It was a lively session for equity traders in Asia on Thursday, with the Nikkei 225 and DAX futures hitting record highs. The Nikkei made its inevitable run to 39k and touched a record high, by a cat's whisker.

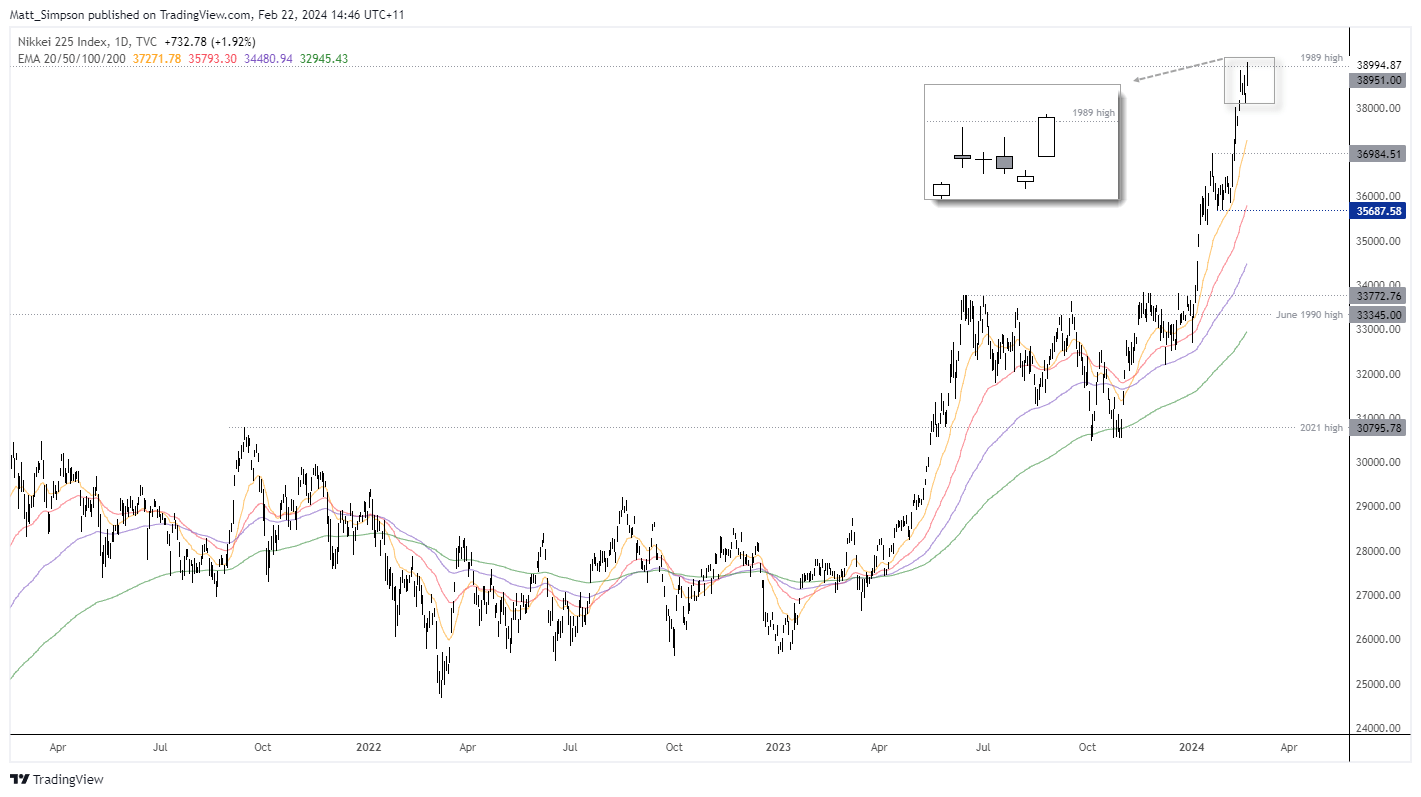

Nikkei 225 technical analysis:

The Nikkei meteoric rise is something to behold, having risen over 9% in 18 trading days, 28% from the October low, or 138% from the pandemic low. The question now is whether it has any juice left in the tank.

But I always remain sceptical of such breaks of big numbers as they can suck in the late comers, only to find they have been 'caught short' at a record high before a volatile shakeout ensues. Call me a sceptic, but I never trust the first break. Even if it does show the potential to eventually trade higher.

Traders may want to err on the side of caution around these highs because, at the time of writing, the ‘breakout’ above the 1989 lacks conviction. And if we fid that Wall Street struggles today, it could be the catalyst to knock the mighty Nikkei from its perch, even if only temporarily. But as long as The Nasdaq 100 holds its trend and the BOJ remain ultra dovish, a move to 40k seems plausible.

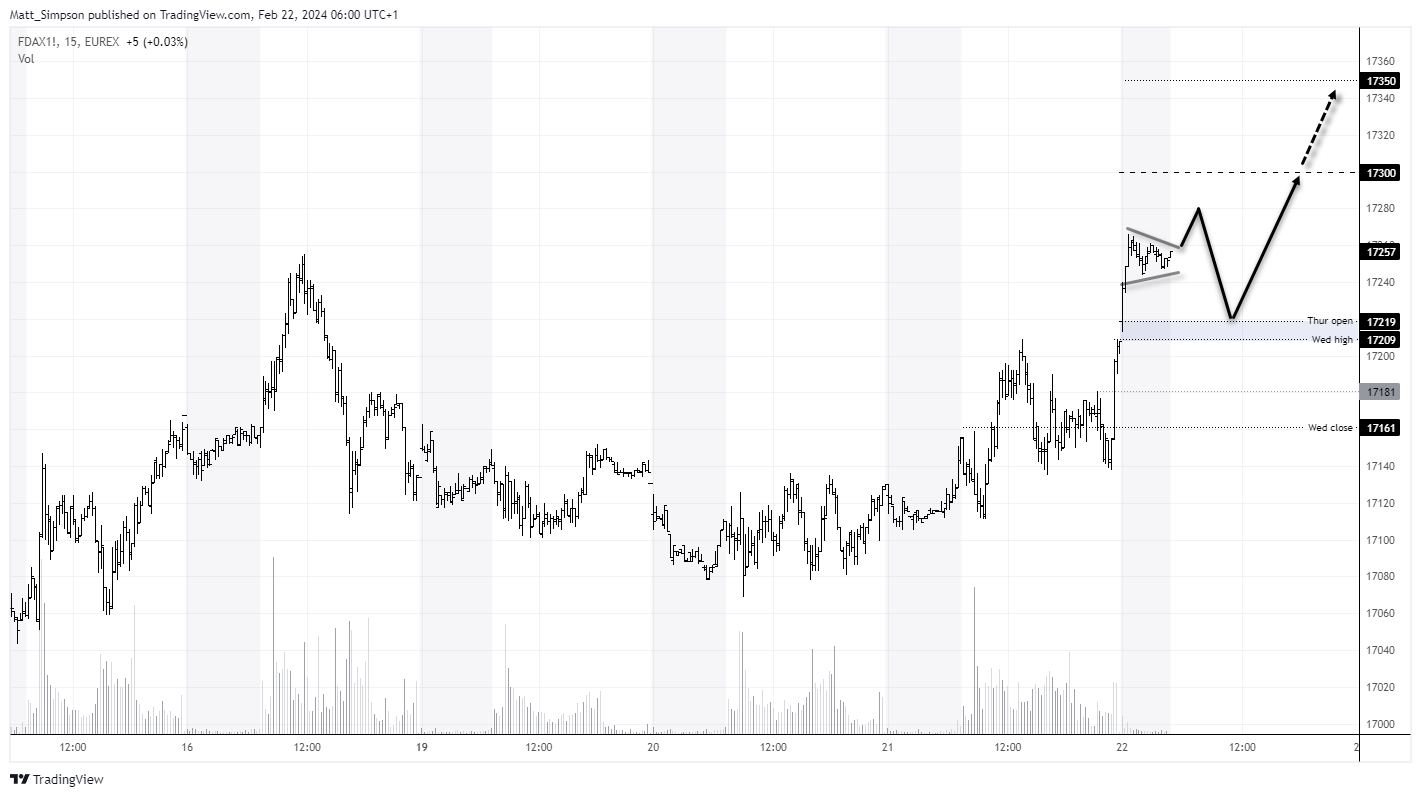

DAX technical analysis:

US and European futures markets gapped higher at the open, seemingly tied to the latest strong earnings from report from Nvidia and the Nikkei hitting a record high. This saw DAX futures gap higher from Wednesday’s close and reach for its own record high, and prices are now consolidating within a potential bullish pennant ahead of the cash market open.

However, trading activity is on very low volume, as was the rally in the final stages of yesterday’s DAX cash session. It is not uncommon to see the ‘false move’ out of a classic continuation pattern before a sharp reversal, and for the true direction to unfold later in the session. Therefore I would prefer to see if prices retrace after the open to fill some its liquidity gaps before finding support and an anticipated swing low, before breaking to new highs.

Events in focus (GMT):

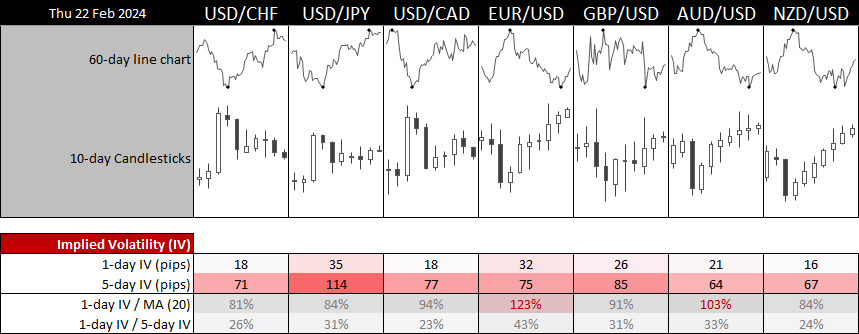

You could consider this an 'in between' week, as what traders really care about the most are inflation figures - but they'll need to wait until next week for the PCE report. Unless we see clear trend in today's PMI reports which could 'get things moving'.

A glance at the composite PMIs for the US, Europe and the UK show that they're either expanding at a faster pace or slowing at a diminishing rate. And that warns of upside pressure for growth and inflation - which ties back into the 'higher for longer' narrative that traders don't want to hear. So if we see that input costs are rising across the main region, it essentially justifies the Fed's stance to push back on rate cuts and the US dollar could regain its footing after a pullback from its YTD highs.

- 09:30 – German PMIs - (manufacturing, services and composite - S&P Global)

- 09:00 – Euro Area PMIs (manufacturing, services and composite - S&P Global)

- 0930 – UK PMIs (manufacturing, services and composite - S&P Global)

- 10:00 – Euro Area inflation

- 12:30 – ECB monetary policy meeting accounts

- 13:30 – US jobless claims

- 14:45 – US PMIs (manufacturing, services and composite - S&P Global)

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade