Asian Indices:

- Australia's ASX 200 index rose by 78 points (1.08%) and currently trades at 7,284.90

- Japan's Nikkei 225 index has risen by 422.67 points (1.22%) and currently trades at 34,988.84

- Hong Kong's Hang Seng index has risen by 303.87 points (1.25%) and currently trades at 24,659.58

- China's A50 Index has risen by 107.38 points (0.72%) and currently trades at 15,115.08

UK and Europe:

- UK's FTSE 100 futures are currently up 21 points (0.28%), the cash market is currently estimated to open at 7,629.92

- Euro STOXX 50 futures are currently up 16 points (0.39%), the cash market is currently estimated to open at 4,159.71

- Germany's DAX futures are currently up 57 points (0.37%), the cash market is currently estimated to open at 15,469.71

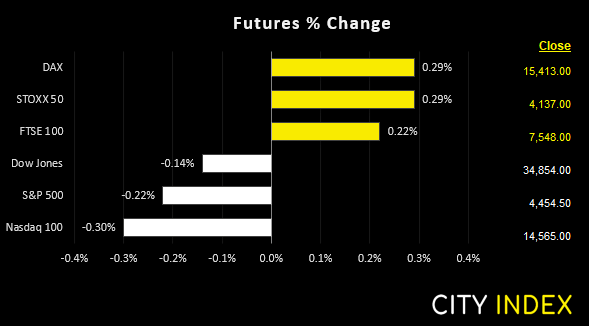

US Futures:

- DJI futures are currently down -23 points (-0.07%)

- S&P 500 futures are currently down -32.25 points (-0.22%)

- Nasdaq 100 futures are currently down -7 points (-0.16%)

Asian equity markets tracked Wall Street’s rebound following Russia’s claims that they were withdrawing some of their troops from Ukraine’s border. Yet is it worth keeping in mind that the US are yet to verify these claims, meaning sentiment remains vulnerable to turning should reports suggest Russia’s claims are not the case. Futures markets in Europe are around +0.2% higher whilst US futures are currently around -0.2% lower.

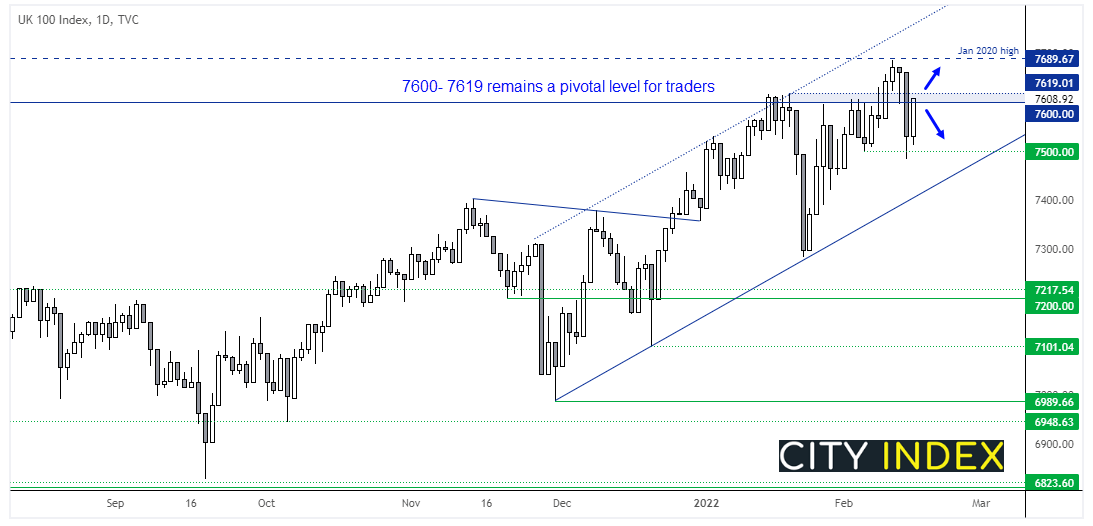

FTSE 100 back above 7600

The FTSE may have had its worst session in three weeks on Monday, but that didn’t prevent it from putting up a fight yesterday. Its bullish inside candle closed above 7600 and at the high of the day. Inflation data aside, a likely driver of sentiment (and therefore equity index direction) is whether US confirms that Russia have withdrawn troops. If so, the FTSE could easily break back above the 7619 high and perhaps even challenge the 2020 high at 7689.67. But if the US state that these are false claims from Russia, we would expect further selling pressure for equity markets today.

FTSE 350: Market Internals

FTSE 350: 4283.36 (1.03%) 15 February 2022

- 275 (78.13%) stocks advanced and 68 (19.32%) declined

- 4 stocks rose to a new 52-week high, 8 fell to new lows

- 37.5% of stocks closed above their 200-day average

- 75% of stocks closed above their 50-day average

- 23.86% of stocks closed above their 20-day average

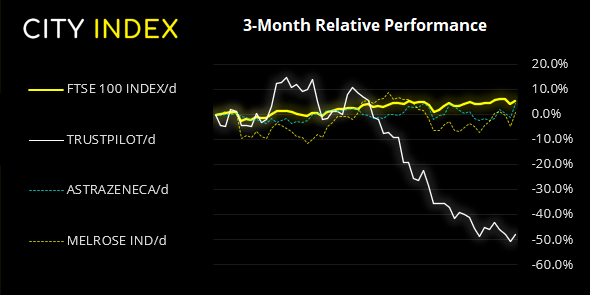

Outperformers:

- + 5.87% - Trustpilot Group PLC (TRST.L)

- + 5.78% - AstraZeneca PLC (AZN.L)

- + 5.63% - Melrose Industries PLC (MRON.L)

Underperformers:

- -4.07% - Plus500 Ltd (PLUSP.L)

- -3.48% - Harbour Energy PLC (HBR.L)

- -3.45% - Fresnillo PLC (FRES.L)

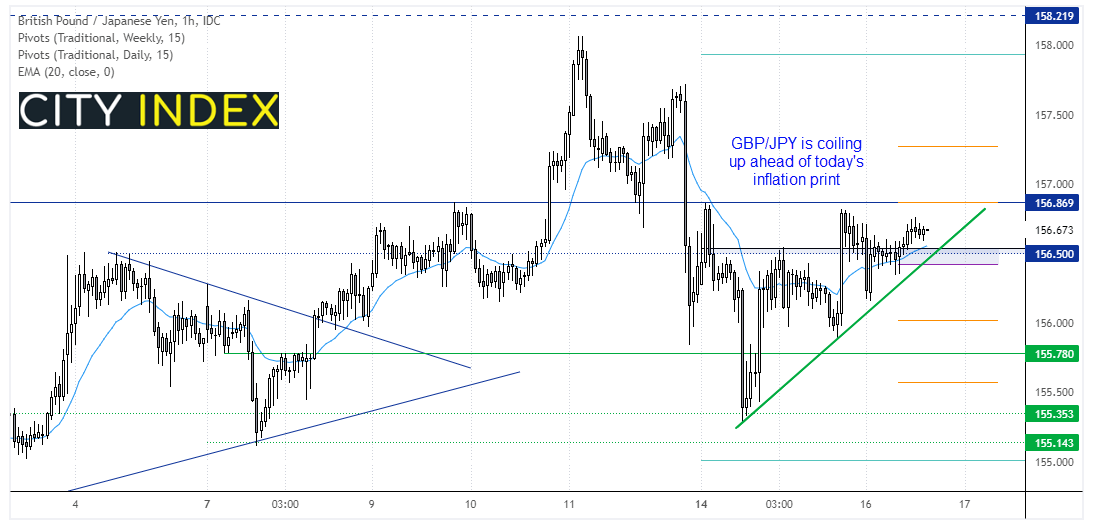

UK inflation at 07:00

Consumer prices in the UK reached their highest levels in 30-year in December. Expected to remain flat (but high) at 5.4%, the BOE are under increasing pressure to raise rates whilst facing criticism that it will not fix the cause behind the inflation it is trying to fix; supply constraints. We will run with the basic assumption that stronger inflation is more likely to send the pound higher as it assumes a greater probability of a hike, sooner. And if appetite for risk is to remain elevated then yen pairs could rally as investors move out of safe-havens. Therefore, the ideal scenario for GBP/JPY longs is for a strong inflation set alongside rising equities (risk-on), whilst weak inflation and risk-off could easily topple the cross.

We can see on the hourly chart that GBP/JPY has been trending higher. In recent hours it has been coiling up above the monthly pivot point around 156.60. We’d be keen on potential longs above this support level with an initial target around the 156.87 high and daily R1 pivot point. A break of hourly close above that pivotal level is constructive for further gains, whilst a break beneath 156.42 invalidates our bullish bias as it invalidates trend support and the daily pivot point.

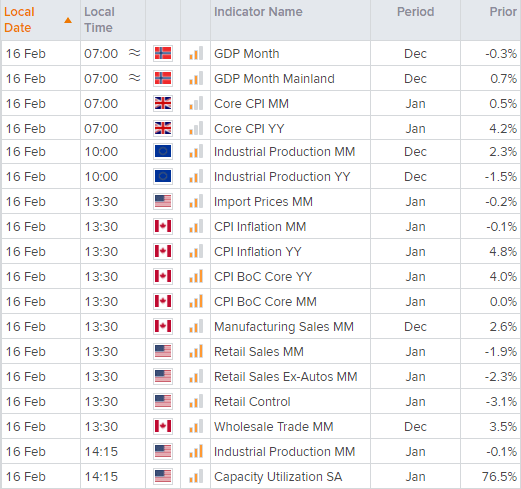

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade