Asian Indices:

- Australia's ASX 200 index rose by 35.9 points (0.49%) and currently trades at 7,306.10

- Japan's Nikkei 225 index has risen by 96.86 points (0.31%) and currently trades at 28,831.27

- Hong Kong's Hang Seng index has risen by 95.36 points (0.33%) and currently trades at 28,837.99

UK and Europe:

- UK's FTSE 100 futures are currently up 16 points (0.23%), the cash market is currently estimated to open at 7,097.01

- Euro STOXX 50 futures are currently up 4 points (0.1%), the cash market is currently estimated to open at 4,100.85

- Germany's DAX futures are currently up 12 points (0.08%), the cash market is currently estimated to open at 15,593.14

US Futures:

- DJI futures are currently down -152.66 points (-0.44%), the cash market is currently estimated to open at 34,294.48

- S&P 500 futures are currently up 14.25 points (0.1%), the cash market is currently estimated to open at 4,233.80

- Nasdaq 100 futures are currently up 5 points (0.12%), the cash market is currently estimated to open at 13,819.94

Learn how to trade indices

China – US trade relations show signs of thawing

Asian equities were firmer overnight with gain led by China as the US agrees to move forward with Beijing over trade. This is following the first call between the two nations since Biden took to office. China’s CSI300 is up 1.2% and SSEC currently trades around 0.9% higher. Futures markets also point to a positive open with FTSE futures up 0.2%, STOXX 50 up 0.1% and US futures up around the same amount.

Separately, the US and UK are planning to reopen travel between the two countries ASAP according to a statement released by the British Government yesterday. Biden arrived in the UK yesterday ahead of tomorrow’s G7 meeting.

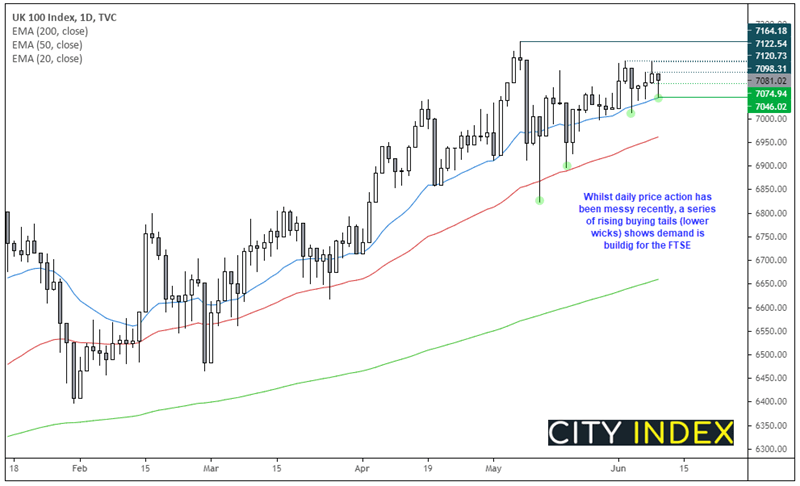

The FTSE 100 closed with a bullish hammer, and its low perfectly respected its 20-day eMA. Whilst price action has been messy as of late, a series of lower wicks (or buying tails) suggests demand is slowly building in line with its bullish trend. Futures markets are pointing for a higher open and the FTSE to open just below 7100 (so right on the cusp of yesterday’s high). This may provide around 20 points of upside potential for day traders, although we’d like to see a break above 7120 to confirm a resumption of its (albeit messy) uptrend.

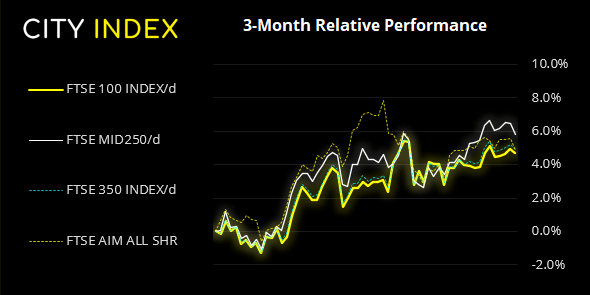

FTSE 350: Market Internals

FTSE 350: 7081.01 (-0.20%) 09 June 2021

- 109 (30.97%) stocks advanced and 237 (67.33%) declined

- 20 stocks rose to a new 52-week high, 1 fell to new lows

- 86.36% of stocks closed above their 200-day average

- 24.43% of stocks closed above their 20-day average

Outperformers:

- + 5.92% - Restaurant Group PLC (RTN.L)

- + 3.27% - International Consolidated Airlines Group SA (ICAG.L)

- + 3.27% - Tui AG (TUIT.L)

Underperformers:

- -9.62% - Thungela Resources Ltd (TGAJ.J)

- -5.27% - Paragon Banking Group PLC (PAGPA.L)

- -4.42% - Crest Nicholson Holdings PLC (CRST.L)

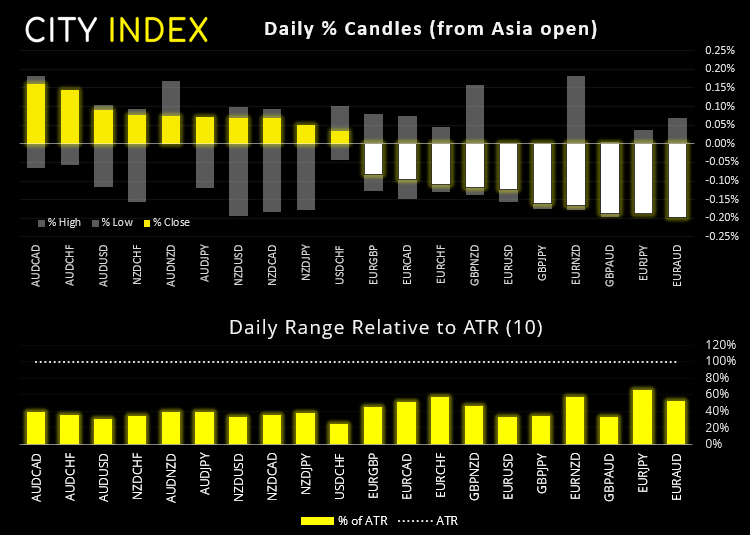

Forex trades in narrow ranges ahead of key calendar events:

AUD and NZD are currently the strongest majors thanks to improved relations between US and China. EUR and CHF are the weakest although ranges are narrow, as one typically expects during an overnight session ahead of a central bank meeting.

EUR/CHF has fallen to a three-month low after breaking below key support on Tuesday. It’s about mid-way to our initial 1.0877 target, yet prices have found support around its 200-day eMA.

USD/CNH fell to a six-day low overnight, but its low levels of volatility show it yet another market whose direction hinges around the US inflation report today. Our bias remains bearish below the 6.4120 high but a strong CPI report could see us step aside before reaching that level, should inflation come in strong.

USD/JPY is slightly lower yet remains near highs of yesterday’s range. With a double bottom having formed at 109.16, a stronger-than-expected inflation report could send the yen closer to 110.

Learn how to trade forex

Commodities:

China reiterated their aim to keep a tabs on rising commodity prices, sending copper and aluminium prices -0.3% and -0.5% lower respectively. Gold was also off by -0.3% overnight but holding around 1890, although gold traders are fully focussed on today’s inflation data.

Oil prices fell to a two-day low overnight as US inventory data suggested fuel demand was weaker-than-expected at the start of the summer. WTI futures fell -0.8% and just beneath yesterday’s low (a Rikshaw Man Doji candle) whilst brent is down just -0.12% from NY close.

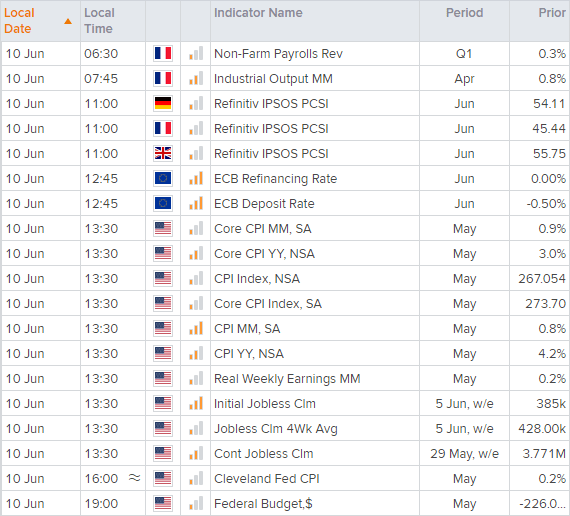

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.