Asian Indices:

- Australia's ASX 200 index fell by -166.6 points (-2.27%) and currently trades at 7,175.80

- Japan's Nikkei 225 index has fallen by -313.26 points (-0.89%) and currently trades at 34,715.39

- Hong Kong's Hang Seng index has fallen by -188.75 points (-0.76%) and currently trades at 24,763.60

- China's A50 Index has fallen by -84.88 points (-0.55%) and currently trades at 15,414.64

UK and Europe:

- UK's FTSE 100 futures are currently down -80.5 points (-1.07%), the cash market is currently estimated to open at 7,504.51

- Euro STOXX 50 futures are currently down -69.5 points (-1.62%), the cash market is currently estimated to open at 4,230.11

- Germany's DAX futures are currently down -218 points (-1.37%), the cash market is currently estimated to open at 15,694.33

US Futures:

- DJI futures are currently down -79 points (-0.23%)

- S&P 500 futures are currently down -182.25 points (-1.23%)

- Nasdaq 100 futures are currently down -28.25 points (-0.63%)

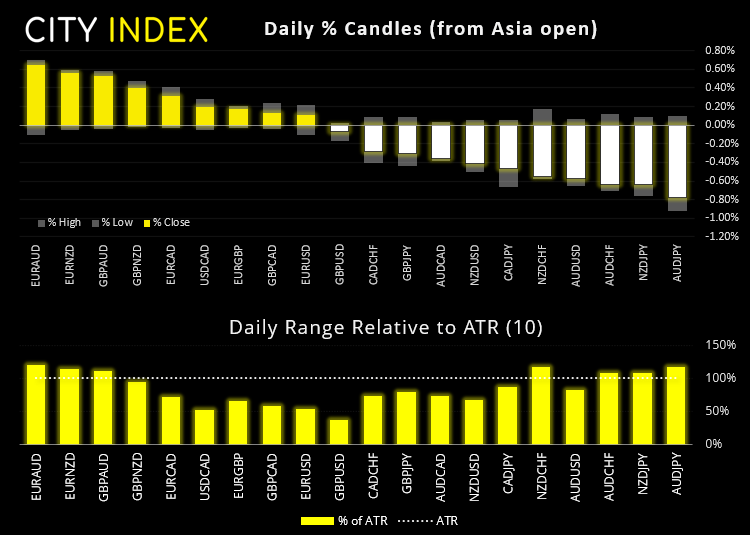

Asian equity markets tracked Wall Street lower overnight, forcing investors to move over to bonds as a safe haven and weigh on yields. What began as excitement at the prospects of the Feed hiking appears to have now turned into fear. Basically, it was a sea of red, the ASX 200 was the weakest major index and hit our lower bearish target around the October lows. The Nikkei fell to a 5-month low, although the Hang Seng was relatively unscathed and further supports our view that China’s equities are set to perform Japan’s. The Japanese yen was also the strongest currency (with the Swiss Franc coming in second place) as they sucked up safe haven flows.

Retail sales for the UK and Canada are the main economic calendar events, yet we suspect these will take a back seat as investors instead absorb the order flows and sentiment of the past couple of days and take it from there.

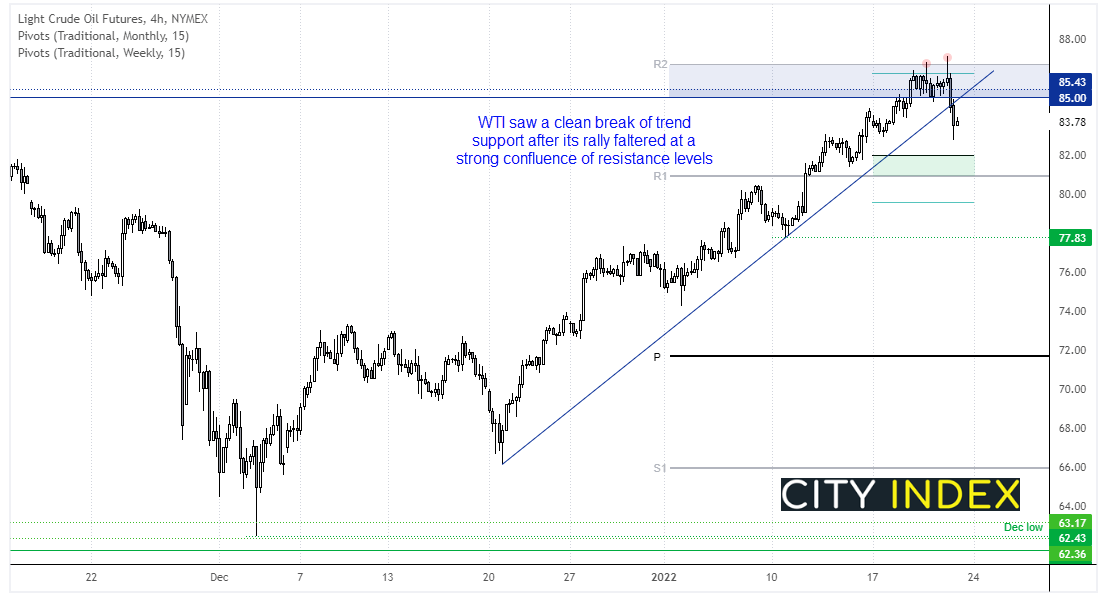

The oil shakeout begins

WTI’s rally up to (and beyond) the October high was nothing short of impressive this week. We expected a bit more resistance around $85 than we saw but after a few false attempts at cracking $85.50 bulls seemingly closed out to book profits. Yet a momentum shift suggests fresh shorts have been initiated.

We can see on the four-hour chart that prices have seen a clean break of trend support yesterday. For today we’d favour fading into minor pullbacks with a view to target the 81.50 – 82.0 zone either later today or early next week. A break above $85 invalidates that bias.

How to start oil trading

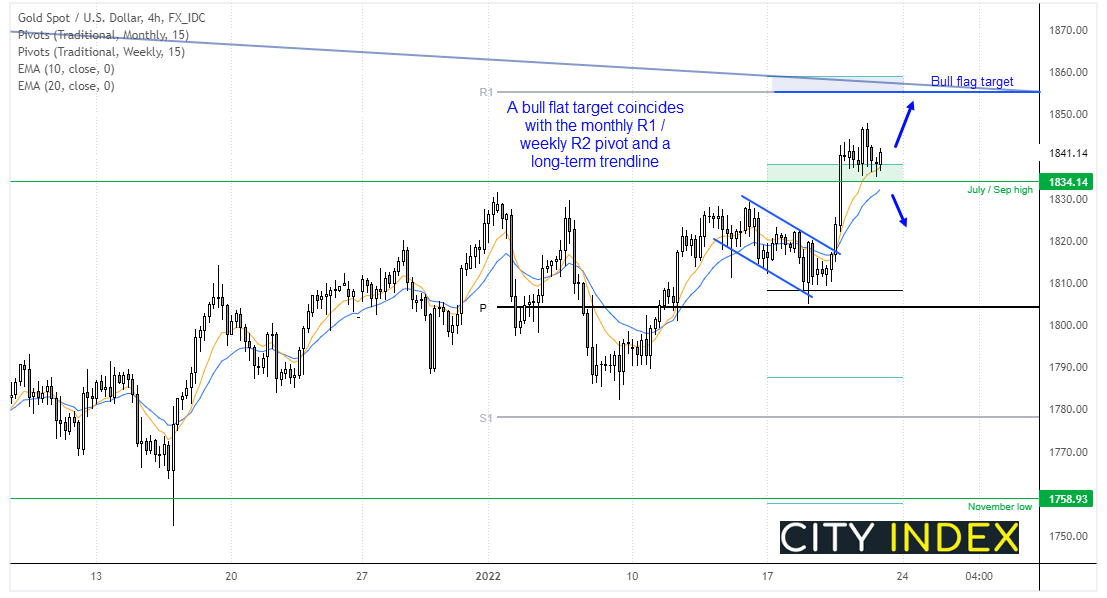

Will the stars align for gold bulls today?

Gold saw an impressive break above 1834 earlier this week. And it’s encouraging for the bull-case to see prices have since held above that milestone breakout level. Prices are now consolidating around the weekly R1 pivot level having broken out of a bull flag. And this is where it gets the more interesting. The flag projects a target right within a decent confluence of resistance levels including the monthly R1 / weekly R2 pivot points and a long-term bearish trendline.

1850 makes a viable initial target ahead of 1855. But given the significance of the levels at the upper zone we do not expect it to break first time around (and may even tempt some bears to the table). Whilst an early break below 1834 places this onto the back burner, at which point we would look for a new level of support to build in line with its bull flag breakout. We would need to see an aggressive close below 1834 to fully remove the bullish bias at this stage.

How do you trade gold on forex markets?

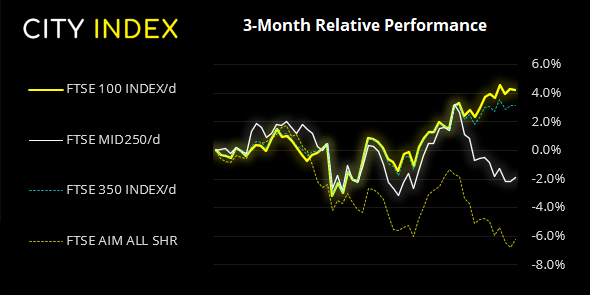

FTSE 350: Market Internals

FTSE 350: 4299.32 (-0.06%) 20 January 2022

- 190 (54.13%) stocks advanced and 143 (40.74%) declined

- 12 stocks rose to a new 52-week high, 4 fell to new lows

- 47.29% of stocks closed above their 200-day average

- 42.74% of stocks closed above their 50-day average

- 13.11% of stocks closed above their 20-day average

Outperformers:

- + 9.03% - Spirent Communications plc (SPT.L)

- + 8.15% - Trainline PLC (TRNT.L)

- + 7.82% - Premier Foods PLC (PFD.L)

Underperformers:

- -5.79% - Safestore Holdings PLC (SAFE.L)

- -4.26% - Countryside Properties PLC (CSPC.L)

- -4.18% - Associated British Foods PLC (ABF.L)

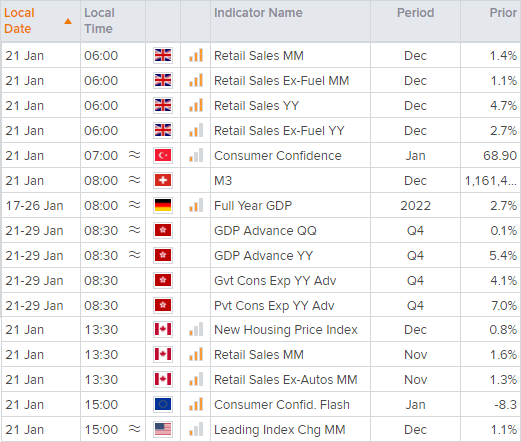

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade