Asian Indices:

- Australia's ASX 200 index fell by -28.1 points (-0.38%) and currently trades at 7,299.00

- Japan's Nikkei 225 index has risen by 499.99 points (1.76%) and currently trades at 28,959.78

- Hong Kong's Hang Seng index has fallen by -189.28 points (-0.81%) and currently trades at 23,231.48

- China's A50 Index has fallen by -71.76 points (-0.45%) and currently trades at 16,048.21

UK and Europe:

- UK's FTSE 100 futures are currently up 65.5 points (0.91%), the cash market is currently estimated to open at 7,236.25

- Euro STOXX 50 futures are currently up 60.5 points (1.45%), the cash market is currently estimated to open at 4,220.18

- Germany's DAX futures are currently up 163 points (1.05%), the cash market is currently estimated to open at 15,639.35

US Futures:

- DJI futures are currently up 383.25 points (1.08%)

- S&P 500 futures are currently up 42.25 points (0.26%)

- Nasdaq 100 futures are currently up 9.5 points (0.2%)

Three big ticks for today’s Australian Labour Market Report

Australian employment more than smashed expectations by adding 366.1k jobs in November, its highest monthly change on record. Unemployment fell 0.6 percentage point from 5.2% to 4.6% - just 0.1 percentage point above its post-pandemic low. Moreover, the participation rate rose by 1.4 percentage points to 66.1. All in all, this is a solid employment report and likely to be welcomed by the RBA. But don’t bank of them getting hawkish any time soon.

RBA’s Philip Lowe in ‘”no hurry to raise rates”

RBA’s Governor Dr Philip Lowe spoke just ahead of the employment report to reiterate that the RBA are “in no hurry to raise rates”. Election uncertainty can have a minor effect on the economy, and he would like to see wages at 4% alongside maximum employment before hikes will be considered. Current wage growth sits at 2.2% after hitting a record low of 1.4% in 2020.

Separately, Delta lockdowns in New Zealand aw GDP fall -3.7% in Q3, to mark its second worst quarter on record. Still, it was better than the -4.5% expected so it clearly could have been worse.

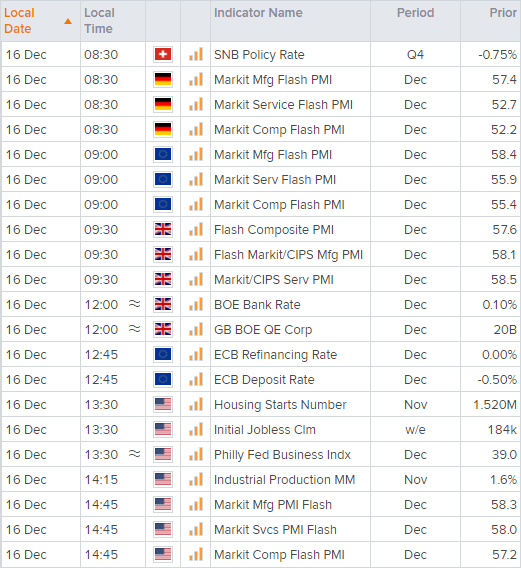

BOE up next (just don’t expect a hike)

The BOE’s November was supposed to be a ‘live’ meeting. It wasn’t. December’s surely has to be live? Nope. Not since the UK is heading into another wave of COVID-19 and plan B has been rolled out. The probability of a hike today is now 0% according to the CME Bank of England Watch Tool, although an 80% probability of a hike is priced in for February. SO it likely comes down to how much of a hawkish tone BOE strike surrounding Omicron, alongside how many voted for a hike today (it was 2 in November’s meeting, for reference).

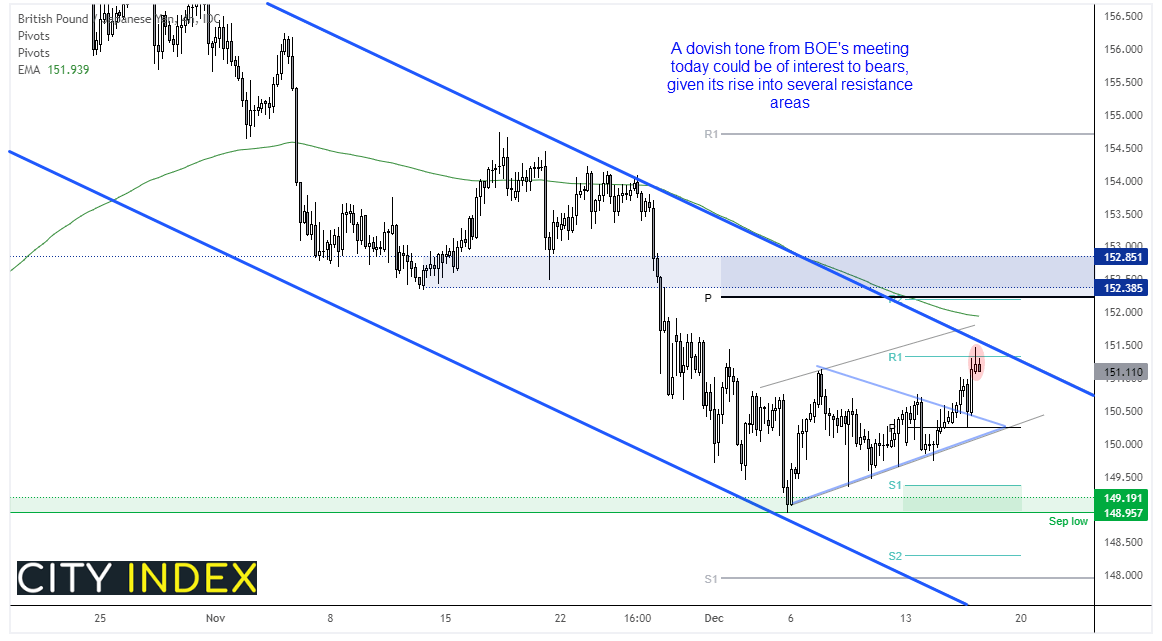

GBP/JPY rises into resistance ahead of BOE

There are two patterns on GBP/JPY which are at odds with each other. A bearish channel is apparent on the daily and four-hour chart, yet we have seen a bullish breakout from a triangle at recent lows. Should the BOE surprise with a ‘hawkish hold’ today then we could see prices break above the bearish trendline and head towards 152.50, which is the upside target projected from the triangle.

However, due to the dominant trend and bearish channel then a dovish BOE meeting could be of interest to bears, given prices have risen to several resistance levels ahead of the meeting (upper channel trendline and weekly R1 pivot). Under this scenario the initial target would be trend support from the triangle, and a break below it suggests bearish trend continuation.

Guide to Pound sterling

FTSE 350: Market Internals

FTSE 350: 4094.69 (-0.66%) 15 December 2021

- 122 (34.76%) stocks advanced and 218 (62.11%) declined

- 4 stocks rose to a new 52-week high, 12 fell to new lows

- 43.87% of stocks closed above their 200-day average

- 34.47% of stocks closed above their 50-day average

- 15.38% of stocks closed above their 20-day average

Outperformers:

- + 8.97%-DCC PLC(DCC.L)

- + 6.01%-Darktrace PLC(DARK.L)

- + 4.76%-Baltic Classifieds Group PLC(BCG.L)

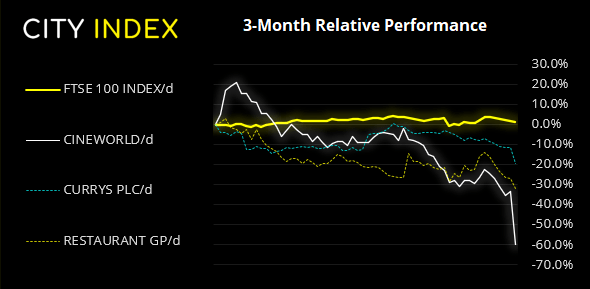

Underperformers:

- -39.4% - Cineworld Group PLC (CINE.L)

- -9.27% - Currys PLC (CURY.L)

- -6.47% - Restaurant Group PLC (RTN.L)

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade