Asian Indices:

- Australia's ASX 200 index rose by 86.3 points (1.2%) and currently trades at 7,269.00

- Japan's Nikkei 225 index has risen by 557.76 points (2.08%) and currently trades at 27,339.44

- Hong Kong's Hang Seng index has risen by 387.18 points (1.87%) and currently trades at 21,084.54

- China's A50 Index has risen by 90.72 points (0.68%) and currently trades at 13,352.08

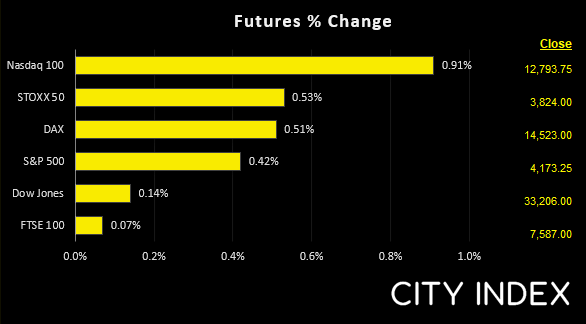

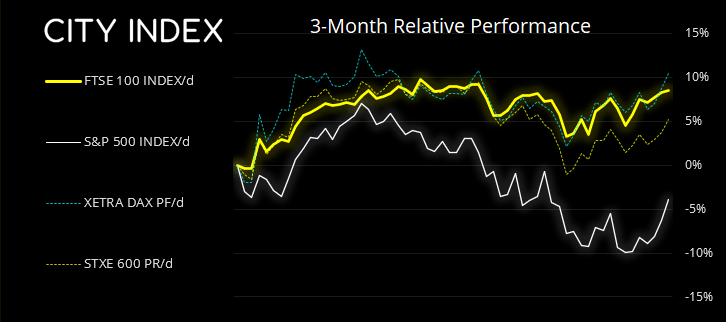

UK and Europe:

- UK's FTSE 100 futures are currently up 4.5 points (0.06%), the cash market is currently estimated to open at 7,589.96

- Euro STOXX 50 futures are currently up 18 points (0.47%), the cash market is currently estimated to open at 3,826.86

- Germany's DAX futures are currently up 70 points (0.48%), the cash market is currently estimated to open at 14,532.19

US Futures:

- DJI futures are currently up 51 points (0.15%)

- S&P 500 futures are currently up 120.5 points (0.95%)

- Nasdaq 100 futures are currently up 18.5 points (0.45%)

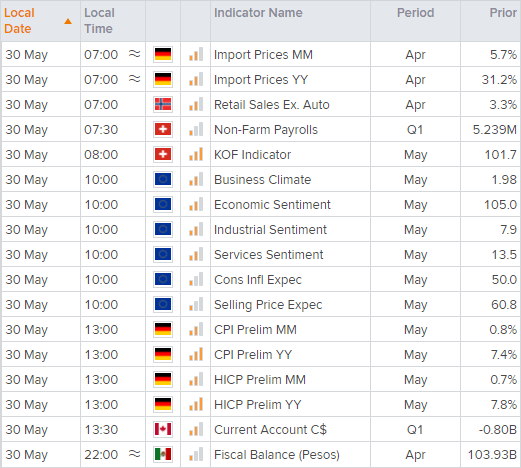

European data takes the centre stage with US markets closed today due to the 3-day weekend. At 10:00 BST we have economic sentiment released for the Eurozone, and we note that the consumer inflation expectation index fell by -12.9 points in April. At 13:00 we have German CPI which could be taken as a proxy for Wednesday’s inflation report for Europe. Should we see inflation move lower it could lower expectations of the ECB raising rates at their next meeting. Conversely, a strong report could simply increase the odds of a 50-bps hike by the ECB.

Worst month this year (so far) for gold

Gold is on track for its worst month in nine. A large part of gold’s underperformance has been due to investors moving to cash whilst equity markets fell, whilst lockdowns in China also dented demand. Typically, June is a bearish month for gold but that seasonal pattern appears to have been shifted forward by one month.

The 3-day weekend in the US means liquidity is lower than usual, and that can result in lower trading ranges. But the US 10-year yield is also trapped within a tight range above key support at 2.72%, whilst the US dollar index is holding above its 50-day exponential average. So we expect gold to also remain in a tight range around 1850 until we see a directional move in yields and / or the US dollar.

How to start gold trading

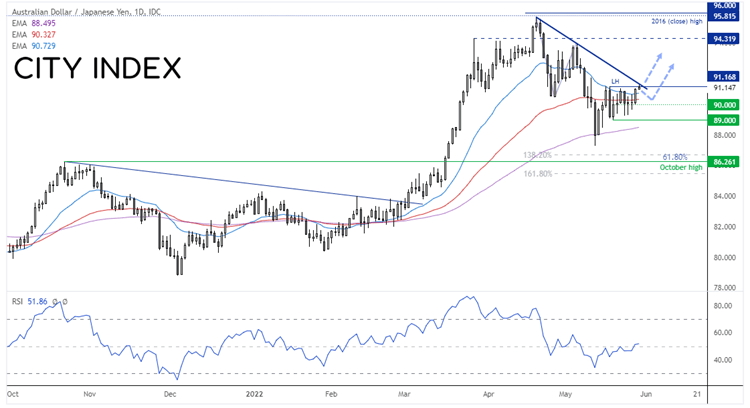

AUD/JPY probes key resistance

If we really are seeing a risk-on rally across equity markets, AUD/JPY is another market to monitor for a potential break higher. The pair has seen a 3-wave retracement against its bullish rally to 95.81, so it’s possible the retracement is now complete. A bullish engulfing candle formed on Friday which closed above the 20 and 50-day eMA’s.

91.17 is a pivotal area as it marks trend resistance and cycle highs, therefore a break above it assumes bullish continuation. But if 97.17 caps as resistance and prices move below 90, we have to consider the potential that the market may break lower. For now, our bias is bullish above 90 and for a break above 91.17.

FTSE: Market Internals

FTSE 350: 4225.3 (0.27%) 27 May 2022

- 245 (70.00%) stocks advanced and 97 (27.71%) declined

- 10 stocks rose to a new 52-week high, 2 fell to new lows

- 29.71% of stocks closed above their 200-day average

- 39.14% of stocks closed above their 50-day average

- 23.43% of stocks closed above their 20-day average

Outperformers:

- + 6.57% - Scottish Mortgage Investment Trust PLC (SMT.L)

- + 5.77% - Ninety One PLC (N91.L)

- + 5.02% - Allianz Technology Trust PLC (ATT.L)

Underperformers:

- -10.77% - Harbour Energy PLC (HBR.L)

- -6.75% - Johnson Matthey PLC (JMAT.L)

- -6.03% - Moonpig Group PLC (MOONM.L)

Up Next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade