Asian Indices:

- Australia's ASX 200 index rose by 8 points (0.11%) and currently trades at 6,998.60

- Japan's Nikkei 225 index has risen by 423.81 points (1.63%) and currently trades at 26,394.63

- Hong Kong's Hang Seng index has fallen by -35.53 points (-0.16%) and currently trades at 22,866.03

- China's A50 Index has risen by 101.78 points (0.7%) and currently trades at 14,693.63

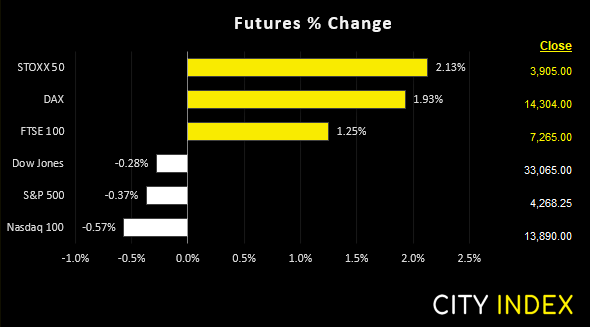

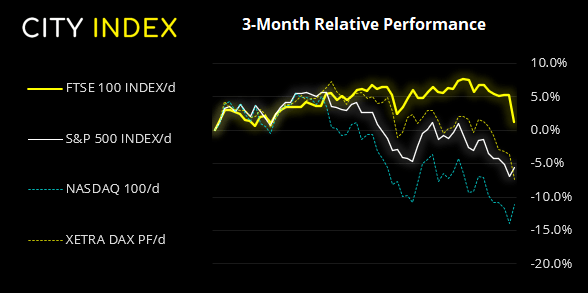

UK and Europe:

- UK's FTSE 100 futures are currently up 90.5 points (1.26%), the cash market is currently estimated to open at 7,297.88

- Euro STOXX 50 futures are currently up 81.5 points (2.13%), the cash market is currently estimated to open at 3,910.79

- Germany's DAX futures are currently up 271 points (1.93%), the cash market is currently estimated to open at 14,323.10

US Futures:

- DJI futures are currently down -86 points (-0.26%)

- S&P 500 futures are currently down -74.75 points (-0.54%)

- Nasdaq 100 futures are currently down -14.75 points (-0.34%)

The nuclear stalemate

Putin used a not-so-veiled threat of nuclear weapons, should anyone ‘interfere’ with the conflict in Ukraine. Today, French President Macron has also fluffed nuclear-peacock feathers to remind Putin that NATO could also stoop that low if need be.

This does little to help the Ukraine but it does show there’s a limit to how far-reaching the conflict becomes. On the international front it seems to be a stalemate; nobody wants a nuclear war, so the West won’t actually help Ukraine defend themselves, who would do well to survive the weekend.

Yet Western sanctions are limited. Russia remains on the international SWIFT system, simply because Europe needs access to Russia’s oil and gas. And Putin know it. Hence the takeover of Ukraine while the West watches.

Volatility – the shadow of its former self?

Despite more than enough smoke signals from Russia that an attack was imminent, yesterday’s invasion still came as enough of a surprise to rattle global markets. Yet with the element of surprise behind us markets are now trading in a shell-shocked way, confined to low pockets of volatility well within yesterday’s ranges. And we may find that pattern persists heading into next week as investors absorb the info, regroup and wait for the next catalyst. Volatility can be a good thing, but too much is unpleasant.

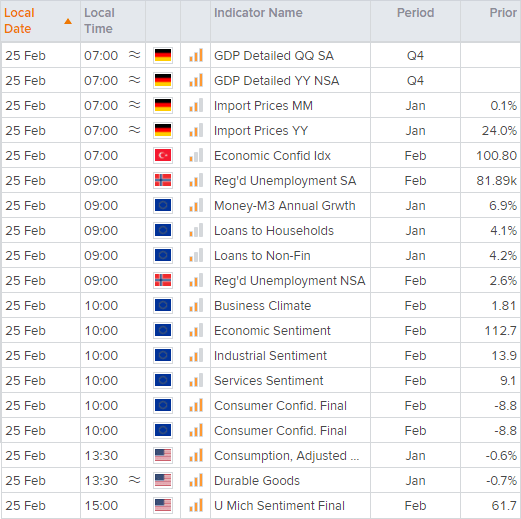

US inflation in focus

Given recent events, I think we can kiss goodbye any expectations the Fed will raise by 50 bps in their March meeting. The probability has fallen to around 22%, down from 33% the day prior, according to Fed Funds futures. Yet that’s no reason to not keep an eye on the Fed’s preferred inflation gauge, Core PCE, later today.

At 4.9%, PCE is at its highest level in nearly 40-years and more than twice the Fed’s ambiguous target. Should that stabilise even slightly it does give some hope that inflationary forces are tailing off. The best result for dollar bears is for it to cool off slightly, as literally nobody is expecting it. Yet a print of 5% or higher could see that expectation for a 50 bps hike creep back up again and support and already bid-dollar.

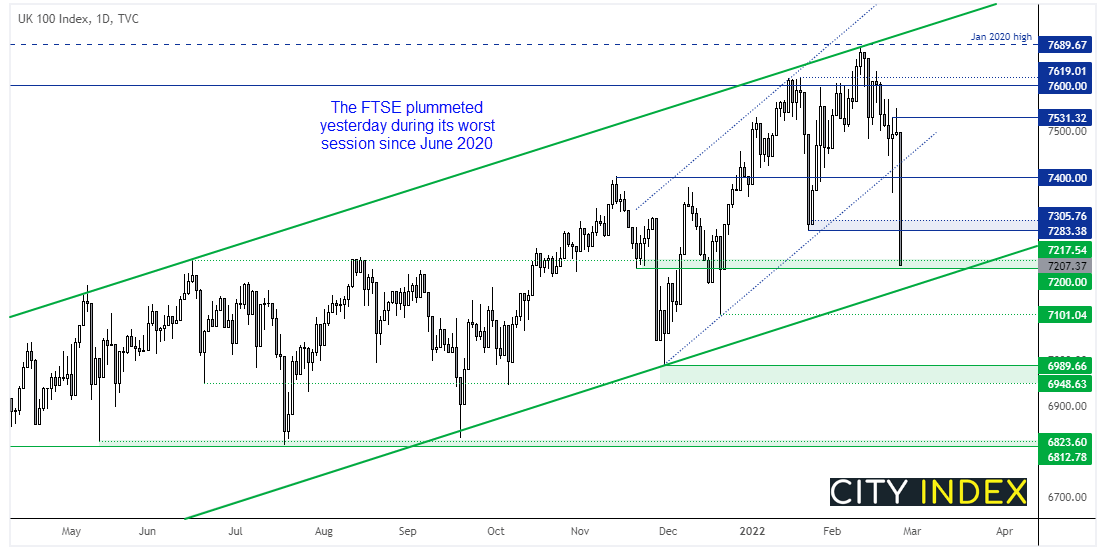

FTSE plummeted to 7200

Well, 7207 if we want to split hairs, but close enough. It was a bad day for sentient in general and that can be seen by the fact the FTSE closed at the low of the day. Granted, Wall Street posted a strong turnaround to finish higher so we’d expect European bourses to be relieved of some pressure today, but that is no immediate reason to become bullish the market unless we have a positive story behind it. For now, we want to see if the FTSE can hold above 7200 and / or within the bullish channel to target the 7300 area, a break above which exposes 7400.

FTSE 350: Market Internals

FTSE 350: 4042.88 (-3.88%) 24 February 2022

- 31 (8.86%) stocks advanced and 312 (89.14%) declined

- 3 stocks rose to a new 52-week high, 109 fell to new lows

- 18.57% of stocks closed above their 200-day average

- 26% of stocks closed above their 50-day average

- 7.71% of stocks closed above their 20-day average

Outperformers:

- +13.77% - Hochschild Mining PLC (HOCM.L)

- +5.16% - BAE Systems PLC (BAES.L)

- +4.72% - Capricorn Energy PLC (CNE.L)

Underperformers:

- -42.6% - Ferrexpo PLC (FXPO.L)

- -37.8% - Polymetal International PLC (POLYP.L)

- -30.4% - EVRAZ plc (EVRE.L)

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade