Crude oil was staging what looked like a short-lived bounce off its earlier lows at the time of writing on Thursday. US Jobless Claims and GDP data both came in better than expected, fuelling hawkish Fed bets and supporting the view the US economy is going to avoid a harsh recession. While the initial positive reaction in WTI to the stronger US data makes sense, let’s see if the resulting rally in the dollar will prevent oil from making a more significant comeback, following its earlier sell-off. We have seen the dollar strength weigh heavily on metals prices, while Chinese concerns have also worked against commodities. Given these mixed influences and despite the efforts of the OPEC+, the crude oil outlook remains as clear as mud.

Saudi’s warning falls on deaf ears

After Saudi Arabia’s Prince Salman warned bearish speculators to “watch out”, oil prices have not been able to hold onto their gains. Both oil contracts were trading lower at the time of writing. While there is a possibility that Saudi energy minister’s threat might be a forewarning of more supply cuts, traders are telling Saudi: “Bring it on, then.” Having cut production already just a month ago, short sellers are happy to call Saudi’s bluff. They are confident the Kingdom would find it almost impossible to convince the other OPEC members to trim their output again.

That being said, the big supply cuts should mean a much tighter oil market in the second half of the year.

OPEC+ cuts mean crude downside limited

So, I would imagine speculators’ shorts bets will be trimmed with time or because of price action. The more time elapses, the tighter the market will become, as the OPEC+ cuts filter through. As a reminder, the group announced in April that it would cut production by an additional 1.1 million barrels per day. This will encourage traders to start looking for bullish than bearish setups on oil prices as we move into H2. Also, if we see oil prices weaken a little further from here, speculators will likely start booking profit on their short trades, adding to the buying pressure.

So, while there is a risk that oil could further extend its short-term declines, owing to ongoing demand concerns and dollar strength, the downside should be supported in the longer-term – because of those OPEC+ cuts, and a more resilient-than-expected US economy. That’s unless demand elsewhere absolutely collapses (like Covid-like lockdown), or we see non-compliance from big OPEC+ producers. Both of these outcomes seem unlikely to me.

US economy more resilient than expected

Meanwhile, there was more evidence of demand remaining strong for US oil, as the Department of Energy reported another big drawdown in US inventories to the tune of 12.4 million barrels, on Wednesday. Gasoline inventories dropped by a sharp 2.1 million barrels.

The US dollar, meanwhile, has continued to rise thanks to hawkish Fed bets and safe-haven flows.

Those hawkish Fed bets rose further as GDP came in at 1.3% compared to 1.1% expected and reported initially. The GDP deflator was 4.2%, higher than 4.0% expected. Jobless claims surprised, too, printing 229K vs. 249K expected.

While oil has managed to hold its own relatively better in the last few days compared to, say, copper, the additional dollar strength is starting to weigh on oil too. But as evidence shows US economy is holding its own better than many other parts of the world, this is keeping a floor under prices.

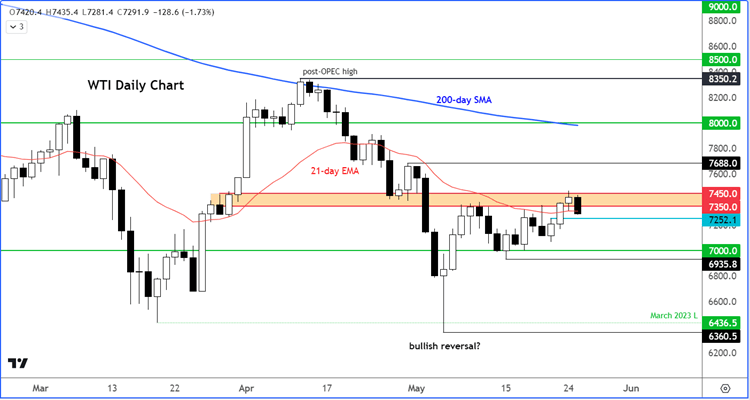

Crude oil outlook: WTI in search of direction

As choppy price action continues, trend followers must be having a difficult time speculating on oil prices. For that to change, we need to see prices breaking out in one or the other direction soon.

The bulls will want WTI to break decisively above the $1 resistance range between $73.50 to $74.50 to trigger follow-up technical buying and invalidate the bearish bias. Recent price action has been somewhat bullish, so prices may well find support on this latest dip – especially with the big risk event ahead: OPEC meeting in early June.

The bears meanwhile will be looking for a move back below $70, which would completely invalidate the whole technical bullish development made over the past few days.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade