so we are also keeping an eye on its potential to roll over either form the highs, or break below monthly R1 to confirm a trend reversal and the bearish wedge pattern.

How to start oil trading

BOK hikes interest rates, optimistic of their recovery

The Bank of Korea raised interest rates by +25 bps, making it the third hike in this cycle which began in August. Rates are now at 1.25% and it looks like there could be more to follow. The central bank claim their economic recovery remained on track, driven by global demand for goods and IT, despite the resurgence of Covid. And that is important as the Asian export economy is a bellwether for other parts of Asia and, ultimately, global demand and growth.

China’s trade balance hits a record high

Exports and imports for China didn’t soften quite as much as expected in December, despite restrictions surrounding the Omicron variant. Exports rose 20.9% y/y, down from 22% and imports were 19.5% y/y, down from 31.7%. China’s trade surplus now sits at a record high.

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade