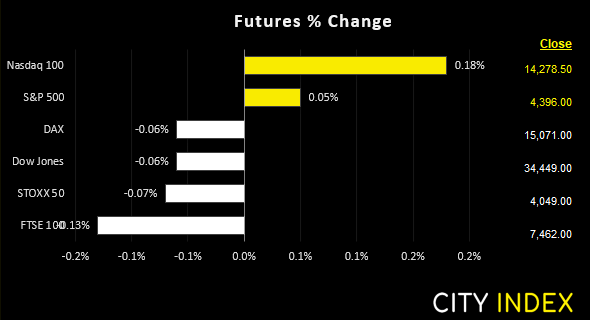

Asian Indices:

- Australia's ASX 200 index fell by -29.2 points (-0.4%) and currently trades at 7,214.70

- Japan's Nikkei 225 index has fallen by -171.89 points (-0.49%) and currently trades at 34,566.17

- Hong Kong's Hang Seng index has fallen by -172.93 points (-0.7%) and currently trades at 24,383.64

- China's A50 Index has risen by 51.91 points (0.35%) and currently trades at 15,004.13

UK and Europe:

- UK's FTSE 100 futures are currently down -10.5 points (-0.14%), the cash market is currently estimated to open at 7,521.09

- Euro STOXX 50 futures are currently down -3 points (-0.07%), the cash market is currently estimated to open at 4,061.45

- Germany's DAX futures are currently down -9 points (-0.06%), the cash market is currently estimated to open at 15,104.97

US Futures:

- DJI futures are currently down -20 points (-0.06%)

- S&P 500 futures are currently up 28.75 points (0.2%)

- Nasdaq 100 futures are currently up 2.5 points (0.06%)

Liquidity injection from PBOC lift China’s equity markets

Asian equity indices were mostly lower overnight, despite a late-session rebound on Wall Street which recouped earlier losses. Tensions between Russia and Ukraine are clearly still weighing on sentiment, even if volatility is subsiding somewhat. The Hang Seng is down around -1% and the ASX 200 is off by around -0.4%. Yet China’s equity markets bucked the trend following another liquidity injection from PBOC to support growth. China’s CSI 300 is up around 1% and the A50 rose around 0.4%.

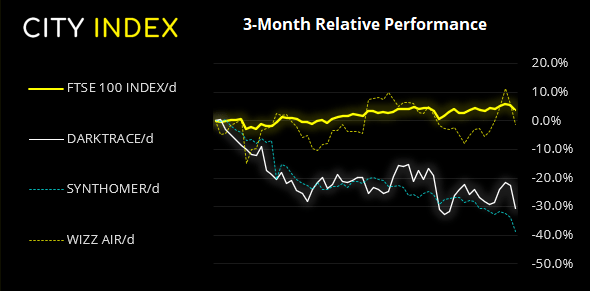

Worst session for the FTSE in three weeks

Despite being tantalisingly close to the January 2020 high, the FTSE rolled over from the open during its worst session in three weeks. Airline stock ICAG (International Airline Group) was the weakest performer as investors priced in the potential for a war between Russia and Ukraine to impact travel.

FTSE 350: Market Internals

FTSE 350: 4239.43 (-1.69%) 14 February 2022

- 31 (8.86%) stocks advanced and 313 (89.43%) declined

- 1 stocks rose to a new 52-week high, 17 fell to new lows

- 32.57% of stocks closed above their 200-day average

- 34% of stocks closed above their 50-day average

- 21.14% of stocks closed above their 20-day average

Outperformers:

- + 25.0% - EVRAZ plc (EVRE.L)

- + 6.97% - Fresnillo PLC (FRES.L)

- + 6.51% - Syncona Ltd (SYNCS.L)

Underperformers:

- -10.68% - Darktrace PLC (DARK.L)

- -7.46% - Synthomer PLC (SYNTS.L)

- -6.34% - Wizz Air Holdings PLC (WIZZ.L)

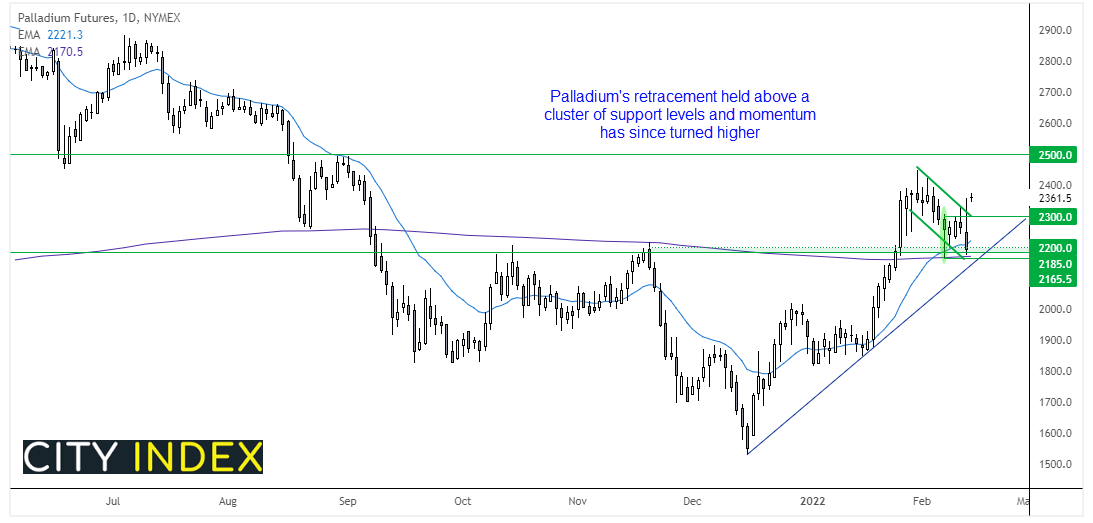

Palladium rebounds from support cluster

Escalating tensions from Russia’s move on Ukraine has been beneficial for gold prices during risk-off trade. Yet with that comes the potential for increased demand for platinum. We outlined a bullish in our video, although we’re yet to see a daily close above 1050.8 to trigger out bullish bias. And whilst we wait for that to come to fruition, we see the potential for palladium to rise.

Platinum prices rallied an impressive 60% from December’s low to January high before embarking upon a retracement over the past couple of weeks. Despite a bearish outside candle forming on Friday, several technical levels provided support which includes the 100-week eMA, 20-day eMA and October and November highs. Prices have since gapped above the high of the bullish outside candle which strongly suggest the corrective low was seen on Friday. From here we think it can now hold above trend support and head towards 2500.

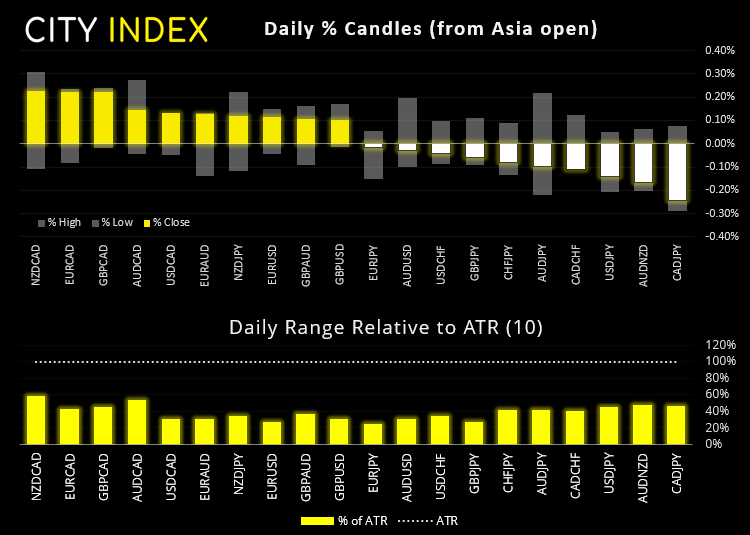

Currencies await the next catalyst

Volatility remained contained for currency pairs overnight, with RBA’s minutes providing little new for traders to digest. Q4 GDP rebounded in Japan as expected, although private consumption added more to the print than forecast. Yet the good data set is already overshadowed by expectations of a negative print for Q1. GBP/AUD is back above 1.9000 and yesterday’s open price. Our original analysis state we remained bullish above the 1.8800 swing low but we have now raised this to 1.8900, just beneath Friday’s low.

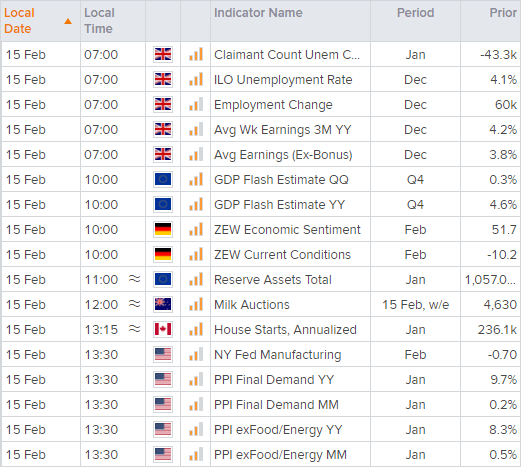

Euro crosses are in focus at 10:00 GMT with flash employment and GDP data for the eurozone. The monthly ZEW report for Germany is also out at the same time and could help support the euro should it all come in on or above expectations. Producer prices are scheduled for 13:30. It rose at a moderate pace of 0.2% in December – its slowest pace in 13-months, but any upside surprise here will simply be a reminder as to how strong inflation data is and likely support the US dollar.

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade